Form Ptr 1 2016

What is the Form Ptr 1

The Form Ptr 1 is a specific document utilized primarily for tax reporting purposes in the United States. This form is designed to collect essential information from taxpayers, allowing them to report their income, deductions, and credits accurately. It is crucial for ensuring compliance with federal tax regulations and is often required by the IRS during the tax filing process. Understanding the purpose and requirements of the Form Ptr 1 is vital for effective tax management.

How to use the Form Ptr 1

Using the Form Ptr 1 involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s and 1099s, that provide the required information for the form. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once you have filled out the form, review it for any errors or omissions. Finally, submit the form either electronically through a secure platform or by mailing it to the appropriate IRS address, depending on your preference and the guidelines provided.

Steps to complete the Form Ptr 1

Completing the Form Ptr 1 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents and information.

- Begin filling out the form, starting with personal identification details.

- Input your income information, including wages and other earnings.

- List any deductions or credits you are eligible for, ensuring to follow IRS guidelines.

- Review the completed form for accuracy and completeness.

- Choose your submission method: electronic filing or postal mail.

Legal use of the Form Ptr 1

The legal use of the Form Ptr 1 is governed by IRS regulations, which outline the requirements for its completion and submission. It is essential to use the form correctly to avoid penalties or issues with tax compliance. The form must be signed and dated appropriately, and it should only be submitted for the tax year it pertains to. Understanding the legal implications of using this form ensures that taxpayers remain compliant with federal tax laws.

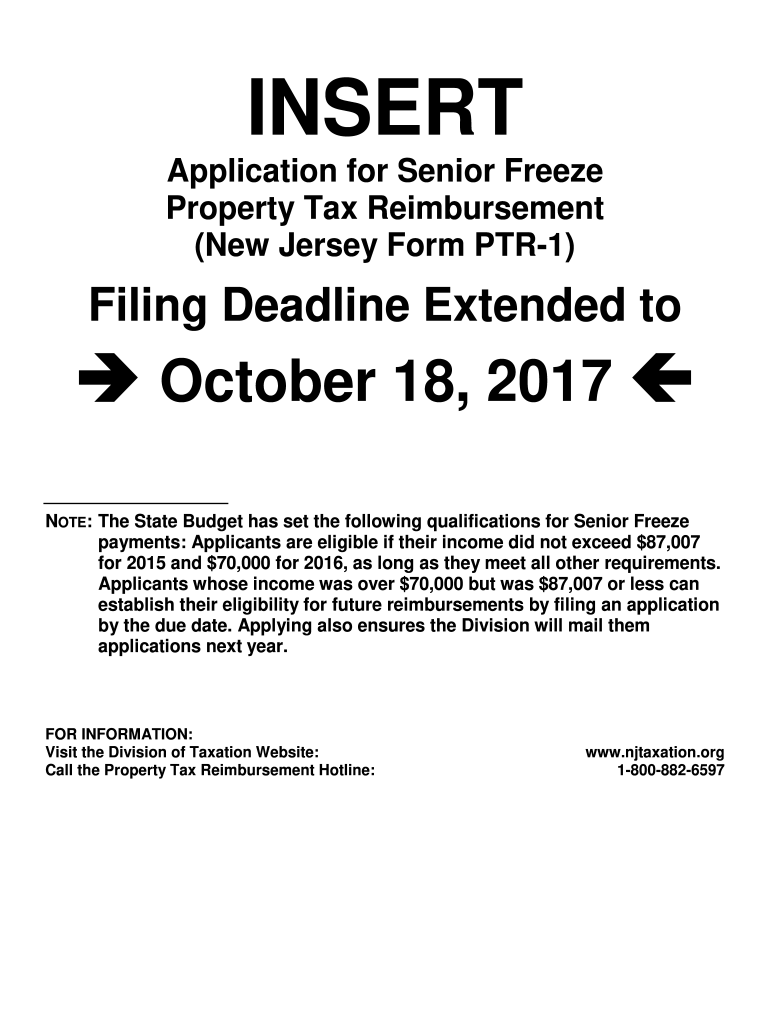

Filing Deadlines / Important Dates

Filing deadlines for the Form Ptr 1 are critical for taxpayers to be aware of to avoid penalties. Typically, the deadline for submitting the form aligns with the annual tax filing deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult a tax professional for any updates regarding specific filing dates and extensions.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form Ptr 1 can be done through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Many taxpayers prefer to submit the form electronically through secure e-filing platforms, which often streamline the process and reduce errors.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS address. Ensure that it is postmarked by the filing deadline.

- In-Person: Some taxpayers may choose to deliver their forms in person at designated IRS offices, although this method is less common.

Quick guide on how to complete form ptr 1 2016

Your assistance manual on how to prepare your Form Ptr 1

If you’re wondering how to fill out and submit your Form Ptr 1, here are some straightforward instructions to make tax submission much smoother.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and effective document solution that allows you to edit, create, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify responses when necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Form Ptr 1 in a matter of minutes:

- Create your account and begin working on PDFs in just a few minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Press Get form to open your Form Ptr 1 in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and amend any mistakes.

- Save your changes, print your document, forward it to your recipient, and download it to your device.

Utilize this information to electronically file your taxes with airSlate SignNow. Please be aware that paper filing might lead to increased return errors and delayed refunds. Certainly, before electronically filing your taxes, consult the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form ptr 1 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

Create this form in 5 minutes!

How to create an eSignature for the form ptr 1 2016

How to generate an eSignature for your Form Ptr 1 2016 in the online mode

How to create an eSignature for your Form Ptr 1 2016 in Chrome

How to make an electronic signature for signing the Form Ptr 1 2016 in Gmail

How to make an electronic signature for the Form Ptr 1 2016 straight from your mobile device

How to make an electronic signature for the Form Ptr 1 2016 on iOS devices

How to make an electronic signature for the Form Ptr 1 2016 on Android devices

People also ask

-

What is Form Ptr 1 and how does it work with airSlate SignNow?

Form Ptr 1 is a crucial document template that streamlines the process for users needing to complete specific forms. With airSlate SignNow, you can easily create, send, and eSign Form Ptr 1, ensuring a seamless workflow. This integration enhances productivity by allowing for quick access and management of your essential documents.

-

Is there a cost associated with using Form Ptr 1 on airSlate SignNow?

Using Form Ptr 1 with airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to match your needs, and each plan includes access to Form Ptr 1 along with other essential features. You can choose a plan that best suits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form Ptr 1?

airSlate SignNow provides a variety of features for managing Form Ptr 1, including customizable templates, advanced eSignature capabilities, and document tracking. These features ensure that you can send, receive, and manage Form Ptr 1 efficiently. Additionally, you can automate workflows to save time and reduce manual errors.

-

Can I integrate Form Ptr 1 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows you to integrate Form Ptr 1 with numerous third-party applications, enhancing your business processes. Whether you use CRM systems, project management tools, or cloud storage services, our integrations help streamline your workflows. This connectivity ensures that Form Ptr 1 fits seamlessly into your existing systems.

-

What are the benefits of using Form Ptr 1 in airSlate SignNow for my business?

Utilizing Form Ptr 1 in airSlate SignNow provides numerous benefits, including improved efficiency and reduced turnaround times for document processing. The ability to eSign Form Ptr 1 electronically enhances accuracy and compliance while reducing the need for physical paperwork. This digital transformation can lead to signNow cost savings for your business.

-

How can airSlate SignNow help ensure the security of Form Ptr 1?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form Ptr 1. We implement industry-standard encryption, secure access controls, and comprehensive audit trails to protect your information. This ensures that your Form Ptr 1 remains confidential and is handled securely throughout its lifecycle.

-

Is it easy to learn how to use Form Ptr 1 with airSlate SignNow?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to learn how to use Form Ptr 1. Our platform offers intuitive navigation, helpful tutorials, and customer support resources to assist you in quickly mastering the features related to Form Ptr 1. You can start sending documents in no time.

Get more for Form Ptr 1

- Emergency medical form maple heights city schools

- Request for public assistance fema form 90 49

- Sofitasa online form

- 888 796 0947 form

- Parentguardian statement of consent i certify that i am labor state ny form

- Giving gala sponsorship packages bright blessings form

- 1 to enter data press to move to the first fiel form

- New hire agreement template form

Find out other Form Ptr 1

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer