Bank Islam Baiti Home Financing Form

What is the Bank Islam Baiti Home Financing

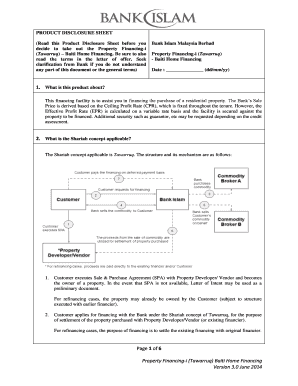

The Bank Islam Baiti Home Financing is a financial product designed to assist individuals in purchasing residential properties. This financing option is structured to comply with Islamic finance principles, ensuring that transactions are free from interest (riba). Instead, the bank utilizes a profit-sharing model, which aligns with Shariah law. This product is particularly beneficial for first-time homebuyers looking for ethical financing solutions.

How to use the Bank Islam Baiti Home Financing

Utilizing the Bank Islam Baiti Home Financing involves several steps. First, potential borrowers should assess their eligibility based on income, credit history, and property type. Once eligibility is confirmed, applicants can proceed to gather necessary documentation, including proof of income, identification, and property details. After submitting the application, the bank will review the information and provide an offer based on the financing terms. Upon acceptance, the funds will be disbursed for the property purchase.

Steps to complete the Bank Islam Baiti Home Financing

Completing the Bank Islam Baiti Home Financing involves a systematic approach:

- Step One: Determine your eligibility by reviewing income requirements and credit scores.

- Step Two: Collect required documents, such as identification, income statements, and property information.

- Step Three: Submit the application form along with the gathered documents to the bank.

- Step Four: Await the bank's assessment and approval of your financing request.

- Step Five: Review and accept the financing offer, ensuring you understand the terms.

- Step Six: Finalize the transaction by completing any necessary paperwork for the property purchase.

Legal use of the Bank Islam Baiti Home Financing

The legal use of the Bank Islam Baiti Home Financing is governed by specific regulations that ensure compliance with Islamic law. This financing must adhere to the principles of transparency and fairness. All agreements should clearly outline the terms of the financing, including profit rates and repayment schedules. It is essential for borrowers to understand their rights and obligations under the agreement to avoid potential legal issues.

Eligibility Criteria

To qualify for the Bank Islam Baiti Home Financing, applicants must meet certain eligibility criteria. Typically, this includes having a steady income that meets the minimum requirement set by the bank, a good credit history, and the ability to provide a down payment. Additionally, the property being financed must meet the bank's specifications regarding location, type, and value. Meeting these criteria is crucial for a smooth application process.

Required Documents

When applying for the Bank Islam Baiti Home Financing, specific documents are necessary to facilitate the application process. Commonly required documents include:

- Government-issued identification (e.g., driver's license or passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Details of the property being purchased

- Any additional documentation requested by the bank

Application Process & Approval Time

The application process for the Bank Islam Baiti Home Financing is designed to be straightforward. After submitting the required documents, the bank typically takes a few days to a few weeks to review the application. Approval time may vary based on the completeness of the application and the bank's current workload. Once approved, borrowers will receive a financing offer detailing the terms and conditions of the loan.

Quick guide on how to complete bank islam baiti home financing

Complete Bank Islam Baiti Home Financing effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Bank Islam Baiti Home Financing on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Bank Islam Baiti Home Financing effortlessly

- Locate Bank Islam Baiti Home Financing and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Bank Islam Baiti Home Financing and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank islam baiti home financing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is baiti home and how does it work?

Baiti home is a platform that allows users to manage their documents and e-signatures seamlessly. With airSlate SignNow, you can easily upload, edit, and send documents for signature, making the process efficient for individuals and businesses alike. It streamlines document workflows and enhances productivity.

-

What are the pricing options for baiti home?

Baiti home offers competitive pricing plans tailored to fit different needs. Users can choose from various subscription models, which include monthly and annual options, ensuring flexibility. Additionally, airSlate SignNow provides a free trial, allowing potential customers to explore the features before commitment.

-

What features does baiti home offer?

Baiti home comes equipped with a variety of features designed to simplify document management. Key functionalities include cloud storage, customizable templates, and real-time tracking of document status. These features enhance collaboration and save time during the signing process.

-

How can baiti home benefit my business?

By using baiti home, businesses can signNowly improve their operational efficiency. The platform reduces the time spent on paperwork and accelerates the signing process, allowing teams to focus on core activities. Moreover, electronic signatures provide security and compliance, protecting your sensitive information.

-

Is baiti home suitable for small businesses?

Absolutely! Baiti home is specifically designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective solutions make it an ideal choice for startups looking to streamline document management without a steep learning curve.

-

What integrations does baiti home support?

Baiti home supports a wide range of integrations with popular applications, enhancing its functionality. You can connect it with platforms like Google Drive, Dropbox, and CRM systems, making it easier to manage and share documents. This integration capability allows for a more cohesive workflow within your organization.

-

Is there a mobile app for baiti home?

Yes, baiti home offers a mobile application that allows you to manage and sign documents on-the-go. This mobile access ensures that you can handle your paperwork anytime, anywhere, which is especially useful for busy professionals. The app is compatible with both iOS and Android devices.

Get more for Bank Islam Baiti Home Financing

- Montego bay community college application form

- Accident report kansas department of labor dol ks form

- Tops form 32851 application for employment fillable 16003753

- Reading street grade 5 pdf 232660358 form

- What does an unemployment approval letter look like form

- Finding slopes y intercepts writing equations to lines and interpreting graphs in context form

- Blank form for automatic payment

- Pa hospital hims health informatics unit forms management form msh016 form msh016 breastscreen qld gov

Find out other Bank Islam Baiti Home Financing

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form