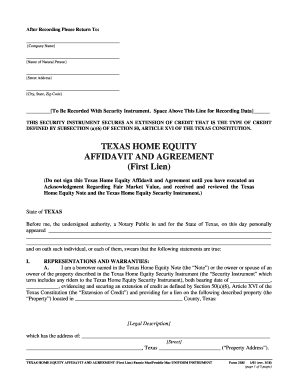

Form 3185 Texas Home Equity Affidavit and Agreement Fannie MaeFreddie Mac Uniform Instrument 2018

Understanding the Texas Home Equity Security Instrument

The Texas home equity security instrument is a legal document that secures a loan against a property in Texas. This instrument is critical for homeowners looking to access their home equity, allowing them to borrow funds while using their home as collateral. It outlines the terms of the loan and the rights of both the lender and the borrower. This form is particularly important in Texas due to the state's unique regulations regarding home equity loans, which are designed to protect consumers.

Steps to Complete the Texas Home Equity Security Instrument

Completing the Texas home equity security instrument involves several key steps to ensure accuracy and compliance with state laws. First, gather all necessary information, including property details, borrower information, and loan terms. Next, fill out the form carefully, ensuring that all fields are completed. It's essential to review the document for any errors or omissions before signing. After filling it out, both the borrower and lender must sign the document in the presence of a notary public to validate it legally. Finally, ensure that the completed instrument is filed with the appropriate county clerk's office.

Legal Use of the Texas Home Equity Security Instrument

The legal use of the Texas home equity security instrument is governed by state laws that dictate how home equity loans can be structured. This instrument must comply with Texas Constitution Article XVI, Section 50, which outlines specific provisions for home equity lending. These provisions include limits on the amount that can be borrowed, the requirement for a 12-day waiting period after the loan application, and the necessity for clear disclosures to the borrower. Understanding these legal requirements is crucial for both lenders and borrowers to ensure that the loan is enforceable.

Key Elements of the Texas Home Equity Security Instrument

Several key elements are included in the Texas home equity security instrument. These elements typically encompass the names of the parties involved, a description of the property securing the loan, the loan amount, interest rates, and repayment terms. Additionally, the document should outline the rights and responsibilities of both the borrower and lender, including what happens in the event of default. Clear articulation of these elements helps prevent disputes and ensures that both parties understand their obligations.

State-Specific Rules for the Texas Home Equity Security Instrument

Texas has specific rules that govern the use of the home equity security instrument. For instance, the state mandates that all home equity loans must be closed in person and requires a detailed disclosure of the loan terms to the borrower. Furthermore, the Texas Constitution places a cap on the total amount of debt secured by a home equity loan, ensuring that homeowners do not overextend themselves financially. Familiarity with these state-specific rules is essential for compliance and to protect the rights of all parties involved.

How to Obtain the Texas Home Equity Security Instrument

Obtaining the Texas home equity security instrument can be done through various means. Homeowners can typically acquire the form from their lender, who will provide the necessary documentation as part of the loan application process. Additionally, the form may be available through legal websites or local government offices. It is important to ensure that the version obtained is the most current and complies with Texas laws, as outdated forms may not be legally valid.

Quick guide on how to complete form 3185 texas home equity affidavit and agreement fannie maefreddie mac uniform instrument

Manage Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument effortlessly on any device

Digital document handling has become increasingly popular among businesses and individuals. It offers a pristine eco-friendly substitute to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow supplies you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Handle Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument with ease

- Locate Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3185 texas home equity affidavit and agreement fannie maefreddie mac uniform instrument

Create this form in 5 minutes!

People also ask

-

What is a Texas home equity security instrument?

A Texas home equity security instrument is a legal document that secures a loan against the equity of a home in Texas. This instrument outlines the terms of the equity loan and ensures the lender's rights to the property in case of default. Understanding this document is vital for homeowners considering a home equity loan.

-

How does a Texas home equity security instrument affect my mortgage?

A Texas home equity security instrument can impact your existing mortgage by creating a second lien on your property. This means that if you take out a home equity loan, it will be subordinate to your original mortgage. Homeowners should consider this hierarchy before proceeding with additional borrowing.

-

What are the benefits of using airSlate SignNow for a Texas home equity security instrument?

Using airSlate SignNow for a Texas home equity security instrument simplifies the eSigning process, enables quick distribution of documents, and provides a secure platform for all parties involved. Our solution enhances efficiency by automating workflow, helping you close transactions faster. It's also user-friendly, making it accessible for everyone.

-

Are there any fees associated with obtaining a Texas home equity security instrument?

Yes, obtaining a Texas home equity security instrument may involve various fees, including appraisal fees, title search fees, and closing costs. These costs can vary based on the lender and the specifics of your loan agreement. It's essential to review them carefully and budget accordingly before proceeding.

-

Can I integrate airSlate SignNow with other software for managing Texas home equity security instruments?

Absolutely! airSlate SignNow supports a variety of integrations with popular business software, allowing for seamless management of Texas home equity security instruments. Whether you're using CRM systems or document management tools, our platform can synchronize to enhance your workflow and document handling efficiency.

-

How can I ensure my Texas home equity security instrument is properly executed?

To ensure your Texas home equity security instrument is executed correctly, consider using airSlate SignNow, which provides a streamlined eSigning process. Each document is recorded and secured, ensuring compliance and proper authentication. Utilizing our platform can help you avoid errors and ensure timely execution.

-

What documentation do I need for the Texas home equity security instrument?

When preparing a Texas home equity security instrument, you typically need proof of income, a title report, and an appraisal of your home. Additionally, any existing mortgage documentation will be required for review. Gathering these documents will facilitate a smooth transaction process.

Get more for Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument

- Legal last will and testament form for widow or widower with minor children tennessee

- Form widower 497327135

- Legal last will and testament form for a widow or widower with adult and minor children tennessee

- Legal last will and testament form for divorced and remarried person with mine yours and ours children tennessee

- Legal last will and testament form with all property to trust called a pour over will tennessee

- Written revocation of will tennessee form

- Last will and testament for other persons tennessee form

- Notice to beneficiaries of being named in will tennessee form

Find out other Form 3185 Texas Home Equity Affidavit And Agreement Fannie MaeFreddie Mac Uniform Instrument

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms