Form 3953 06 09

What is the Form 3953 06 09

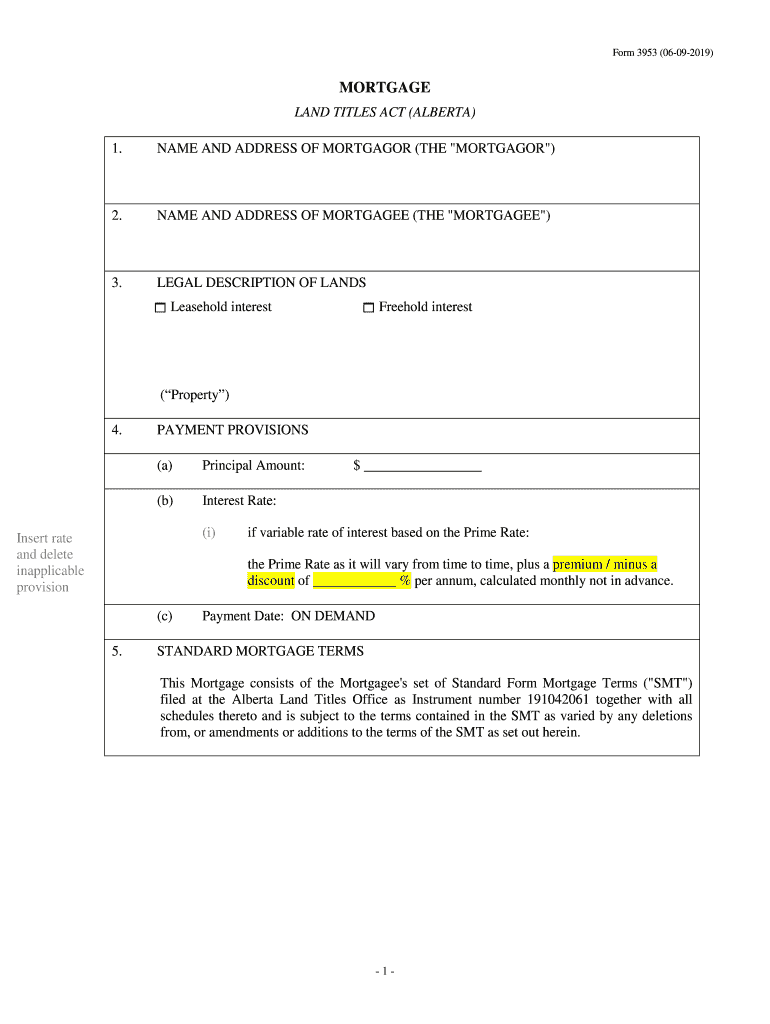

The Form 3953 06 09 is a crucial document related to the Canada bank mortgage process. This form is used to formalize agreements between parties involved in a mortgage transaction, ensuring that all terms and conditions are clearly outlined. It serves as a legal instrument that binds the parties to the stipulations within the Canada mortgage act, providing a framework for the responsibilities and rights of each party. Understanding this form is essential for anyone involved in obtaining a mortgage in Canada, as it lays the groundwork for the entire mortgage process.

Steps to complete the Form 3953 06 09

Completing the Form 3953 06 09 involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary personal and financial information, including details about the property and the parties involved. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. After filling out the form, review it thoroughly for any errors or omissions. Finally, the form must be signed by all parties involved, and it is advisable to use a reliable electronic signature solution to ensure that the signatures are legally binding and compliant with eSignature regulations.

Legal use of the Form 3953 06 09

The legal use of the Form 3953 06 09 is governed by the Canada mortgage act and relevant eSignature laws. To be considered valid, the form must be completed in accordance with these regulations. This includes ensuring that all parties provide their signatures in a manner that meets legal standards. Utilizing a trusted electronic signature platform can enhance the legal standing of the document, as it provides secure authentication and an audit trail, which are essential for verifying the identities of the signers and the integrity of the document.

Key elements of the Form 3953 06 09

Understanding the key elements of the Form 3953 06 09 is vital for its effective use. Important components include the identification of the parties involved, a detailed description of the mortgage terms, and any conditions that must be met for the agreement to be valid. The form also requires signatures from all parties, which must be executed in a legally compliant manner. Additionally, the form may include provisions for dispute resolution and other legal stipulations that protect the interests of all parties involved.

How to obtain the Form 3953 06 09

The Form 3953 06 09 can typically be obtained through financial institutions that offer Canada bank mortgages or from official government websites that provide access to mortgage-related documents. It is important to ensure that you are using the most current version of the form to avoid any complications during the mortgage process. If you are unsure where to find the form, contacting your lender or a legal professional can provide guidance on how to obtain it.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 3953 06 09 can be done through various methods, depending on the requirements of the financial institution or legal entity involved. Common submission methods include online submissions via secure portals, mailing the completed form to the appropriate address, or delivering it in person to the lender or relevant authority. Each method has its own advantages, and it is essential to choose the one that best meets your needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form 3953 06 09

Complete Form 3953 06 09 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without any delays. Manage Form 3953 06 09 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Form 3953 06 09 with ease

- Locate Form 3953 06 09 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Alter and eSign Form 3953 06 09 and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3953 06 09

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canada bank mortgage?

A Canada bank mortgage is a type of loan provided by Canadian banks to help individuals purchase real estate. It is secured against the property being financed and typically features terms that include fixed or variable interest rates. Understanding the terms and benefits of a Canada bank mortgage can help you make informed decisions about home financing.

-

What are the benefits of obtaining a Canada bank mortgage?

Obtaining a Canada bank mortgage offers several advantages, including access to competitive interest rates and flexible repayment options. Additionally, many banks provide comprehensive support throughout the mortgage process, making it easier for homebuyers to secure financing. Choosing a Canada bank mortgage can be a smart financial move when investing in property.

-

How do fees work with a Canada bank mortgage?

When you take out a Canada bank mortgage, you may encounter various fees—including application fees, appraisal fees, and legal fees. It's essential to carefully review the fee structure provided by your bank. Understanding all costs associated with a Canada bank mortgage will help you budget effectively and avoid unexpected expenses.

-

What features should I look for in a Canada bank mortgage?

Key features to consider when selecting a Canada bank mortgage include interest rates, loan terms, and prepayment options. Look for flexibility with repayment in case of financial changes. Additionally, check if the mortgage includes any added benefits like a portable mortgage or home equity options.

-

Can I refinance my Canada bank mortgage?

Yes, refinancing your Canada bank mortgage is possible and can be beneficial if you seek lower interest rates or better repayment terms. This process may involve evaluating the current equity in your home and any applicable fees. Consulting with your bank will help determine if refinancing is the right choice for your financial situation.

-

Are there any integrations for managing my Canada bank mortgage?

Many banks offer online platforms and tools to help you manage your Canada bank mortgage effectively. These platforms often include budgeting tools, payment reminders, and online payment options. Some may even integrate with financial management software for more streamlined oversight of your mortgage.

-

How can I determine if a Canada bank mortgage is right for me?

To determine if a Canada bank mortgage is suitable for you, assess your financial situation, goals, and home buying needs. Evaluate your credit score, income stability, and debt-to-income ratio. Consulting with a financial advisor can provide insights tailored to your circumstances when considering a Canada bank mortgage.

Get more for Form 3953 06 09

Find out other Form 3953 06 09

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed