Idaho Transfer Form 2021-2026

What is the Idaho Duplicate Title Application?

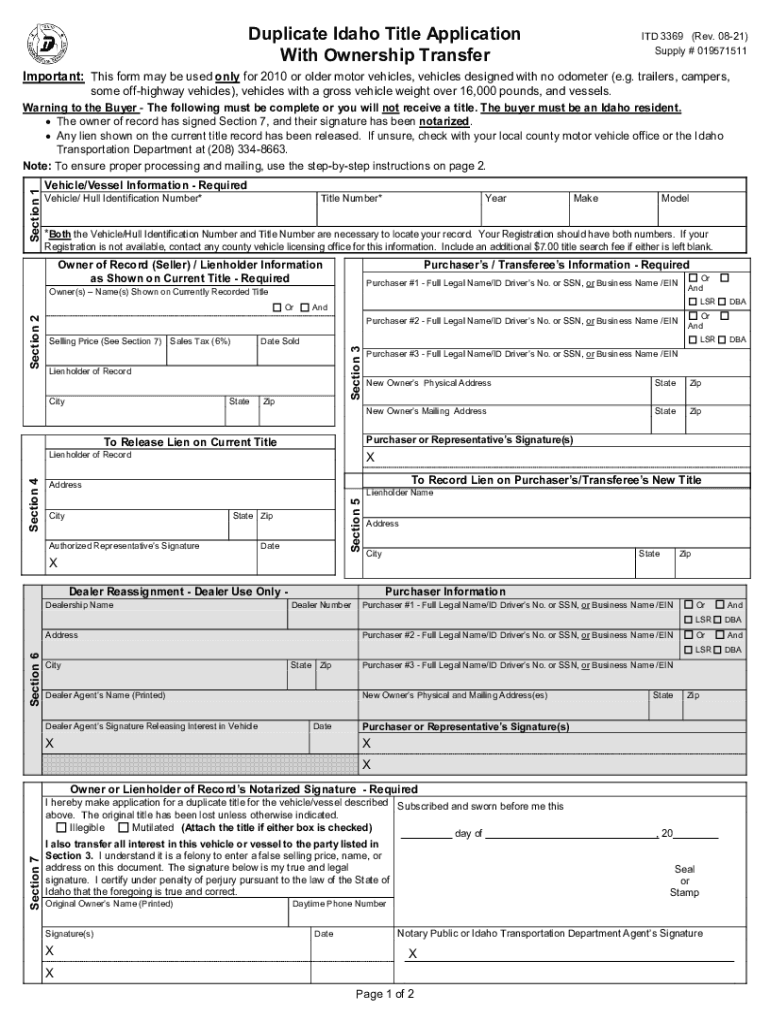

The Idaho duplicate title application is a legal document used to request a replacement for a lost, stolen, or damaged vehicle title. This form is essential for vehicle owners in Idaho who need to establish ownership or transfer ownership rights. The application must be completed accurately to ensure that the new title is issued without delays. It is important to understand that the duplicate title serves the same legal purpose as the original title, providing proof of ownership for vehicles registered in Idaho.

Steps to Complete the Idaho Duplicate Title Application

Completing the Idaho duplicate title application involves several key steps:

- Obtain the Idaho duplicate title application form, known as ITD 3369, from the Idaho Department of Motor Vehicles (DMV) or their official website.

- Fill out the application form with accurate information, including the vehicle identification number (VIN), make, model, year, and your personal details.

- Sign the application to certify that the information provided is true and correct.

- Submit the completed form along with any required fees to the DMV. Payment can typically be made via check, money order, or credit card.

- Wait for the DMV to process your application. Processing times may vary, so check with your local DMV for specific timelines.

Required Documents for the Idaho Duplicate Title Application

When applying for a duplicate title in Idaho, certain documents may be required to support your application:

- The completed ITD 3369 form.

- Proof of identity, such as a driver's license or state-issued ID.

- Any additional documentation proving ownership, such as a bill of sale or previous title, if available.

- Payment for the duplicate title fee, which varies by county.

Legal Use of the Idaho Duplicate Title Application

The Idaho duplicate title application must be used in accordance with state laws governing vehicle ownership and title transfers. A duplicate title is legally binding and serves as proof of ownership. It is crucial to ensure that the application is filled out correctly and submitted to the appropriate DMV office to avoid any legal complications. Failure to comply with the requirements can result in delays or denial of the application.

Form Submission Methods for the Idaho Duplicate Title Application

There are several methods to submit the Idaho duplicate title application:

- Online: Some counties may allow online submission through the Idaho DMV website.

- By Mail: You can mail the completed application and payment to your local DMV office.

- In-Person: Visit your local DMV office to submit the application and pay the fee directly.

State-Specific Rules for the Idaho Duplicate Title Application

Idaho has specific rules that govern the issuance of duplicate titles. These include:

- The requirement to provide accurate vehicle information, including the VIN.

- Verification of identity and ownership before a duplicate title is issued.

- Payment of applicable fees, which may vary by county.

- Compliance with any additional state regulations regarding vehicle titles and ownership transfers.

Quick guide on how to complete idaho transfer form

Effortlessly Prepare Idaho Transfer Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Idaho Transfer Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric procedure today.

How to Modify and eSign Idaho Transfer Form with Ease

- Find Idaho Transfer Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Idaho Transfer Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idaho transfer form

Create this form in 5 minutes!

How to create an eSignature for the idaho transfer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Idaho duplicate title application?

An Idaho duplicate title application is a form that you need to fill out when your vehicle's title is lost or damaged. This application allows you to obtain a replacement title from the Idaho Department of Transportation, ensuring that your vehicle ownership can be verified without issues.

-

How much does the Idaho duplicate title application cost?

The fee for an Idaho duplicate title application typically ranges, so it's best to check with the Idaho Department of Transportation for the latest pricing. Additionally, our airSlate SignNow service offers an easy and cost-effective way to complete the necessary forms online, which can further streamline your process.

-

How can airSlate SignNow help with my Idaho duplicate title application?

With airSlate SignNow, you can easily fill out and eSign your Idaho duplicate title application online. Our platform simplifies the document management process, allowing you to complete your application quickly and securely from anywhere, reducing the time spent on paperwork.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and secure eSignature options. These features enable users to efficiently handle their Idaho duplicate title application and other documents with ease and confidence.

-

Is it safe to submit my Idaho duplicate title application through airSlate SignNow?

Yes, submitting your Idaho duplicate title application through airSlate SignNow is safe and secure. We prioritize data protection with advanced encryption and compliance measures to ensure that your sensitive information remains confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for my Idaho duplicate title application?

Yes, airSlate SignNow can be easily integrated with various tools and platforms that you may already be using. This feature allows for a seamless workflow management process, making it even easier to handle your Idaho duplicate title application along with other important documents.

-

How long does it take to process an Idaho duplicate title application?

The processing time for an Idaho duplicate title application can vary, but typically it may take a few weeks. By utilizing airSlate SignNow, you can expedite your application submission, ensuring your request is handled promptly and efficiently.

Get more for Idaho Transfer Form

Find out other Idaho Transfer Form

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure