Form #9402ECS 916

What is the Form #9402ECS 916

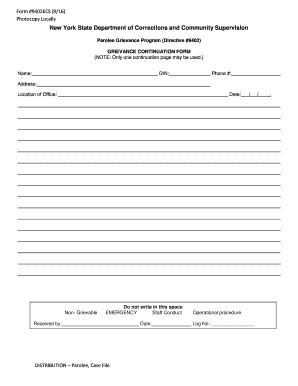

The Form #9402ECS 916 is a specific document used primarily for tax purposes in the United States. This form is typically associated with certain tax credits or deductions that individuals or businesses may claim. Understanding its purpose is essential for ensuring compliance with IRS regulations and for maximizing potential tax benefits. The form requires accurate information about the taxpayer's financial situation and may include details related to income, expenses, and other relevant financial data.

How to use the Form #9402ECS 916

Using the Form #9402ECS 916 involves several steps to ensure that all information is accurately reported. First, gather all necessary documentation, including income statements, receipts, and any other financial records relevant to the form. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check for any errors or omissions that could lead to delays or issues with processing. Once completed, the form can be submitted according to the specified guidelines, either electronically or by mail.

Steps to complete the Form #9402ECS 916

Completing the Form #9402ECS 916 requires a systematic approach:

- Gather necessary documents, including income and expense records.

- Review the form's instructions to understand each section's requirements.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Double-check the form for any errors or missing information.

- Submit the completed form electronically or by mail, following the provided submission guidelines.

Legal use of the Form #9402ECS 916

The legal use of the Form #9402ECS 916 is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out completely and accurately. Any discrepancies or inaccuracies may lead to penalties or denial of claims. Additionally, it is important to maintain records of the submitted form and any supporting documentation, as these may be required for future audits or reviews by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form #9402ECS 916 are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or specific tax situations. It is advisable to check the IRS website or consult a tax professional for the most current deadlines related to this form.

Who Issues the Form

The Form #9402ECS 916 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and instructions for taxpayers to accurately report their financial information and comply with tax laws. It is essential to use the most current version of the form, as updates may occur annually or as tax laws change.

Quick guide on how to complete form 9402ecs 916

Effortlessly Prepare Form #9402ECS 916 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form #9402ECS 916 on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related task today.

How to Edit and Electronically Sign Form #9402ECS 916 with Ease

- Locate Form #9402ECS 916 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form #9402ECS 916 to ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9402ecs 916

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form #9402ECS 916?

Form #9402ECS 916 is a specialized document designed for managing employee-related data in a concise manner. Utilizing airSlate SignNow, you can fill out and eSign this form seamlessly, ensuring compliance and efficiency in your business processes.

-

How does airSlate SignNow enhance the use of Form #9402ECS 916?

airSlate SignNow provides tools that streamline the completion and signing of Form #9402ECS 916. With its user-friendly interface, businesses can efficiently manage their forms, improving workflow and reducing turnaround time for approvals and eSignatures.

-

Is there a cost associated with using Form #9402ECS 916 on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow; however, it is designed to be cost-effective. The value offered in terms of security and ease of use with Form #9402ECS 916 makes our solution beneficial for businesses of all sizes.

-

What features does airSlate SignNow offer for Form #9402ECS 916?

Key features include customizable templates for Form #9402ECS 916, automated workflows, and secure cloud storage. These features help businesses manage their documents efficiently and ensure that all signatures are collected in a secure manner.

-

Can I integrate Form #9402ECS 916 with other applications?

Absolutely! airSlate SignNow supports integrations with a variety of platforms, allowing you to link Form #9402ECS 916 to your existing systems for a more streamlined workflow. This ensures your data remains organized and easily accessible.

-

What are the benefits of using Form #9402ECS 916 with airSlate SignNow?

Using Form #9402ECS 916 with airSlate SignNow provides signNow benefits such as increased efficiency, enhanced security, and the ability to track document status in real-time. This eliminates manual processes and helps organizations stay compliant.

-

Is it easy to learn how to use Form #9402ECS 916 in airSlate SignNow?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to learn how to use Form #9402ECS 916. With intuitive navigation and helpful resources, users can quickly become proficient in managing their documents.

Get more for Form #9402ECS 916

Find out other Form #9402ECS 916

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document