Common Use Tax Exempt Form Rev 6 2010doc

What is the Common Use Tax Exempt Form Rev 6 2010doc

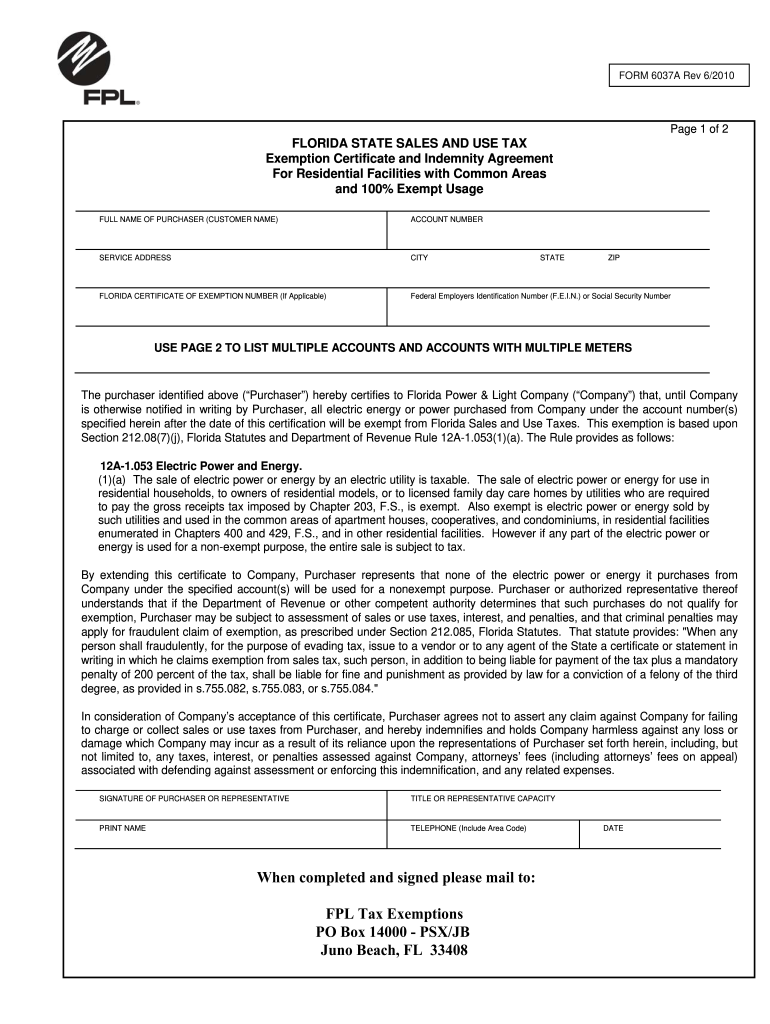

The Common Use Tax Exempt Form Rev 6 2010doc is a document utilized primarily in the United States to claim exemption from sales tax for specific purchases. This form is essential for organizations and individuals who qualify for tax-exempt status, allowing them to avoid paying sales tax on eligible items. The form is often used by non-profit organizations, government entities, and certain educational institutions. By completing this form, a purchaser certifies their tax-exempt status and provides the necessary information to the seller to validate the exemption.

How to use the Common Use Tax Exempt Form Rev 6 2010doc

Using the Common Use Tax Exempt Form Rev 6 2010doc involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, download the form from a reliable source or obtain it from your state’s tax authority. Fill out the form accurately, providing all required information, including your tax-exempt number and the details of the purchase. Once completed, present the form to the seller at the time of purchase. It is important to keep a copy of the form for your records, as it may be needed for future reference or audits.

Steps to complete the Common Use Tax Exempt Form Rev 6 2010doc

Completing the Common Use Tax Exempt Form Rev 6 2010doc requires careful attention to detail. Follow these steps for successful completion:

- Obtain the form from a credible source.

- Fill in your organization’s name, address, and tax-exempt number.

- Specify the type of exemption you are claiming.

- Detail the items being purchased, including descriptions and quantities.

- Sign and date the form to certify the information is accurate.

After filling out the form, ensure that it is delivered to the seller before completing the transaction to avoid any sales tax charges.

Legal use of the Common Use Tax Exempt Form Rev 6 2010doc

The legal use of the Common Use Tax Exempt Form Rev 6 2010doc is governed by state laws regarding sales tax exemptions. To be legally valid, the form must be completed accurately and presented at the time of purchase. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties, including fines and back taxes owed. It is crucial for users to understand their state's specific regulations concerning tax exemptions to ensure compliance and avoid legal issues.

Key elements of the Common Use Tax Exempt Form Rev 6 2010doc

Several key elements must be included in the Common Use Tax Exempt Form Rev 6 2010doc for it to be valid:

- Purchaser Information: Name, address, and tax-exempt number.

- Seller Information: Name and address of the seller.

- Exemption Type: A clear indication of the type of exemption being claimed.

- Item Description: Detailed descriptions of the items being purchased.

- Signature: The signature of an authorized representative of the purchasing entity.

Including all these elements ensures that the form is complete and legally binding.

Eligibility Criteria

To use the Common Use Tax Exempt Form Rev 6 2010doc, individuals or organizations must meet specific eligibility criteria. Typically, these include being a recognized non-profit organization, a government entity, or an educational institution that qualifies for tax-exempt status under state laws. Each state may have different requirements, so it is essential to verify your eligibility based on local regulations. Additionally, having a valid tax-exempt number is crucial for successfully claiming exemption on purchases.

Quick guide on how to complete common use tax exempt form rev 6 2010doc

Effortlessly Prepare Common Use Tax Exempt Form Rev 6 2010doc on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage Common Use Tax Exempt Form Rev 6 2010doc on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric tasks today.

The easiest way to alter and electronically sign Common Use Tax Exempt Form Rev 6 2010doc seamlessly

- Locate Common Use Tax Exempt Form Rev 6 2010doc and click Get Form to commence.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and electronically sign Common Use Tax Exempt Form Rev 6 2010doc to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the common use tax exempt form rev 6 2010doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Common Use Tax Exempt Form Rev 6 2010doc?

The Common Use Tax Exempt Form Rev 6 2010doc is a standardized document used to claim tax exemption on certain purchases. This form is essential for businesses that wish to avoid sales tax on qualifying transactions while ensuring compliance with tax regulations. Using airSlate SignNow, you can easily fill out and sign this document electronically.

-

How can I obtain the Common Use Tax Exempt Form Rev 6 2010doc?

You can easily access the Common Use Tax Exempt Form Rev 6 2010doc from various online sources or directly through airSlate SignNow. Once you have the form, our platform allows for seamless editing and electronic signing, simplifying the process of tax exemption. It's designed to cater to the needs of businesses looking for an efficient solution.

-

Is there a cost associated with using airSlate SignNow to manage the Common Use Tax Exempt Form Rev 6 2010doc?

Yes, there is a cost for using airSlate SignNow, but it is designed to be an affordable solution for businesses of all sizes. Our pricing plans vary based on features and user requirements, allowing you to choose the best option for managing documents like the Common Use Tax Exempt Form Rev 6 2010doc. You can sign up for a free trial to evaluate the service before committing to a plan.

-

What features does airSlate SignNow offer for the Common Use Tax Exempt Form Rev 6 2010doc?

airSlate SignNow provides essential features to efficiently manage the Common Use Tax Exempt Form Rev 6 2010doc, including customizable templates, electronic signatures, and a user-friendly interface. Our platform also allows document tracking, ensuring that you can monitor the signing status in real-time. These features streamline the entire process and enhance compliance.

-

How does using airSlate SignNow benefit my business when handling tax exempt forms?

Using airSlate SignNow to manage tax exempt forms like the Common Use Tax Exempt Form Rev 6 2010doc offers several benefits, including time savings, improved accuracy, and enhanced security. The digital format eliminates the hassle of paper documents and reduces the risk of lost paperwork. This leads to a more efficient workflow for your tax exemption requests.

-

Can airSlate SignNow integrate with other software I use for accounting?

Yes, airSlate SignNow offers integrations with various accounting and business management software. This means you can seamlessly incorporate the Common Use Tax Exempt Form Rev 6 2010doc into your existing workflows without disruption. Integrating with your current systems enhances productivity and data accuracy across the board.

-

Is the Common Use Tax Exempt Form Rev 6 2010doc valid in all states?

The Common Use Tax Exempt Form Rev 6 2010doc is recognized in many states, but validity can vary depending on local tax laws. It is crucial to verify the specific requirements in your state or jurisdiction when using this form. airSlate SignNow helps ensure compliance by providing access to updated legal resources and guidelines.

Get more for Common Use Tax Exempt Form Rev 6 2010doc

Find out other Common Use Tax Exempt Form Rev 6 2010doc

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF