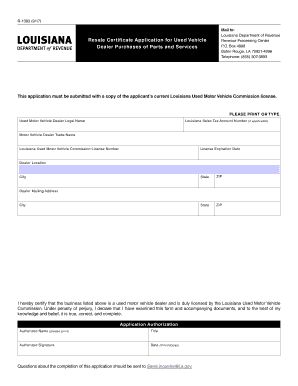

Form R 1393 Louisiana Department of Revenue

What is the Form R 1393 Louisiana Department Of Revenue

The Form R 1393 is a tax-related document issued by the Louisiana Department of Revenue. It is primarily used for reporting specific tax information and ensuring compliance with state tax regulations. This form is essential for taxpayers who need to disclose certain financial details to the state, thereby facilitating accurate tax assessments and collections.

How to use the Form R 1393 Louisiana Department Of Revenue

Using the Form R 1393 involves several steps to ensure that all required information is accurately reported. Taxpayers must first gather relevant financial documents, such as income statements and previous tax returns. Once the necessary information is collected, individuals can fill out the form, providing details like income sources, deductions, and credits. After completing the form, it should be reviewed for accuracy before submission to avoid potential penalties.

Steps to complete the Form R 1393 Louisiana Department Of Revenue

Completing the Form R 1393 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill in personal information, such as name, address, and Social Security number.

- Report income from all sources, including wages, self-employment income, and any other earnings.

- Include applicable deductions and credits to accurately calculate taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Form R 1393 Louisiana Department Of Revenue

The Form R 1393 is legally binding when completed and submitted correctly. To ensure its legal validity, taxpayers must adhere to all state regulations regarding the reporting of income and other financial information. It is crucial to provide truthful and accurate information, as any discrepancies may lead to penalties or legal repercussions. Utilizing electronic signature solutions can enhance the legal standing of the form by ensuring compliance with eSignature laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form R 1393. The methods include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Louisiana Department of Revenue's online portal, which offers a streamlined process.

- Mail: The form can also be printed and mailed to the appropriate state office. Ensure that it is sent to the correct address to avoid delays.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at designated state offices is an option.

Key elements of the Form R 1393 Louisiana Department Of Revenue

The Form R 1393 includes several key elements that are vital for accurate reporting. These elements typically consist of:

- Taxpayer identification information, including name and Social Security number.

- Detailed reporting of income from various sources.

- Applicable deductions and credits that may reduce taxable income.

- Signature and date fields to confirm the accuracy of the information provided.

Quick guide on how to complete form r 1393 louisiana department of revenue

Prepare Form R 1393 Louisiana Department Of Revenue seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form R 1393 Louisiana Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Form R 1393 Louisiana Department Of Revenue with ease

- Obtain Form R 1393 Louisiana Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would prefer to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from a device of your preference. Modify and electronically sign Form R 1393 Louisiana Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r 1393 louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form R 1393 from the Louisiana Department of Revenue?

Form R 1393 is a tax form provided by the Louisiana Department of Revenue, specifically designed for businesses. It allows taxpayers to report certain tax liabilities and fulfill state tax obligations efficiently. Utilizing airSlate SignNow can streamline the process of submitting Form R 1393, ensuring compliance and accuracy.

-

How can airSlate SignNow help with Form R 1393 submissions?

airSlate SignNow offers a user-friendly platform for businesses to complete and eSign Form R 1393. By leveraging our electronic signature solution, you can quickly gather necessary approvals and ensure that your form is submitted on time. This not only saves you time but also minimizes the risk of errors in the submission process.

-

Is there a cost associated with using airSlate SignNow for Form R 1393?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs. The investment in our platform to facilitate the submission of Form R 1393 is generally outweighed by the time and cost saved by streamlining document handling and eSignatures. Visit our pricing page to find a plan that fits your requirements.

-

What features does airSlate SignNow offer for handling Form R 1393?

airSlate SignNow includes features such as customizable templates, detailed audit trails, and secure eSignature options that are perfect for Form R 1393. These tools ensure that your forms are not only compliant with Louisiana Department of Revenue standards but also secure and easy to manage. Our platform simplifies the entire signing and submission process.

-

Can I integrate airSlate SignNow with other accounting software for Form R 1393?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software systems, allowing for a smooth workflow when dealing with Form R 1393. This integration ensures that data flows effortlessly between platforms, minimizing the likelihood of errors and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Form R 1393?

Using airSlate SignNow for Form R 1393 provides numerous advantages, including increased efficiency, reduced turnaround times, and enhanced compliance. By simplifying the eSigning process, businesses can focus on core activities rather than paperwork. Additionally, our security features ensure that your sensitive information is protected.

-

Is it easy to use airSlate SignNow for eSigning Form R 1393?

Yes, airSlate SignNow is designed to be intuitive and user-friendly. Even those with minimal technical knowledge can easily navigate the platform to eSign Form R 1393. Our straightforward interface ensures that you can quickly adopt this solution and start benefiting from its features without extensive training.

Get more for Form R 1393 Louisiana Department Of Revenue

Find out other Form R 1393 Louisiana Department Of Revenue

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation