NJ Property Tax Reimbursement Senior Ze Program Property Tax Reimbursement Senior Ze Program 2015

What is the NJ Property Tax Reimbursement Senior Freeze Program?

The NJ Property Tax Reimbursement Senior Freeze Program is designed to assist eligible senior citizens and disabled persons in New Jersey by reimbursing them for property tax increases. This program aims to ensure that those on fixed incomes can maintain their homes without the burden of rising property taxes. The reimbursement amount is based on the difference between the property taxes paid in the base year and the current year, providing financial relief to qualifying individuals.

Eligibility Criteria

To qualify for the NJ Property Tax Reimbursement Senior Freeze Program, applicants must meet specific criteria, including:

- Being at least sixty-five years old or classified as disabled.

- Having lived in New Jersey for at least ten years.

- Occupying the property as their principal residence.

- Meeting income limits set by the state, which may vary annually.

Steps to Complete the NJ Property Tax Reimbursement Senior Freeze Program

Completing the application for the NJ Property Tax Reimbursement Senior Freeze Program involves several steps:

- Gather required documentation, including proof of age, income, and property tax payments.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application by the specified deadline, either online or by mail.

- Keep a copy of the submitted application and any supporting documents for your records.

Required Documents

When applying for the NJ Property Tax Reimbursement Senior Freeze Program, applicants must provide certain documents, such as:

- Proof of age or disability, such as a birth certificate or disability award letter.

- Income documentation, including tax returns or Social Security statements.

- Property tax bills from the base year and the current year.

Form Submission Methods

Applicants can submit their NJ Property Tax Reimbursement Senior Freeze Program forms through various methods:

- Online submission via the New Jersey Division of Taxation's website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices, if applicable.

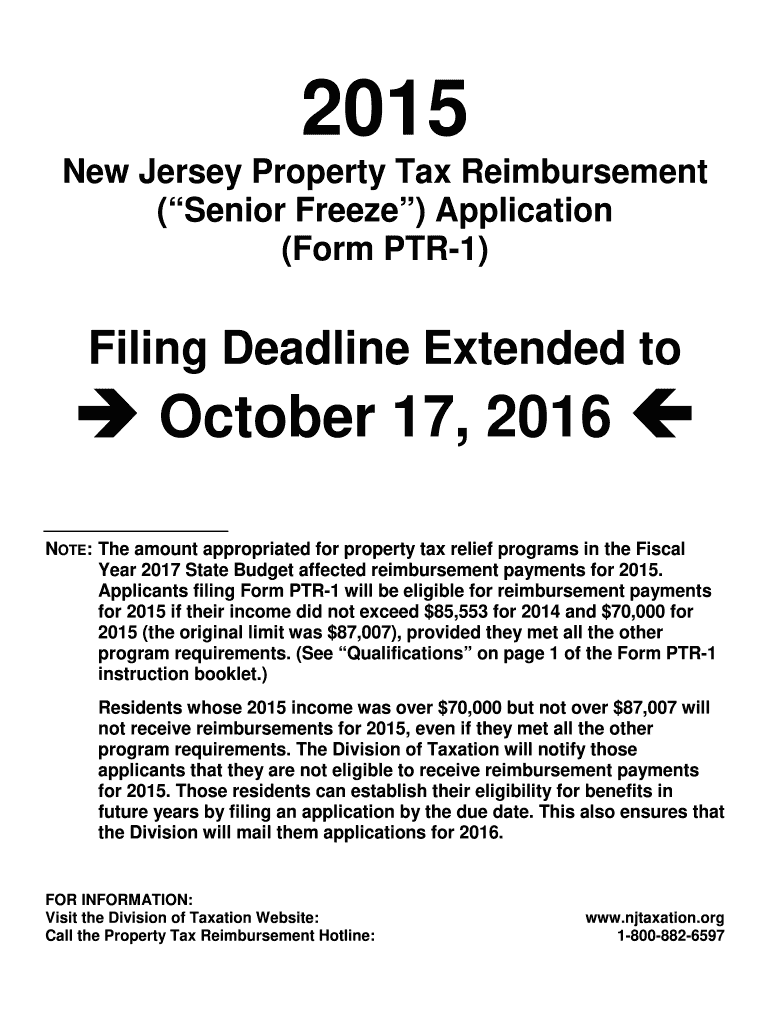

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of the filing deadlines for the NJ Property Tax Reimbursement Senior Freeze Program. Typically, applications must be submitted by a specific date each year, usually in the summer months. Keeping track of these dates ensures that eligible individuals do not miss out on potential reimbursements.

Quick guide on how to complete nj property tax reimbursement senior freeze program property tax reimbursement senior freeze program

Effortlessly prepare NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program on any device

The management of documents online has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program with ease

- Locate NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj property tax reimbursement senior freeze program property tax reimbursement senior freeze program

Create this form in 5 minutes!

How to create an eSignature for the nj property tax reimbursement senior freeze program property tax reimbursement senior freeze program

How to generate an eSignature for the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program online

How to generate an electronic signature for the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program in Google Chrome

How to create an eSignature for putting it on the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program in Gmail

How to make an eSignature for the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program straight from your mobile device

How to create an eSignature for the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program on iOS devices

How to create an eSignature for the Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program on Android

People also ask

-

What is the NJ Property Tax Reimbursement Senior ze Program?

The NJ Property Tax Reimbursement Senior ze Program is designed to help eligible senior citizens and disabled individuals in New Jersey reimburse part of their property taxes. This program aims to alleviate financial burdens associated with property taxes for seniors. By participating in the NJ Property Tax Reimbursement Senior ze Program, recipients can gain substantial savings on their property tax bills.

-

Who qualifies for the NJ Property Tax Reimbursement Senior ze Program?

To qualify for the NJ Property Tax Reimbursement Senior ze Program, applicants must be residents of New Jersey, aged 65 and older or disabled. Additionally, they must meet certain income requirements and have lived in the same property for a minimum period. Understanding these eligibility criteria is essential for seniors seeking financial assistance through the program.

-

How do I apply for the NJ Property Tax Reimbursement Senior ze Program?

Applying for the NJ Property Tax Reimbursement Senior ze Program involves completing and submitting a specific application form to the New Jersey Division of Taxation. This process can be done online or via mail. Ensure you have all necessary documents ready to streamline your application for the NJ Property Tax Reimbursement Senior ze Program.

-

What documents are required to apply for the NJ Property Tax Reimbursement Senior ze Program?

When applying for the NJ Property Tax Reimbursement Senior ze Program, you'll need to provide proof of age or disability, income information, and property tax bills. Having these documents ready will ensure that your application process is as smooth as possible. It's crucial to adhere to the documentation requirements to qualify for the NJ Property Tax Reimbursement Senior ze Program.

-

Can I use airSlate SignNow to submit my application for the NJ Property Tax Reimbursement Senior ze Program?

Yes, airSlate SignNow can be used to electronically sign and submit your application for the NJ Property Tax Reimbursement Senior ze Program. The platform provides an easy-to-use solution for handling documents securely. By utilizing airSlate SignNow, you can expedite your application process without the hassle of printing and mailing.

-

What are the benefits of the NJ Property Tax Reimbursement Senior ze Program?

The NJ Property Tax Reimbursement Senior ze Program offers signNow financial relief to eligible seniors and disabled citizens by reimbursing a portion of their property taxes. This program can help individuals maintain their homes while reducing economic stress. Ultimately, the benefits of participating in the NJ Property Tax Reimbursement Senior ze Program can greatly enhance the quality of life for its recipients.

-

How often is reimbursement provided through the NJ Property Tax Reimbursement Senior ze Program?

Reimbursement under the NJ Property Tax Reimbursement Senior ze Program is typically provided annually based on the application review process. Once approved, beneficiaries will receive their reimbursement directly from the state. Timely application ensures that seniors can take full advantage of the funding available each year through this beneficial program.

Get more for NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program

- Washington quitclaim form

- Subway form

- Form backhoe certification

- Dd form 2890 2013 2019

- Complete an ftri application have it signed by an approved certifier and either mail it in or visit a regional distribution form

- Log loader truck mounted certification form dot ny

- Ga confidence form

- 433 b oic form

Find out other NJ Property Tax Reimbursement Senior ze Program Property Tax Reimbursement Senior ze Program

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now