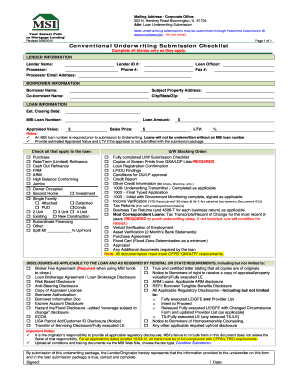

Underwriting Checklist Form

What is the underwriting checklist?

The underwriting checklist is a vital document used in the evaluation process for loans, insurance, and other financial applications. It ensures that all necessary information and documentation are collected to assess the risk associated with a potential client or transaction. This checklist typically includes items such as financial statements, credit reports, and identification documents. By adhering to a structured underwriting checklist, organizations can streamline their processes and enhance decision-making accuracy.

How to use the underwriting checklist

Using the underwriting checklist involves several steps to ensure a thorough review of the applicant's information. Begin by gathering all required documents as outlined in the checklist. This may include income verification, asset documentation, and any relevant legal documents. Next, review each item systematically, confirming that all information is complete and accurate. If any documents are missing or require clarification, reach out to the applicant promptly to resolve these issues. Finally, once all items are verified, the underwriting process can proceed, leading to informed decisions regarding approval or denial.

Key elements of the underwriting checklist

Key elements of the underwriting checklist typically encompass several critical components that contribute to a comprehensive evaluation. These elements may include:

- Personal information: Full name, address, and contact details of the applicant.

- Financial documents: Recent pay stubs, tax returns, and bank statements.

- Credit history: A detailed report outlining the applicant's credit score and history.

- Employment verification: Confirmation of current employment status and income.

- Property information: Details regarding any assets being financed or insured.

Each of these elements plays a crucial role in assessing the applicant's financial stability and risk profile.

Steps to complete the underwriting checklist

Completing the underwriting checklist involves a systematic approach to ensure all necessary information is gathered and reviewed. The following steps can guide this process:

- Review the checklist: Familiarize yourself with the items required for completion.

- Gather documentation: Collect all necessary documents as specified in the checklist.

- Verify accuracy: Ensure all information is accurate and complete before submission.

- Submit the checklist: Provide the completed checklist along with supporting documentation to the underwriting department.

- Follow up: Stay in contact with the underwriting team for any additional requests or clarifications.

This structured process helps maintain efficiency and accuracy throughout the underwriting evaluation.

Legal use of the underwriting checklist

The legal use of the underwriting checklist is essential for compliance with various regulations governing financial transactions. It ensures that all required documentation is collected and reviewed, which protects both the lender and the borrower. Compliance with laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA) is crucial, as these laws mandate non-discriminatory practices in lending. Additionally, maintaining a well-documented underwriting checklist can serve as evidence of due diligence in the event of disputes or audits.

Examples of using the underwriting checklist

Examples of using the underwriting checklist can vary depending on the context, such as mortgage lending or insurance underwriting. In mortgage lending, the checklist may include items like property appraisals, title searches, and borrower credit histories. For insurance underwriting, the checklist might focus on risk assessments, such as prior claims history and property inspections. Each example illustrates the importance of a tailored approach to ensure that all relevant factors are considered in the underwriting decision-making process.

Quick guide on how to complete underwriting checklist

Complete Underwriting Checklist effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the right form and securely archive it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents promptly without any interruptions. Handle Underwriting Checklist on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

How to modify and eSign Underwriting Checklist effortlessly

- Find Underwriting Checklist and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow meets all your document management needs in a few clicks from your chosen device. Edit and eSign Underwriting Checklist and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the underwriting checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an underwriting checklist?

An underwriting checklist is a vital tool used in the underwriting process to ensure that all necessary documents and information are collected before proceeding with a loan application. This checklist helps streamline the approval process, allowing for quicker decisions and improved efficiency.

-

How can airSlate SignNow enhance my underwriting checklist process?

airSlate SignNow simplifies the management of your underwriting checklist by allowing you to send, sign, and store documents electronically. This not only saves time but also minimizes errors associated with traditional paper processes, enabling a more efficient review and approval cycle.

-

Is there a cost associated with using airSlate SignNow for my underwriting checklist needs?

Yes, airSlate SignNow offers competitive pricing plans tailored to the needs of businesses of all sizes. You can choose a plan that best fits your budget while ensuring you have access to essential features for managing your underwriting checklist effectively.

-

What features does airSlate SignNow offer for managing underwriting checklists?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking that can be particularly beneficial for managing your underwriting checklist. These tools facilitate collaboration and maintain visibility throughout the underwriting process.

-

Can I integrate airSlate SignNow with other software to streamline my underwriting checklist?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems, which helps streamline the entire underwriting checklist process. These integrations ensure that all relevant information is accessible in one place, enhancing overall efficiency.

-

What benefits does using an electronic underwriting checklist provide?

Using an electronic underwriting checklist through airSlate SignNow offers several benefits, including reduced paperwork, improved accuracy, and faster turnaround times. This digital approach allows for easy updates and access to all parties involved in the underwriting process.

-

How does airSlate SignNow ensure the security of my underwriting checklist data?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols and complies with industry standards to protect your underwriting checklist data, ensuring that sensitive information remains secure during the document signing process.

Get more for Underwriting Checklist

Find out other Underwriting Checklist

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney