Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185 2007

What is the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

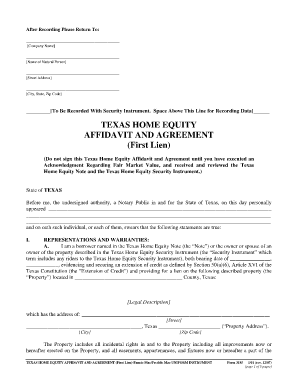

The Texas Home Equity Affidavit and Agreement First Lien Form 3185 is a crucial legal document used in the home equity lending process. This form serves to affirm the borrower's understanding and agreement to the terms of the home equity loan. It outlines the rights and responsibilities of both the borrower and the lender, ensuring that the transaction complies with Texas law. The form is essential for securing a home equity loan, as it provides necessary disclosures and protects the interests of all parties involved.

Steps to Complete the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

Completing the Texas Home Equity Affidavit and Agreement First Lien Form 3185 involves several key steps:

- Gather necessary information, including property details, loan amount, and borrower information.

- Carefully read through the entire form to understand all terms and conditions.

- Fill in the required fields accurately, ensuring that all information is complete and truthful.

- Review the document for any errors or omissions before finalizing.

- Sign the form in the designated areas, ensuring that all required signatures are included.

- Submit the completed form to the lender as per their submission guidelines.

Key Elements of the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

The Texas Home Equity Affidavit and Agreement First Lien Form 3185 includes several key elements that are vital for its validity:

- Borrower Information: Details about the borrower, including name, address, and contact information.

- Property Description: Accurate description of the property being used as collateral for the loan.

- Loan Amount: The total amount of the home equity loan being requested.

- Affidavit Statement: A declaration affirming the borrower's understanding of the loan terms and their legal obligations.

- Signatures: Required signatures from all borrowers and, if applicable, co-borrowers.

Legal Use of the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

The legal use of the Texas Home Equity Affidavit and Agreement First Lien Form 3185 is governed by Texas state law. This form must be executed correctly to ensure that the home equity loan is legally binding. Compliance with state regulations is essential, as failure to adhere to legal requirements can result in the loan being deemed invalid. The form must be signed in the presence of a notary public to enhance its legal standing and protect against potential disputes.

How to Obtain the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

The fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185 can be obtained through various means:

- Visit the official website of the Texas state government or relevant financial institutions that provide the form.

- Request a copy from your lender, who may provide the form as part of the loan application process.

- Utilize online document management platforms that offer access to legal forms, ensuring you select the correct version.

State-Specific Rules for the Fillable Texas Home Equity Affidavit and Agreement First Lien Form 3185

Texas has specific rules governing home equity loans, which directly impact the use of the Home Equity Affidavit and Agreement Form 3185. Key regulations include:

- The requirement for a 12-day waiting period after the loan application before closing.

- Restrictions on the amount of equity that can be borrowed, typically limited to eighty percent of the home's value.

- Mandatory disclosures regarding the terms of the loan, including interest rates and fees.

- Provisions that protect borrowers from predatory lending practices.

Quick guide on how to complete fillable texas home equity affidavit and agreement first lien form 3185

Complete Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185 effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185 without any hassle

- Locate Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185 and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable texas home equity affidavit and agreement first lien form 3185

Create this form in 5 minutes!

How to create an eSignature for the fillable texas home equity affidavit and agreement first lien form 3185

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is a Texas home equity affidavit and agreement?

A Texas home equity affidavit and agreement is a legal document that establishes the terms and conditions surrounding a home equity loan. It outlines the borrower's rights and obligations, ensuring compliance with Texas laws. This document is essential for anyone considering leveraging the equity in their home.

-

How can airSlate SignNow help with Texas home equity affidavit and agreement?

airSlate SignNow simplifies the process of creating, sending, and eSigning a Texas home equity affidavit and agreement. Our platform allows for quick document preparation and secure electronic signing, streamlining the entire transaction. This makes it easier for homeowners to access their home equity without unnecessary delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, starting from a free trial to premium options. Each plan provides access to features necessary for managing Texas home equity affidavit and agreement efficiently. You can choose a plan based on your volume of documents and required functionalities.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as templates, reminders, and automated workflows which are essential for managing Texas home equity affidavit and agreement efficiently. You can customize documents, track their status, and ensure compliance with state regulations. These tools help streamline your workflow and save time.

-

Is airSlate SignNow compliant with Texas laws?

Yes, airSlate SignNow is designed to comply with all relevant Texas laws, including those pertaining to the Texas home equity affidavit and agreement. Our documents are structured to meet regulatory requirements, providing peace of mind for users. Thus, you can trust that your transactions are legally valid and secure.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems, cloud storage services, and other business tools. This means you can easily manage your Texas home equity affidavit and agreement alongside your existing workflows. Integrations help enhance productivity and cohesiveness in your operations.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning your Texas home equity affidavit and agreement offers signNow benefits, including speed, security, and convenience. The platform reduces paperwork and allows for immediate signing from any device. These features not only save time but also enhance the overall user experience.

Get more for Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185

- Assumption of risk and indemnity waiver athena gun club form

- Ldss 4882c form

- Declaration of domestic partnership form

- How to fill out the va offer to purchase form

- Pennsylvania new hire reporting form

- Kansas standard offense report theft form

- Girl scout cookies order form

- Eviction packetpdf midland county co midland tx form

Find out other Fillable Texas Home Equity Affidavit And Agreement First Lien Form 3185

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself