Application for Residence Homestead Exemption McLennan Mclennancad Form

Understanding the Application for Residence Homestead Exemption McLennan CAD

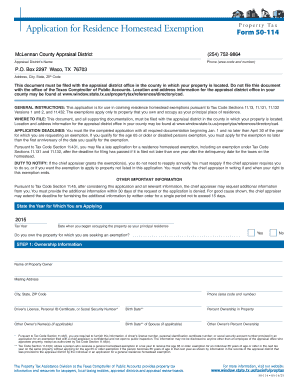

The Application for Residence Homestead Exemption in McLennan County, often referred to as the McLennan CAD form, is a crucial document for homeowners seeking property tax relief. This exemption allows eligible homeowners to reduce their property tax burden by applying for a homestead exemption through the McLennan Central Appraisal District (CAD). The application is specifically designed for those who occupy their property as their primary residence, providing significant savings on property taxes.

Steps to Complete the Application for Residence Homestead Exemption McLennan CAD

Completing the Application for Residence Homestead Exemption involves several key steps:

- Gather Required Information: Collect personal identification details, property information, and any supporting documentation that proves residency.

- Fill Out the Application: Complete the application form accurately, ensuring all sections are filled out as required.

- Provide Supporting Documents: Attach necessary documents such as proof of identity and residency, which may include utility bills or a driver’s license.

- Submit the Application: Send the completed application to the McLennan CAD via the preferred submission method, whether online, by mail, or in person.

Eligibility Criteria for the Application for Residence Homestead Exemption McLennan CAD

To qualify for the homestead exemption in McLennan County, applicants must meet specific eligibility criteria. These generally include:

- The applicant must own the property.

- The property must be the applicant's primary residence.

- The applicant must not have claimed a homestead exemption on another property.

- Applicants must provide proof of residency, such as a utility bill or government-issued identification.

Form Submission Methods for the Application for Residence Homestead Exemption McLennan CAD

There are several methods to submit the Application for Residence Homestead Exemption in McLennan County:

- Online Submission: Applicants can complete and submit the form electronically through the McLennan CAD website.

- Mail Submission: The completed application can be printed and mailed to the McLennan CAD office.

- In-Person Submission: Applicants may also choose to deliver the application directly to the McLennan CAD office during business hours.

Key Elements of the Application for Residence Homestead Exemption McLennan CAD

When filling out the Application for Residence Homestead Exemption, several key elements must be included:

- Property Description: Include the address and legal description of the property.

- Owner Information: Provide the name and contact details of the property owner.

- Residency Information: Indicate the date the property was occupied as a primary residence.

- Signature: The application must be signed by the property owner to validate the information provided.

Legal Use of the Application for Residence Homestead Exemption McLennan CAD

The Application for Residence Homestead Exemption is legally binding once submitted and signed. It is essential that all information provided is accurate, as any discrepancies can lead to denial of the exemption. The McLennan CAD follows strict guidelines to ensure compliance with state regulations, making it crucial for applicants to understand the legal implications of their application.

Quick guide on how to complete application for residence homestead exemption mclennan mclennancad

Complete Application For Residence Homestead Exemption McLennan Mclennancad effortlessly on any device

Online document management has become increasingly popular with companies and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Application For Residence Homestead Exemption McLennan Mclennancad on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and electronically sign Application For Residence Homestead Exemption McLennan Mclennancad without hassle

- Locate Application For Residence Homestead Exemption McLennan Mclennancad and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new copies of documents to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Application For Residence Homestead Exemption McLennan Mclennancad to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for residence homestead exemption mclennan mclennancad

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mclennan cad and how can it benefit my business?

mclennan cad is a powerful tool that enhances your business's document management capabilities. By streamlining the process of creating, sending, and signing documents, it improves efficiency and reduces turnaround time. With mclennan cad, you can ensure that your documents are secured and compliant, making it easier to manage critical transactions.

-

What pricing plans are available for mclennan cad?

The mclennan cad pricing plans are designed to fit businesses of all sizes. We offer flexible options, including monthly and annual subscriptions, with features tailored to different needs. By selecting a plan that aligns with your requirements, you can maximize the benefits of mclennan cad while staying within your budget.

-

Can mclennan cad integrate with other software I use?

Yes, mclennan cad easily integrates with a variety of other software applications commonly used in business. This includes CRM systems, project management tools, and cloud storage solutions. By leveraging these integrations, you can enhance workflow efficiency and centralize your document processes.

-

What features does mclennan cad offer for document signing?

mclennan cad provides a suite of features that facilitate hassle-free document signing. These include customizable templates, automated reminders, and secure cloud storage. Additionally, the user-friendly interface makes it easy for all parties to sign documents electronically without any technical barriers.

-

Is mclennan cad secure and compliant with regulations?

Absolutely, mclennan cad prioritizes security and compliance by employing industry-leading encryption technologies. It adheres to regulatory standards such as ESIGN and UETA, ensuring that your electronic signatures are legally binding. This gives you peace of mind knowing that your sensitive documents are protected.

-

How can mclennan cad improve my team's productivity?

mclennan cad enhances team productivity by simplifying document management processes. With features that enable quick sending, tracking, and signing of documents, your team can focus on more strategic tasks. Ultimately, mclennan cad helps you reduce bottlenecks and streamline operations, leading to faster project completion.

-

What are the benefits of using mclennan cad for remote work?

mclennan cad is particularly beneficial for remote work, as it allows teams to collaborate on documents from anywhere. By using cloud-based technology, team members can access, sign, and share files securely, regardless of their location. This fosters a more flexible and connected working environment, essential for today's workforce.

Get more for Application For Residence Homestead Exemption McLennan Mclennancad

- Esic form 4

- Haccp plan for hamburgers form

- Design an experiment worksheet answer key form

- Paycheck math worksheet form

- Social work discharge planning template form

- Form 652 general information certificate of termination of a sos texas

- Petition for expedited modification of child support west virginia courtswv form

- Dcb bank passbook form

Find out other Application For Residence Homestead Exemption McLennan Mclennancad

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later