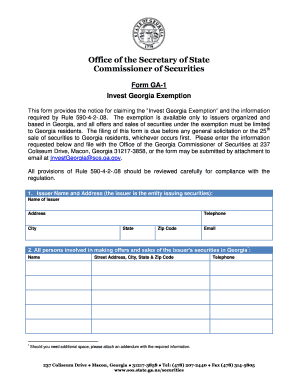

Invest Georgia Exemption Form

What is the Invest Georgia Exemption

The Invest Georgia Exemption is a tax incentive designed to encourage investment in Georgia-based businesses. This exemption allows investors to receive a tax credit for their investments, promoting economic growth within the state. It is particularly beneficial for those looking to support small businesses and startups, as it provides a financial incentive for individuals and entities to invest in local ventures.

How to use the Invest Georgia Exemption

Utilizing the Invest Georgia Exemption involves several steps. First, investors must identify eligible businesses that qualify for the exemption. Once an investment is made, the investor can claim the tax credit on their state tax return. It is essential to keep detailed records of the investment and any related documentation to ensure compliance with state regulations.

Steps to complete the Invest Georgia Exemption

Completing the Invest Georgia Exemption requires careful attention to detail. Follow these steps:

- Identify eligible businesses that qualify for the exemption.

- Make the investment in the chosen business.

- Collect all necessary documentation, including proof of investment.

- Fill out the appropriate forms for claiming the tax credit.

- Submit your tax return, including the exemption claim, to the state.

Eligibility Criteria

To qualify for the Invest Georgia Exemption, both investors and businesses must meet specific eligibility criteria. Investors must be individuals or entities that make a qualifying investment in a Georgia-based business. The business must be a qualified Georgia company, which typically includes small businesses and startups that meet certain revenue and operational thresholds. Understanding these criteria is crucial for both parties to ensure compliance and maximize benefits.

Legal use of the Invest Georgia Exemption

The legal use of the Invest Georgia Exemption is governed by state laws and regulations. Investors must ensure that their investments align with the requirements set forth by the state to avoid penalties. This includes adhering to guidelines regarding the types of businesses that qualify and the amount of investment that can be claimed. Proper documentation and compliance with legal standards are essential for the exemption to be valid.

Key elements of the Invest Georgia Exemption

Several key elements define the Invest Georgia Exemption. These include:

- The maximum investment amount eligible for the exemption.

- The types of businesses that qualify for the exemption.

- The process for claiming the tax credit on state tax returns.

- The duration of the exemption and any renewal requirements.

Application Process & Approval Time

The application process for the Invest Georgia Exemption involves submitting the necessary forms and documentation to the appropriate state authorities. Once submitted, the approval time can vary based on the volume of applications and the completeness of the submitted information. It is advisable to apply well in advance of tax deadlines to ensure timely processing and to avoid any potential delays in receiving the tax credit.

Quick guide on how to complete invest georgia exemption

Prepare invest georgia exemption effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing users to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage invest georgia exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign invest georgia exemption with ease

- Locate invest georgia exemption and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign invest georgia exemption and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to invest georgia exemption

Create this form in 5 minutes!

How to create an eSignature for the invest georgia exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask invest georgia exemption

-

What is the invest Georgia exemption and how does it work?

The invest Georgia exemption is a tax incentive designed to encourage investments in qualified businesses within Georgia. By participating in this program, eligible companies can receive signNow tax benefits, which can enhance their growth and operational capabilities. Understanding this exemption can be crucial for businesses looking to maximize their investment potential in Georgia.

-

How can airSlate SignNow assist with the invest Georgia exemption process?

airSlate SignNow provides a streamlined electronic signature solution that can simplify the paperwork involved in applying for the invest Georgia exemption. With our easy-to-use platform, businesses can manage and sign documents quickly and securely, ensuring compliance and saving time. This makes the process of claiming your exemption more efficient.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to different business needs, including basic, advanced, and enterprise solutions. Each plan is designed to optimize workflow and enhance document management. Investing in airSlate SignNow is a cost-effective way to ensure your documentation is handled efficiently, especially when applying for the invest Georgia exemption.

-

What key features does airSlate SignNow offer that support the invest Georgia exemption application?

Key features of airSlate SignNow include customizable templates, automated workflows, and advanced security measures, all of which are beneficial for processing documents related to the invest Georgia exemption. The platform allows users to create templates specific to their exemption applications, enhancing efficiency. Additionally, security features ensure that your sensitive information remains protected throughout the process.

-

What benefits does using airSlate SignNow provide when applying for the invest Georgia exemption?

Using airSlate SignNow for your invest Georgia exemption application offers numerous benefits, including faster turnaround times and reduced paperwork. The electronic signature capabilities allow for quick approvals, and the integration with other apps ensures a seamless workflow. Overall, this expedites the entire process, allowing businesses to focus more on growth rather than logistics.

-

Can airSlate SignNow integrate with other tools to help with the invest Georgia exemption?

Yes, airSlate SignNow offers integrations with various tools such as CRM and document management systems. This means you can easily connect your existing software to streamline the application for the invest Georgia exemption. By using integrated tools, you can enhance efficiency and maintain visibility throughout the compliance process.

-

Is airSlate SignNow secure for handling documents related to the invest Georgia exemption?

Absolutely, airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect all documents, including those related to the invest Georgia exemption. You can trust that your sensitive information is safeguarded against unauthorized access. This level of security is essential for businesses operating in compliance-sensitive environments.

Get more for invest georgia exemption

Find out other invest georgia exemption

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney