05 391 Form

What is the 05 391

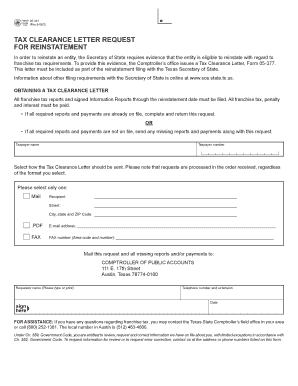

The 05 391 form, also known as the Texas Form 05 391, is a document used primarily for various legal and administrative purposes within the state of Texas. This form is often utilized in situations involving the transfer of property, particularly in cases of inheritance or other legal transactions. Understanding its purpose is crucial for individuals involved in such processes, as it ensures compliance with state regulations and facilitates the proper handling of legal matters.

How to use the 05 391

Using the 05 391 form involves several steps to ensure that all necessary information is accurately provided. First, gather all required documents and information related to the transaction or legal matter at hand. This may include identification, property details, and any relevant legal documents. Next, carefully fill out the form, ensuring that all sections are completed as required. Once the form is filled out, it may need to be signed in the presence of a notary public to validate the document. Finally, submit the completed form to the appropriate authority or agency as specified by Texas law.

Steps to complete the 05 391

Completing the 05 391 form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Obtain the latest version of the form from a reliable source.

- Read the instructions carefully to understand what information is needed.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign the form in front of a notary public if required.

- Submit the form to the designated agency or office.

Legal use of the 05 391

The legal use of the 05 391 form is governed by Texas state laws and regulations. To be considered legally binding, the form must be completed correctly and submitted to the appropriate authorities. It is essential to ensure that all signatures are valid and that the form is notarized if necessary. Additionally, retaining copies of the completed form for personal records is advisable, as it may be required for future reference or legal proceedings.

Key elements of the 05 391

Several key elements are essential for the proper completion and use of the 05 391 form. These include:

- Identification Information: This includes the names and addresses of all parties involved.

- Property Details: Accurate descriptions of the property in question, including location and legal descriptions.

- Signatures: Required signatures from all parties involved, ensuring that they are valid and notarized if necessary.

- Date of Execution: The date when the form is signed and completed.

Form Submission Methods

The 05 391 form can be submitted through various methods depending on the requirements of the specific agency or authority. Common submission methods include:

- Online Submission: Some agencies may allow electronic submission of the form through their official websites.

- Mail: The completed form can be sent via postal mail to the appropriate office.

- In-Person: Individuals may also choose to submit the form in person at designated offices or agencies.

Quick guide on how to complete 05 391

Manage 05 391 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle 05 391 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign 05 391 with ease

- Find 05 391 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your edits.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign 05 391 and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 391

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 05 391 and why is it important?

Form 05 391 is a key document used for various administrative purposes. It is essential for ensuring compliance and proper record-keeping within many businesses. Using airSlate SignNow allows for the effortless generation and eSigning of form 05 391, enhancing efficiency and accuracy.

-

How can airSlate SignNow help me with form 05 391?

airSlate SignNow simplifies the process of filling out and signing form 05 391. With its user-friendly interface, you can quickly complete the required information and send it directly for eSignature. This streamlines your workflow, saving you time and reducing the chances for errors.

-

Is there a cost associated with using airSlate SignNow for form 05 391?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. When using the platform for form 05 391, you can choose a plan that suits your budget while accessing advanced features. There are affordable options that provide excellent value for managing your documents securely.

-

What features does airSlate SignNow offer for managing form 05 391?

airSlate SignNow provides features such as customizable templates, bulk sending, and advanced tracking for form 05 391. These functionalities enhance your ability to manage documents efficiently and monitor their status. Additionally, you can integrate it with other applications to streamline your operations further.

-

Can I integrate airSlate SignNow with other tools while working with form 05 391?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, allowing you to work efficiently with form 05 391. Whether you're using CRM systems, cloud storage, or project management tools, signNow can connect with them to provide a cohesive workflow.

-

What are the benefits of using airSlate SignNow for form 05 391?

Using airSlate SignNow for form 05 391 yields several benefits, including improved efficiency, reduced paper usage, and enhanced security. The platform enables quick turnaround times with eSignatures, ensuring that your document processes are faster and more reliable. It's a cost-effective solution for businesses of all sizes.

-

Is airSlate SignNow secure for handling form 05 391?

Yes, airSlate SignNow prioritizes security when managing form 05 391. The platform employs advanced encryption and compliance with industry regulations, ensuring that your sensitive documents remain protected. You can confidently sign and store your documents without worrying about data bsignNowes.

Get more for 05 391

Find out other 05 391

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors