Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin Form

What is the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

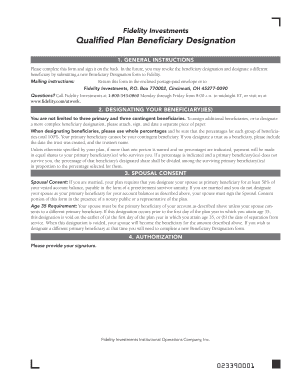

The Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin is a crucial document that allows individuals to specify who will receive their benefits from a qualified retirement plan upon their passing. This designation is essential for ensuring that the intended beneficiaries, such as family members or other loved ones, receive the financial assets accumulated in the plan. The form is designed to clearly outline the beneficiaries and their respective shares, providing clarity and legal standing to the distribution of assets.

Steps to complete the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

Completing the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin involves several important steps. First, gather necessary personal information, including the names, addresses, and Social Security numbers of the beneficiaries. Next, fill out the form accurately, ensuring that all details are correct. It is essential to indicate the percentage of benefits each beneficiary will receive. After completing the form, review it for any errors and sign it to validate your choices. Finally, submit the form according to the instructions provided, ensuring it is sent to the correct department at Fidelity Investments.

Legal use of the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

The legal use of the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin hinges on its compliance with federal and state laws governing beneficiary designations. This form must be executed properly to ensure that it is legally binding. The use of electronic signatures is permitted, provided that the signing process adheres to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws validate the electronic execution of documents, ensuring that the designation holds up in legal contexts.

Key elements of the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

Several key elements are essential to the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin. These include the identification of the primary and contingent beneficiaries, the allocation of benefits among them, and the signature of the plan participant. Additionally, the form should include any necessary witness signatures if required by state law. Providing accurate and complete information is vital, as any discrepancies can lead to delays or disputes during the distribution of benefits.

How to use the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

Using the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin involves filling out the form to designate beneficiaries for your retirement plan. Once completed, the form should be submitted to Fidelity Investments, either electronically or via mail, depending on the options provided. It is important to keep a copy of the completed form for personal records. Regularly reviewing and updating the beneficiary designation is also recommended, especially after significant life events such as marriage, divorce, or the birth of a child.

Examples of using the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

Examples of using the Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin include designating a spouse as the primary beneficiary, ensuring that they receive the retirement benefits upon the account holder's death. Another example is naming children as contingent beneficiaries, which ensures that they receive benefits if the primary beneficiary is unable to do so. Additionally, individuals may choose to designate a trust or charity, reflecting their specific wishes for asset distribution.

Quick guide on how to complete qualified plan beneficiary designation fidelity investments bowdoin

Accomplish Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without any hold-ups. Handle Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin without any hassle

- Obtain Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your modifications.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qualified plan beneficiary designation fidelity investments bowdoin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin?

A Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin is a formal document that specifies who will receive benefits from your retirement account upon your passing. It ensures that your assets are distributed according to your wishes, providing peace of mind for you and your beneficiaries.

-

How do I complete a Qualified Plan Beneficiary Designation for Fidelity Investments at Bowdoin?

To complete a Qualified Plan Beneficiary Designation for Fidelity Investments at Bowdoin, you can typically access the necessary forms through your Fidelity account or request them directly from Bowdoin's HR department. Ensure all required information is filled out accurately to avoid any issues with your designation.

-

What are the benefits of using airSlate SignNow for my Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin?

Using airSlate SignNow for your Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin streamlines the signing process, ensuring your documents are securely completed and sent quickly. The platform's user-friendly interface makes managing your beneficiary designations more efficient, saving you time and reducing stress.

-

Are there any costs associated with filing a Qualified Plan Beneficiary Designation at Fidelity Investments through Bowdoin?

Filing a Qualified Plan Beneficiary Designation at Fidelity Investments through Bowdoin is typically a straightforward process with no direct fees involved for the designation itself. However, it is recommended to check with Bowdoin or Fidelity for any potential fees related to account management or additional services.

-

Can I change my Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin?

Yes, you can change your Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin at any time. It is important to keep your designations updated to reflect any changes in your personal circumstances, such as marriage, divorce, or new dependents.

-

Does airSlate SignNow integrate with Fidelity Investments for managing Qualified Plan Beneficiary Designations at Bowdoin?

Yes, airSlate SignNow integrates smoothly with Fidelity Investments, allowing you to manage your Qualified Plan Beneficiary Designations at Bowdoin effortlessly. This integration provides a seamless experience, ensuring all necessary documentation can be handled without extra hassle.

-

What features does airSlate SignNow offer for my Qualified Plan Beneficiary Designation needs with Fidelity Investments at Bowdoin?

airSlate SignNow offers features like electronic signing, document templates, and secure storage to assist with your Qualified Plan Beneficiary Designation with Fidelity Investments at Bowdoin. These tools help safeguard your important documents and simplify the signing process.

Get more for Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

Find out other Qualified Plan Beneficiary Designation Fidelity Investments Bowdoin

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later