3b Married Filing Separately on Separate Forms

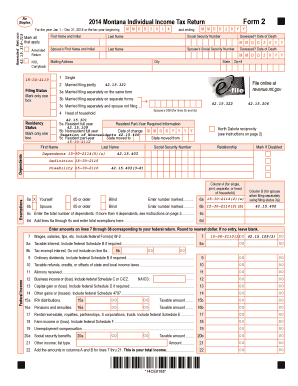

What is the 3b Married Filing Separately On Separate Forms

The 3b Married Filing Separately On Separate Forms is a tax filing option available to married couples in the United States. This option allows each spouse to report their income, deductions, and credits on separate tax returns. By choosing this filing status, couples can maintain individual tax liabilities and responsibilities, which may be beneficial in various financial situations. It is important to understand the implications of this filing status, as it can affect tax rates, eligibility for certain credits, and overall tax liability.

How to use the 3b Married Filing Separately On Separate Forms

Using the 3b Married Filing Separately On Separate Forms involves several key steps. First, each spouse must gather their financial documents, including W-2s, 1099s, and any other relevant income statements. Next, they should complete their individual tax returns using the appropriate forms, ensuring that they accurately report their income and deductions. It is crucial to avoid double claiming deductions or credits that are only available to one spouse. After completing the forms, each spouse must sign and submit their returns to the IRS, either electronically or by mail.

Steps to complete the 3b Married Filing Separately On Separate Forms

Completing the 3b Married Filing Separately On Separate Forms requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, such as income statements and deduction records.

- Choose the correct tax forms for your filing status, typically Form 1040 or 1040-SR.

- Fill out the forms accurately, ensuring that each spouse reports only their income and eligible deductions.

- Review the completed forms for accuracy, checking for any errors or omissions.

- Sign the forms, ensuring both spouses have provided their signatures.

- Submit the forms to the IRS by the filing deadline, either electronically or via mail.

Key elements of the 3b Married Filing Separately On Separate Forms

Several key elements define the 3b Married Filing Separately On Separate Forms. These include:

- Individual reporting: Each spouse files their own return, reporting only their income and deductions.

- Tax implications: This filing status may result in higher tax rates and limited access to certain tax credits.

- Responsibility: Each spouse is responsible for their own tax liability, which can be beneficial in cases of financial separation.

- Eligibility: Couples must be legally married to file separately; unmarried individuals cannot use this status.

IRS Guidelines

The IRS provides specific guidelines for couples considering the 3b Married Filing Separately On Separate Forms. According to IRS rules, both spouses must agree to file separately, and they must ensure that they do not claim deductions or credits that are restricted to those filing jointly. Additionally, the IRS outlines the necessary forms and any specific documentation required to support claims made on the tax returns. Familiarizing oneself with these guidelines is essential to avoid potential penalties or issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 3b Married Filing Separately On Separate Forms align with standard tax deadlines in the United States. Typically, the deadline for filing individual tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Couples should also be aware of any extensions that may apply if they need additional time to complete their returns. Missing the deadline can result in penalties and interest on any taxes owed.

Quick guide on how to complete 3b married filing separately on separate forms

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools for crafting, altering, and electronically signing your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Revise and electronically sign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 3b Married Filing Separately On Separate Forms

Create this form in 5 minutes!

People also ask

-

What does '3b Married Filing Separately On Separate Forms' mean?

'3b Married Filing Separately On Separate Forms' refers to a tax filing status where married couples choose to file their taxes separately using different forms. This can impact their tax rates and deductions. It's important to understand how this status affects your overall tax picture.

-

How can airSlate SignNow help with filing '3b Married Filing Separately On Separate Forms'?

airSlate SignNow provides an easy-to-use platform for preparing and signing your tax forms, including those related to '3b Married Filing Separately On Separate Forms.' By using our service, you can streamline document preparation and ensure everything is signed and submitted promptly.

-

Are there any additional costs associated with using airSlate SignNow for '3b Married Filing Separately On Separate Forms'?

While airSlate SignNow offers competitive pricing, additional costs may apply if you choose premium features or services. However, it remains a cost-effective solution compared to traditional methods of managing '3b Married Filing Separately On Separate Forms,' ensuring you receive great value.

-

What features does airSlate SignNow offer for managing tax documents like '3b Married Filing Separately On Separate Forms'?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage that help you efficiently manage tax-related documents, including those for '3b Married Filing Separately On Separate Forms.' These features enhance your productivity and ease the filing process.

-

Is airSlate SignNow compliant with tax regulations for '3b Married Filing Separately On Separate Forms'?

Yes, airSlate SignNow is designed to comply with applicable tax regulations when handling documents related to '3b Married Filing Separately On Separate Forms.' We prioritize security and compliance, ensuring your transactions are both safe and legally valid.

-

Can I integrate airSlate SignNow with my accounting software for '3b Married Filing Separately On Separate Forms'?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage documents related to '3b Married Filing Separately On Separate Forms' easily. This integration helps streamline your financial processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for tax forms like '3b Married Filing Separately On Separate Forms'?

Using airSlate SignNow to manage tax forms like '3b Married Filing Separately On Separate Forms' offers numerous benefits, including faster document turnaround times, enhanced security, and the convenience of eSigning from anywhere. This results in a more efficient tax filing experience.

Get more for 3b Married Filing Separately On Separate Forms

- Future generali form

- Draft form this is

- Enrg b indd montana department of revenue form

- Portland shl series registration form pdf arnaud versluys

- Form 5305 e rev october efile

- Hereby give my permission to my childs coach or team leader appointed person to sign for any medical form

- 1012 sibshop information form this information form

- Print form wind brasil fortaleza formula windsurfing grand prix world tour monday 25th october to sunday 31st october an

Find out other 3b Married Filing Separately On Separate Forms

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free