New Mexico Rate Lock Disclosure InterBank Form

Understanding the New Mexico Rate Lock Disclosure InterBank

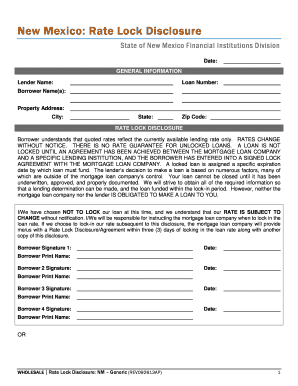

The New Mexico Rate Lock Disclosure InterBank is a crucial document that outlines the terms and conditions associated with locking in a mortgage interest rate. This form is essential for borrowers who want to secure a specific interest rate for a defined period, protecting them from potential rate increases during the loan processing time. It includes details such as the duration of the lock, the applicable interest rate, and any associated fees. Understanding this document is vital for making informed decisions when applying for a mortgage in New Mexico.

Steps to Complete the New Mexico Rate Lock Disclosure InterBank

Completing the New Mexico Rate Lock Disclosure InterBank involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal details, loan amount, and property information. Next, fill out the form by entering the required data in the designated fields. It is crucial to review the terms of the rate lock, including the duration and any fees, before signing. After completing the form, ensure that all signatures are obtained, and retain a copy for your records. Utilizing a digital platform can streamline this process, making it easier to complete and store the document securely.

Legal Use of the New Mexico Rate Lock Disclosure InterBank

The New Mexico Rate Lock Disclosure InterBank serves a legal purpose in the mortgage lending process. It establishes a binding agreement between the borrower and the lender regarding the locked interest rate. For this document to be legally enforceable, it must meet specific requirements, such as clear identification of the parties involved, accurate terms of the rate lock, and proper signatures. Compliance with federal and state regulations is essential to ensure that the document holds up in legal scenarios, making it important for borrowers to understand their rights and obligations under this agreement.

Key Elements of the New Mexico Rate Lock Disclosure InterBank

Several key elements are included in the New Mexico Rate Lock Disclosure InterBank that borrowers should be aware of. These elements typically encompass:

- Interest Rate: The specific rate being locked in for the loan.

- Lock Period: The duration for which the rate is locked, usually ranging from 30 to 90 days.

- Fees: Any applicable fees associated with the rate lock, which may vary by lender.

- Expiration Date: The date by which the loan must close to maintain the locked rate.

- Conditions: Any conditions that must be met for the rate lock to remain valid.

Understanding these elements can help borrowers navigate the mortgage process more effectively.

How to Obtain the New Mexico Rate Lock Disclosure InterBank

Obtaining the New Mexico Rate Lock Disclosure InterBank is a straightforward process. Borrowers typically receive this form from their lender during the mortgage application process. It is advisable to request the form directly from your lender or mortgage broker, who can provide guidance on completing it correctly. Additionally, many lenders offer digital options for accessing and signing the form, which can enhance convenience and efficiency. Ensuring you have the most current version of the form is essential for compliance and accuracy.

Examples of Using the New Mexico Rate Lock Disclosure InterBank

Practical examples of using the New Mexico Rate Lock Disclosure InterBank can illustrate its importance in real-world scenarios. For instance, a borrower may lock in a favorable interest rate when market conditions are optimal, protecting themselves from potential rate hikes. Another example could involve a borrower who anticipates a closing delay; they may need to extend their rate lock to avoid losing the locked rate. These situations highlight the necessity of understanding the terms and implications of the rate lock disclosure, ensuring borrowers can make informed decisions throughout the mortgage process.

Quick guide on how to complete new mexico rate lock disclosure interbank

Prepare New Mexico Rate Lock Disclosure InterBank effortlessly on any device

Digital document management has surged in popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can retrieve the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage New Mexico Rate Lock Disclosure InterBank on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

How to modify and eSign New Mexico Rate Lock Disclosure InterBank with ease

- Locate New Mexico Rate Lock Disclosure InterBank and then click Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your requirements in document management in just a few clicks from any device. Alter and eSign New Mexico Rate Lock Disclosure InterBank and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico rate lock disclosure interbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico Rate Lock Disclosure InterBank?

The New Mexico Rate Lock Disclosure InterBank is a document that outlines the terms and conditions of locking in a specific interest rate on a mortgage or loan in New Mexico. It helps consumers understand their rights and obligations, ensuring transparency in financial transactions. This disclosure is essential for anyone looking to secure a favorable interest rate through InterBank.

-

How can airSlate SignNow help with the New Mexico Rate Lock Disclosure InterBank?

airSlate SignNow streamlines the signing process for the New Mexico Rate Lock Disclosure InterBank, making it easy for businesses to send and eSign documents electronically. With our user-friendly interface, you can quickly manage and execute your rate lock disclosures, saving time and resources. Stay compliant and ensure that all parties have easy access to signed documents.

-

What are the pricing options for using airSlate SignNow for my New Mexico Rate Lock Disclosure InterBank?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs, including those requiring the New Mexico Rate Lock Disclosure InterBank. You can choose from monthly or yearly subscriptions that provide access to all essential features. Additionally, there are flexible options for businesses of all sizes, allowing you to select a plan that aligns with your budget and transaction volume.

-

What features does airSlate SignNow offer for managing the New Mexico Rate Lock Disclosure InterBank?

With airSlate SignNow, you can utilize features such as template creation, document tracking, and secure cloud storage for your New Mexico Rate Lock Disclosure InterBank. Our platform enables electronic signatures that are legally binding and compliant. Customized workflows also help ensure that the right people are signing the documents at the right time, enhancing efficiency.

-

Are there integrations available for airSlate SignNow with other platforms for the New Mexico Rate Lock Disclosure InterBank?

Yes, airSlate SignNow offers seamless integrations with various popular platforms such as CRM tools, email services, and document management systems, enhancing your capability to manage the New Mexico Rate Lock Disclosure InterBank. This flexibility allows you to streamline your processes and reduce manual entry, making document handling more efficient. Check our integration options to find the best fit for your needs.

-

What benefits can I expect from using airSlate SignNow for the New Mexico Rate Lock Disclosure InterBank?

Using airSlate SignNow for the New Mexico Rate Lock Disclosure InterBank provides several benefits, including faster turnaround times on document signing, reduced paperwork, and improved accuracy. Our solution is designed to eliminate the hassles of traditional signing methods, making it easy to handle documents remotely. Ultimately, you can enhance customer satisfaction and ensure a smoother overall experience.

-

Is airSlate SignNow secure for managing the New Mexico Rate Lock Disclosure InterBank?

Absolutely! Security is a top priority at airSlate SignNow. When managing the New Mexico Rate Lock Disclosure InterBank, you can trust that your data is protected with industry-standard encryption, secure cloud storage, and compliance with various regulatory requirements. You can confidently use our platform, knowing that sensitive information remains safe throughout the signing process.

Get more for New Mexico Rate Lock Disclosure InterBank

Find out other New Mexico Rate Lock Disclosure InterBank

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT