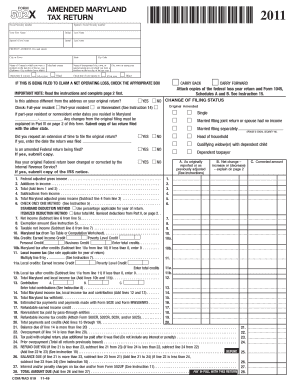

502 FORM X AMENDED MARYLAND TAX RETURN

What is the Maryland Form 502X Amended Tax Return?

The Maryland Form 502X is used for filing an amended tax return in the state of Maryland. This form allows taxpayers to correct errors or make changes to their previously filed Maryland income tax returns. Common reasons for filing an amended return include changes in income, deductions, or credits that were not reported accurately on the original return. The 502X form is essential for ensuring that the state has the most accurate information regarding a taxpayer's financial situation.

Steps to Complete the Maryland Form 502X Amended Tax Return

Completing the Maryland Form 502X involves several important steps:

- Gather your original tax return and any relevant documents that support the changes you are making.

- Clearly indicate the changes on the 502X form, providing detailed explanations for each correction.

- Calculate any adjustments to your income, deductions, or credits based on the new information.

- Sign and date the amended return, ensuring that all required fields are completed accurately.

- Submit the completed form to the Maryland Comptroller’s office either by mail or electronically, depending on your preference.

How to Obtain the Maryland Form 502X Amended Tax Return

The Maryland Form 502X can be obtained through several avenues. Taxpayers can download the form directly from the Maryland Comptroller's website. Additionally, physical copies of the form are available at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to avoid any issues with your submission.

Legal Use of the Maryland Form 502X Amended Tax Return

The legal use of the Maryland Form 502X is governed by state tax laws, which require that all amendments to tax returns be filed in a timely manner. Taxpayers must adhere to the guidelines provided by the Maryland Comptroller to ensure that their amended returns are accepted. Properly filing this form can help avoid penalties and ensure compliance with state tax regulations.

Filing Deadlines for the Maryland Form 502X Amended Tax Return

Taxpayers should be aware of the deadlines associated with filing the Maryland Form 502X. Generally, the amended return must be filed within three years from the original due date of the tax return or within one year of the date the tax was paid, whichever is later. Adhering to these deadlines is crucial to avoid potential penalties and interest on any unpaid taxes.

Required Documents for Filing the Maryland Form 502X Amended Tax Return

When filing the Maryland Form 502X, taxpayers should prepare several key documents, including:

- Your original Maryland tax return.

- Any supporting documentation for the changes being made, such as W-2s, 1099s, or receipts.

- Proof of any payments made or additional tax owed.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is provided.

Quick guide on how to complete 502 form x amended maryland 2011 tax return

Execute 502 FORM X AMENDED MARYLAND TAX RETURN effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any disruptions. Manage 502 FORM X AMENDED MARYLAND TAX RETURN on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

An effortless method to alter and electronically sign 502 FORM X AMENDED MARYLAND TAX RETURN

- Obtain 502 FORM X AMENDED MARYLAND TAX RETURN and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and electronically sign 502 FORM X AMENDED MARYLAND TAX RETURN to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the 502 form x amended maryland 2011 tax return

How to generate an electronic signature for the 502 Form X Amended Maryland 2011 Tax Return online

How to make an eSignature for the 502 Form X Amended Maryland 2011 Tax Return in Google Chrome

How to generate an eSignature for signing the 502 Form X Amended Maryland 2011 Tax Return in Gmail

How to make an eSignature for the 502 Form X Amended Maryland 2011 Tax Return straight from your smart phone

How to generate an eSignature for the 502 Form X Amended Maryland 2011 Tax Return on iOS devices

How to generate an eSignature for the 502 Form X Amended Maryland 2011 Tax Return on Android devices

People also ask

-

What is the 502 FORM X AMENDED MARYLAND TAX RETURN?

The 502 FORM X AMENDED MARYLAND TAX RETURN is a specific form used by Maryland taxpayers to correct or amend a previously filed tax return. This form allows individuals to adjust their tax liability, claim additional deductions, or rectify errors. It's essential for ensuring that your tax records are accurate and up-to-date.

-

How can airSlate SignNow help with the 502 FORM X AMENDED MARYLAND TAX RETURN?

airSlate SignNow simplifies the process of completing and submitting the 502 FORM X AMENDED MARYLAND TAX RETURN by allowing users to eSign and send documents securely. With our user-friendly interface, you can easily fill out the form, add your signature, and submit it electronically, making tax amendments hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 502 FORM X AMENDED MARYLAND TAX RETURN?

Yes, airSlate SignNow offers various pricing plans to fit your needs, including options for individuals and businesses. The cost-effective solution allows you to efficiently manage your document signing needs, including the 502 FORM X AMENDED MARYLAND TAX RETURN, without breaking the bank. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for managing tax forms like the 502 FORM X AMENDED MARYLAND TAX RETURN?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for tax forms like the 502 FORM X AMENDED MARYLAND TAX RETURN. These features ensure that your documents are completed accurately and processed swiftly, enhancing your overall tax filing experience.

-

Can I integrate airSlate SignNow with other software for filing the 502 FORM X AMENDED MARYLAND TAX RETURN?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, streamlining the process of filing the 502 FORM X AMENDED MARYLAND TAX RETURN. This integration helps you manage your documents and financial information in one place, enhancing productivity and accuracy.

-

What are the benefits of using airSlate SignNow for the 502 FORM X AMENDED MARYLAND TAX RETURN?

Using airSlate SignNow for the 502 FORM X AMENDED MARYLAND TAX RETURN offers numerous benefits, including increased efficiency, reduced paper usage, and secure document handling. With our platform, you can easily make amendments, track changes, and ensure compliance with Maryland tax regulations.

-

How secure is the eSigning process for the 502 FORM X AMENDED MARYLAND TAX RETURN with airSlate SignNow?

The eSigning process for the 502 FORM X AMENDED MARYLAND TAX RETURN with airSlate SignNow is highly secure. We utilize advanced encryption and security protocols to protect your sensitive tax information, ensuring that your documents are safe from unauthorized access during the signing and submission process.

Get more for 502 FORM X AMENDED MARYLAND TAX RETURN

Find out other 502 FORM X AMENDED MARYLAND TAX RETURN

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy