Filing Due Dates for Alcoholic Beverages Forms 2015

What is the Filing Due Dates For Alcoholic Beverages Forms

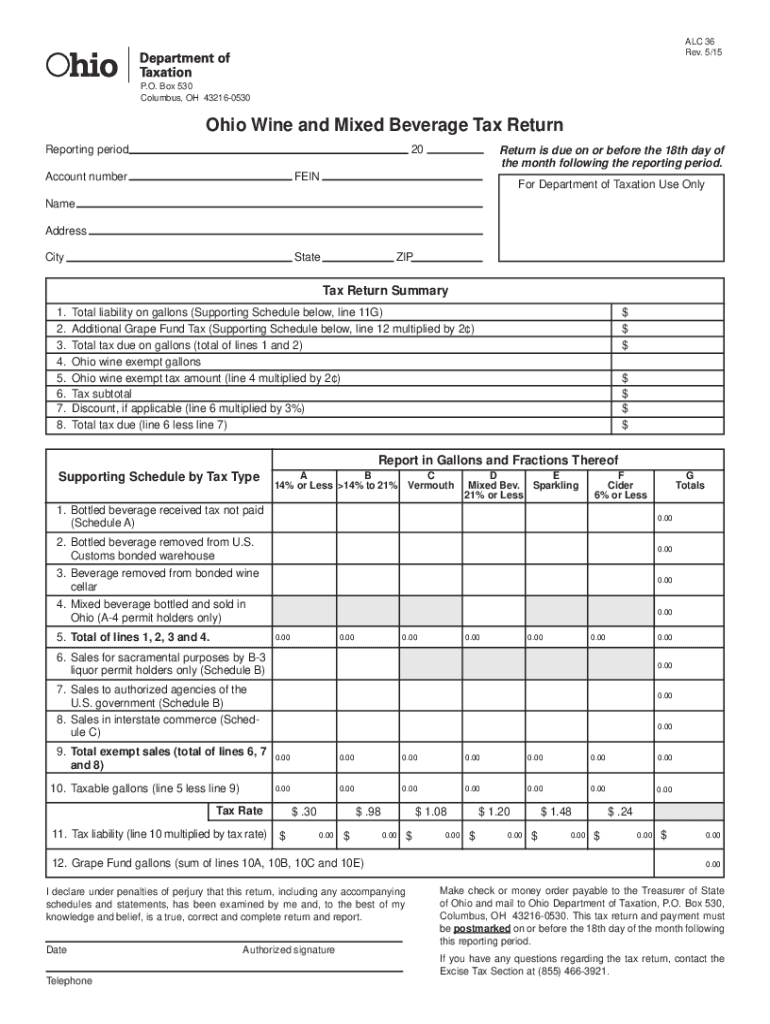

The filing due dates for alcoholic beverages forms refer to the specific deadlines set by regulatory authorities for submitting required documentation related to the production, distribution, and sale of alcoholic beverages. These forms are essential for compliance with federal, state, and local laws governing the alcohol industry. Each state may have its own set of forms and deadlines, which can vary significantly. Understanding these due dates is crucial for businesses to avoid penalties and ensure uninterrupted operations.

Steps to complete the Filing Due Dates For Alcoholic Beverages Forms

Completing the filing due dates for alcoholic beverages forms involves several key steps:

- Identify the specific forms required for your business based on your state and type of alcohol operation.

- Gather all necessary information and documentation, including business licenses, tax identification numbers, and any previous filings.

- Fill out the forms accurately, ensuring all information is current and correct.

- Review the forms for completeness and compliance with state regulations.

- Submit the forms by the designated due date, either electronically or via mail, depending on state requirements.

State-specific rules for the Filing Due Dates For Alcoholic Beverages Forms

Each state in the U.S. has its own regulations regarding the filing due dates for alcoholic beverages forms. It is important for businesses to familiarize themselves with their state’s specific rules, as these can dictate not only the forms required but also the deadlines for submission. Some states may have quarterly or annual filing requirements, while others may require more frequent updates. Checking with the state’s alcohol regulatory agency can provide clarity on these rules.

Penalties for Non-Compliance

Failure to comply with the filing due dates for alcoholic beverages forms can result in significant penalties. These may include fines, suspension of licenses, or even legal action. The severity of penalties often depends on the nature of the violation and the state’s regulations. Businesses should prioritize compliance to avoid these consequences and maintain their operational licenses.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the filing due dates for alcoholic beverages forms, which can include:

- Online Submission: Many states offer electronic filing options, allowing businesses to submit forms directly through a secure online portal.

- Mail Submission: Forms can often be printed and mailed to the appropriate regulatory agency, though this method may take longer for processing.

- In-Person Submission: Some businesses may choose to submit forms in person at local regulatory offices, which can provide immediate confirmation of receipt.

Legal use of the Filing Due Dates For Alcoholic Beverages Forms

The legal use of the filing due dates for alcoholic beverages forms is crucial for ensuring that businesses operate within the law. These forms serve as official documentation of compliance with state and federal regulations. Properly filed forms can protect businesses in legal disputes and provide evidence of adherence to licensing requirements. It is essential for businesses to understand the legal implications of these forms and maintain accurate records of all submissions.

Quick guide on how to complete filing due dates for alcoholic beverages forms

Fill out Filing Due Dates For Alcoholic Beverages Forms effortlessly on any device

The management of online documents has become increasingly favored by both companies and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Filing Due Dates For Alcoholic Beverages Forms on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Filing Due Dates For Alcoholic Beverages Forms with ease

- Locate Filing Due Dates For Alcoholic Beverages Forms and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Select important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that task.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Filing Due Dates For Alcoholic Beverages Forms and guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing due dates for alcoholic beverages forms

Create this form in 5 minutes!

How to create an eSignature for the filing due dates for alcoholic beverages forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Filing Due Dates For Alcoholic Beverages Forms?

The Filing Due Dates For Alcoholic Beverages Forms vary by state and type of license. It's essential to consult your local regulations to ensure compliance. Keeping track of these dates can prevent potential fines and ensure your business remains operational.

-

How can airSlate SignNow help with managing Filing Due Dates For Alcoholic Beverages Forms?

airSlate SignNow streamlines the process of managing Filing Due Dates For Alcoholic Beverages Forms through automated reminders and easy document tracking. This ensures you never miss a deadline. Our platform is designed to keep your business compliant efficiently.

-

Are there any costs associated with using airSlate SignNow for Filing Due Dates For Alcoholic Beverages Forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that simplify the management of Filing Due Dates For Alcoholic Beverages Forms. You can choose a plan that fits your budget and volume requirements.

-

What features does airSlate SignNow offer for Filing Due Dates For Alcoholic Beverages Forms?

airSlate SignNow offers features like eSigning, document templates, and automated reminders specifically tailored for Filing Due Dates For Alcoholic Beverages Forms. These features enhance document management and ensure timely submissions. Our user-friendly interface makes it easy to navigate and utilize these tools.

-

Can I integrate airSlate SignNow with other tools for better management of Filing Due Dates For Alcoholic Beverages Forms?

Yes, airSlate SignNow seamlessly integrates with various business applications. This allows you to synchronize your Filing Due Dates For Alcoholic Beverages Forms with other tools you may already be using. Integration simplifies communication and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for Filing Due Dates For Alcoholic Beverages Forms?

Using airSlate SignNow for Filing Due Dates For Alcoholic Beverages Forms provides numerous benefits, including time savings and improved accuracy. Automated workflows reduce human error and ensure compliance. Additionally, our platform helps maintain organization and clarity in the submission process.

-

Is training available for using airSlate SignNow with Filing Due Dates For Alcoholic Beverages Forms?

Yes, airSlate SignNow offers training and support resources to help you effectively manage Filing Due Dates For Alcoholic Beverages Forms. Our comprehensive guides and support team ensure that you can utilize all features effectively. This investment in training can signNowly enhance your workflows.

Get more for Filing Due Dates For Alcoholic Beverages Forms

Find out other Filing Due Dates For Alcoholic Beverages Forms

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy