Oregon735 1334 Form

What is the Oregon

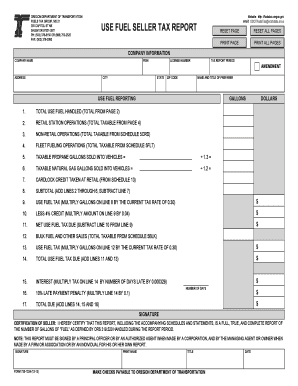

The Oregon form is a document used primarily for reporting fuel tax information to the Oregon Department of Transportation Fuels Group. This form is essential for businesses and individuals involved in the distribution or sale of fuel within the state of Oregon. It helps ensure compliance with state fuel tax laws and regulations, providing a structured way to report fuel usage and tax liabilities.

How to use the Oregon

To effectively use the Oregon form, individuals and businesses must accurately fill out all required sections. This includes providing detailed information about fuel purchases, sales, and any applicable tax exemptions. Users should ensure that all data is current and reflects the actual transactions that occurred during the reporting period. Once completed, the form can be submitted electronically or via mail, depending on the preference of the user.

Steps to complete the Oregon

Completing the Oregon form involves several key steps:

- Gather all relevant documentation, including fuel purchase receipts and sales records.

- Fill out the form with accurate information regarding fuel types, quantities, and tax rates.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, ensuring it is sent to the correct department.

Legal use of the Oregon

The Oregon form is legally binding when completed and submitted according to state regulations. It is crucial for users to understand that inaccuracies or fraudulent information can lead to penalties, including fines or legal action. Compliance with the reporting requirements of this form helps maintain transparency and accountability in fuel tax reporting.

Key elements of the Oregon

Key elements of the Oregon form include:

- Identification of the filer, including name and contact information.

- Details of fuel transactions, including types and amounts of fuel.

- Calculation of tax owed or refundable amounts.

- Signature of the filer, certifying the accuracy of the provided information.

Form Submission Methods

The Oregon form can be submitted through multiple methods to accommodate different preferences. Users may choose to file the form electronically through the Oregon Department of Transportation's online portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate office. In-person submissions may also be possible, depending on the local office's policies.

Quick guide on how to complete oregon735 1334

Complete Oregon735 1334 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Oregon735 1334 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Oregon735 1334 without hassle

- Obtain Oregon735 1334 and then click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your delivery method for the form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Revise and electronically sign Oregon735 1334 and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon735 1334

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 735 1334?

Form 735 1334 is a document used for specific regulatory purposes. It allows businesses to ensure compliance while streamlining their document processes. Understanding this form is crucial for efficient workflow management.

-

How can airSlate SignNow assist with Form 735 1334?

airSlate SignNow provides an easy-to-use platform for professionals needing to send and eSign Form 735 1334. Our solution simplifies the signature process, allowing users to complete documents quickly and securely. This way, you can focus more on your business and less on paperwork.

-

What are the pricing options for using airSlate SignNow for Form 735 1334?

airSlate SignNow offers competitive pricing plans to cater to various business needs when managing Form 735 1334. You can choose from different subscription models that fit your usage levels, including monthly and annual options, ensuring cost-effectiveness. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Form 735 1334?

With airSlate SignNow, you gain access to features such as templates, automated reminders, and tracking for Form 735 1334. Our platform also supports advanced security measures to protect sensitive data. These features help streamline your document handling process effortlessly.

-

Can I integrate airSlate SignNow with other applications for Form 735 1334?

Yes, airSlate SignNow seamlessly integrates with various applications to facilitate the use of Form 735 1334. Whether you're using CRM systems, cloud storage, or other tools, our integrations enhance your workflow efficiency. This connectivity ensures that you can manage documents without switching platforms.

-

What benefits does airSlate SignNow provide over traditional methods for Form 735 1334?

Using airSlate SignNow for Form 735 1334 offers substantial advantages over traditional methods, including speed and efficiency. Digital signing reduces turnaround time, while our platform eliminates paper trail hassles. Overall, this transition to digital promotes environmentally friendly practices and enhances business productivity.

-

Is airSlate SignNow user-friendly for new users dealing with Form 735 1334?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it ideal for new users handling Form 735 1334. The intuitive interface and straightforward setup process enable users to get started quickly without extensive training. Plus, our customer support is always available for any questions.

Get more for Oregon735 1334

Find out other Oregon735 1334

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later