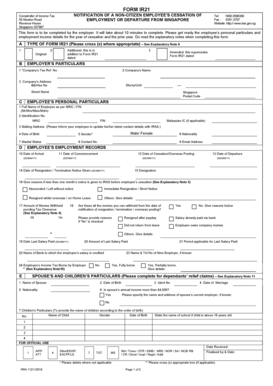

Iras Form

What is the Iras

The Iras, or Individual Retirement Accounts, are tax-advantaged savings accounts designed to help individuals save for retirement in the United States. They provide a way to invest money while enjoying tax benefits, either through tax-deferred growth or tax-free withdrawals, depending on the type of account. The two main types of Iras are Traditional Iras and Roth Iras, each with distinct tax implications and eligibility requirements.

How to use the Iras

Using an Iras involves several key steps. First, individuals must choose the type of Iras that best fits their financial situation and retirement goals. Next, they can open an account through a financial institution, such as a bank or brokerage. Once the account is established, individuals can contribute funds up to the annual limit, which may vary based on age and income. It is essential to understand the contribution limits and withdrawal rules to maximize the benefits of the Iras.

Steps to complete the Iras

Completing the Iras involves a straightforward process:

- Determine eligibility based on income and tax filing status.

- Choose between a Traditional Iras or Roth Iras.

- Open an Iras account with a financial institution.

- Contribute funds up to the allowed limit for the tax year.

- Keep track of contributions and any investment performance.

- Review and adjust contributions as necessary to align with retirement goals.

Legal use of the Iras

To ensure the legal use of Iras, individuals must adhere to specific regulations set forth by the Internal Revenue Service (IRS). This includes understanding contribution limits, eligibility requirements, and withdrawal rules. Contributions to a Traditional Iras may be tax-deductible, while withdrawals during retirement are taxed as ordinary income. In contrast, contributions to a Roth Iras are made with after-tax dollars, allowing for tax-free withdrawals in retirement. Compliance with these regulations is crucial to avoid penalties and ensure the intended tax benefits.

Required Documents

When opening an Iras, individuals typically need to provide several documents, including:

- Identification, such as a driver's license or Social Security card.

- Proof of income, which may include pay stubs or tax returns.

- Bank account information for fund transfers.

- Any previous retirement account statements if rolling over funds.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Iras is essential for maximizing contributions. The deadline for making contributions to an Iras for a given tax year is typically April 15 of the following year. It is important to keep track of these dates to ensure contributions are made on time and to avoid penalties. Additionally, individuals should be aware of any changes in tax laws that may affect their Iras.

Quick guide on how to complete iras

Effortlessly Prepare Iras on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a perfect environmentally friendly substitute to traditional printed and signed forms, allowing easy access to the necessary templates and secure online storage. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Iras on any device using the airSlate SignNow applications for Android or iOS, and enhance your document-driven workflows today.

How to Edit and eSign Iras with Ease

- Find Iras and click on Get Form to begin.

- Take advantage of the tools provided to complete your document.

- Emphasize signNow parts of the documents or redact sensitive information using the tools airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending the document, whether via email, text message (SMS), or an invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, time-consuming searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Iras while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iras

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are iras in the context of airSlate SignNow?

Iras, or individual retirement accounts, are financial tools that can benefit from efficient document management. With airSlate SignNow, businesses can streamline the signing process of iras-related documents, ensuring compliance and speedy transactions.

-

How does airSlate SignNow simplify the creation and signing of iras documents?

airSlate SignNow provides an intuitive platform for drafting and eSigning iras documents. Users can create templates tailored for iras and utilize electronic signatures for quick approval, ensuring your paperwork is handled efficiently.

-

What are the pricing options for using airSlate SignNow for iras management?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options perfect for handling iras documentation. Each plan includes essential features for managing iras at a cost-effective rate, helping you maximize your budget while staying compliant.

-

Can I integrate airSlate SignNow with other tools to manage iras?

Absolutely! airSlate SignNow integrates seamlessly with various platforms that help manage iras. Whether it's CRM systems, cloud storage, or financial software, these integrations ensure a comprehensive workflow for all your iras-related activities.

-

What security features does airSlate SignNow provide for iras documents?

Security is paramount when handling iras documents, and airSlate SignNow provides high-level encryption and secure access controls. These features help protect sensitive information related to iras, giving you peace of mind about your data integrity.

-

How does airSlate SignNow enhance the signing experience for iras?

With airSlate SignNow, the signing experience for iras documents is streamlined. Users can send documents for eSigning with just a few clicks, reducing turnaround time and improving usability for all parties involved in the iras process.

-

What are the benefits of using airSlate SignNow for managing iras?

Using airSlate SignNow for managing iras offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced organization. By digitizing the process, businesses can focus more on strategic decisions related to iras rather than getting bogged down in administrative tasks.

Get more for Iras

Find out other Iras

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA