Where to File Addresses for Taxpayers and Tax Professionals 2022-2026

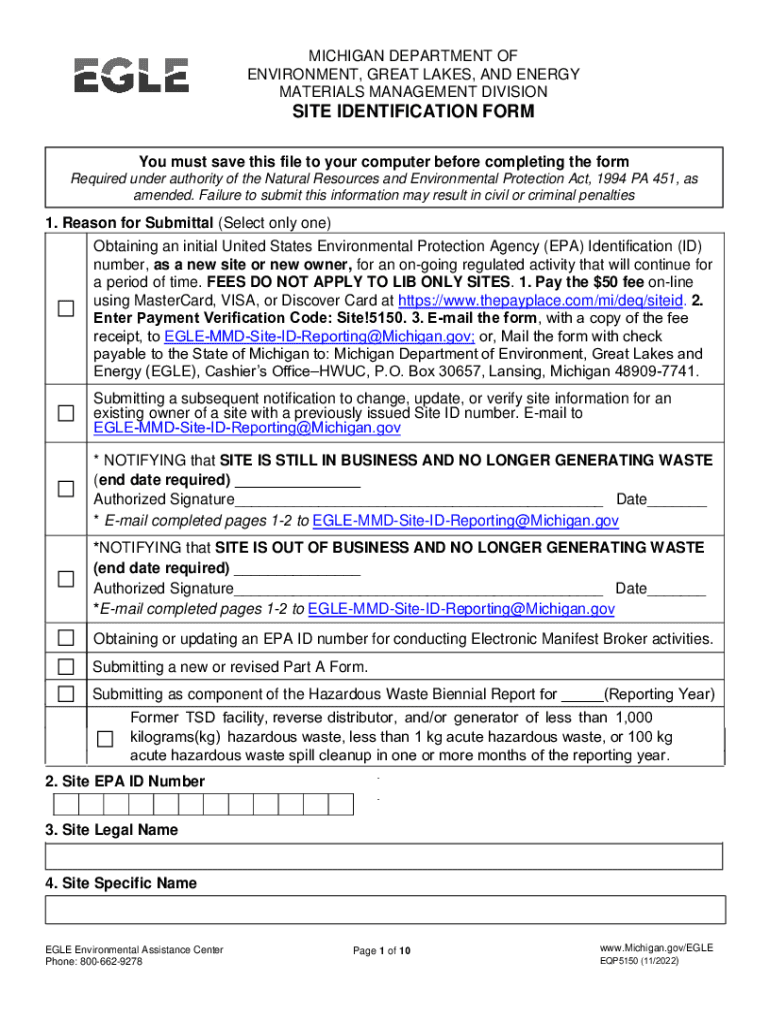

What is the eqp5150 form?

The eqp5150 form is utilized by taxpayers and tax professionals to determine the appropriate addresses for filing various tax documents. This form is essential for ensuring that submissions are sent to the correct locations, thereby facilitating timely processing by the IRS. Understanding the specifics of this form can help avoid delays and potential penalties associated with misfiled documents.

Steps to complete the eqp5150 form

Completing the eqp5150 form involves several straightforward steps:

- Gather necessary information, including your tax identification number and the type of tax return you are submitting.

- Identify the correct filing address based on your state and the nature of your tax return.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the instructions provided, either electronically or via mail.

Legal use of the eqp5150 form

The eqp5150 form is legally binding when completed correctly and submitted to the appropriate tax authority. Adhering to IRS guidelines ensures that the information provided is accurate and compliant with federal regulations. It is important to maintain records of the submission for future reference and to protect against potential disputes.

IRS Guidelines for the eqp5150 form

The IRS provides specific guidelines for completing and submitting the eqp5150 form. Taxpayers should refer to the IRS website or official publications for the latest updates and requirements. Compliance with these guidelines is crucial for ensuring that the form is accepted and processed without issues.

Filing Deadlines / Important Dates for the eqp5150 form

Timely submission of the eqp5150 form is essential to avoid penalties. Key deadlines typically align with the tax filing season, and it is advisable to check the IRS calendar for specific dates each year. Being aware of these deadlines helps taxpayers plan their submissions effectively.

Examples of using the eqp5150 form

Common scenarios for using the eqp5150 form include:

- Individuals filing their annual tax returns who need to confirm the correct mailing address.

- Tax professionals assisting clients with various tax filings, ensuring submissions go to the right locations.

- Businesses submitting quarterly tax payments and needing to verify the appropriate filing addresses.

Quick guide on how to complete where to file addresses for taxpayers and tax professionals

Complete Where To File Addresses For Taxpayers And Tax Professionals effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Where To File Addresses For Taxpayers And Tax Professionals on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest way to edit and electronically sign Where To File Addresses For Taxpayers And Tax Professionals effortlessly

- Find Where To File Addresses For Taxpayers And Tax Professionals and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you’d like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about losing or misplacing files, tedious form searching, or errors that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Where To File Addresses For Taxpayers And Tax Professionals and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct where to file addresses for taxpayers and tax professionals

Create this form in 5 minutes!

How to create an eSignature for the where to file addresses for taxpayers and tax professionals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the primary features of airSlate SignNow for handling tax documents?

airSlate SignNow offers features like eSigning, document templates, and secure storage to streamline your tax document management. These tools are particularly helpful when you need to know 'Where To File Addresses For Taxpayers And Tax Professionals' efficiently, especially during tax season.

-

How does airSlate SignNow ensure the security of tax documents?

Security is a top priority for airSlate SignNow. The platform uses industry-standard encryption protocols to protect your documents, ensuring that sensitive information related to 'Where To File Addresses For Taxpayers And Tax Professionals' remains confidential and secure.

-

Is there a free trial option available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users. This allows you to explore its features, especially how it assists in organizing 'Where To File Addresses For Taxpayers And Tax Professionals', without any financial commitment.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs. Whether you're a small firm or a large enterprise dealing with 'Where To File Addresses For Taxpayers And Tax Professionals', you can choose a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to centralize your workflow. This integration is valuable when dealing with 'Where To File Addresses For Taxpayers And Tax Professionals', ensuring you access all necessary information in one place.

-

What customer support options are available with airSlate SignNow?

airSlate SignNow provides comprehensive customer support through various channels, including live chat, email, and a knowledge base. Their team is ready to assist users with questions related to 'Where To File Addresses For Taxpayers And Tax Professionals', ensuring a smooth experience.

-

How user-friendly is the airSlate SignNow platform?

The airSlate SignNow interface is designed for ease of use, making it accessible for both tax professionals and individual taxpayers. This simplicity allows users to quickly find 'Where To File Addresses For Taxpayers And Tax Professionals' without extensive training.

Get more for Where To File Addresses For Taxpayers And Tax Professionals

Find out other Where To File Addresses For Taxpayers And Tax Professionals

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free