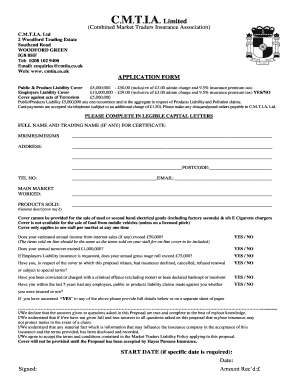

Cmtia Form

What is the Cmtia?

The Combined Market Traders Insurance Association (Cmtia) is an organization that provides specialized insurance coverage tailored for market traders. This insurance is designed to protect individuals and businesses engaged in trading activities from various risks associated with their operations. The Cmtia offers a range of insurance products that cover aspects such as liability, property damage, and loss of income, ensuring that traders can operate with confidence in a competitive market environment.

How to use the Cmtia

Utilizing the Cmtia involves understanding the specific insurance products it offers and how they apply to your trading activities. Traders should first assess their unique needs, including the types of risks they face in their operations. After identifying these needs, they can explore the available insurance options through the Cmtia. It is advisable to consult with an insurance representative to ensure that the chosen coverage adequately protects against potential liabilities and losses.

Steps to complete the Cmtia

Completing the Cmtia insurance application involves several key steps:

- Gather necessary documentation, including proof of trading activities and financial statements.

- Fill out the application form accurately, providing all required information about your trading operations.

- Submit the completed application along with any supporting documents to the Cmtia.

- Await confirmation and review of your application from the Cmtia representatives.

- Once approved, review the policy terms and ensure you understand the coverage provided.

Legal use of the Cmtia

The legal use of the Cmtia insurance is governed by various regulations that ensure compliance with state and federal laws. It is essential for traders to understand the legal implications of their insurance coverage, including any obligations they may have under the policy. The Cmtia adheres to legal frameworks that validate the insurance contracts, ensuring that they are enforceable in a court of law. Traders should keep records of their insurance documents and correspondence with the Cmtia to demonstrate compliance if needed.

Eligibility Criteria

Eligibility for Cmtia insurance typically requires traders to meet specific criteria, which may include:

- Being actively engaged in trading activities within the markets.

- Providing proof of business operations and financial stability.

- Complying with any local, state, or federal regulations pertinent to trading.

- Meeting any additional requirements set forth by the Cmtia based on the type of coverage sought.

Required Documents

When applying for Cmtia insurance, traders must prepare and submit various documents, which may include:

- Proof of identity and business registration.

- Financial statements or tax returns from previous years.

- Documentation of trading activities, such as transaction records.

- Any previous insurance policies or claims history.

Quick guide on how to complete cmtia

Complete Cmtia effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Cmtia on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign Cmtia with ease

- Obtain Cmtia and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this task.

- Create your electronic signature with the Sign tool, which takes moments and has the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Cmtia and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cmtia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is market traders insurance?

Market traders insurance is a specialized type of insurance designed to protect individuals engaged in trading activities in various markets. This insurance typically covers risks associated with trading activities, including financial loss, liability claims, and property damage. It's essential for market traders to have this coverage to safeguard their investments and maintain compliance.

-

Why do I need market traders insurance?

Having market traders insurance is crucial for protecting your financial interests and mitigating risks associated with trading. This type of insurance can cover unexpected losses due to market fluctuations, thus providing you with peace of mind as you engage in your trading activities. It can also protect you from liability claims that may arise during your operations.

-

What features should I look for in market traders insurance?

When selecting market traders insurance, look for features such as coverage against financial losses, protection against cyber threats, and liability coverage. It's also important to consider additional endorsements that may cover specific activities in your trading business. A comprehensive policy should tailor to the unique needs of market traders.

-

How much does market traders insurance cost?

The cost of market traders insurance can vary based on factors such as the size of your trading activities, the level of coverage you choose, and your claims history. Generally, premiums can range from a few hundred to several thousand dollars annually. It's advisable to get quotes from multiple insurers to find the most competitive pricing and suitable coverage.

-

Can market traders insurance be customized?

Yes, market traders insurance can often be customized to fit the specific needs of your trading business. Many insurers offer flexible policies that allow you to choose the coverage limits and add-ons necessary for your operations. Customization ensures that you only pay for the coverage relevant to your trading activities.

-

Is market traders insurance necessary for online trading?

Yes, market traders insurance is essential even for online trading. As digital platforms are prone to cybersecurity threats, having insurance protects you from potential data bsignNowes and financial losses. It also handles liability issues that may arise from the online trading environment.

-

Are there integrations available for market traders insurance?

Many market traders insurance providers offer integrations with various trading platforms and financial software. These integrations can simplify the process of managing your insurance, claims, and trading activities. Check with your insurance provider for available integrations that can enhance your operational efficiency.

Get more for Cmtia

Find out other Cmtia

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement