Sommaire Des Retenues Et Des Cotisations De L'employeur Form

What is the Sommaire Des Retenues Et Des Cotisations De L'employeur

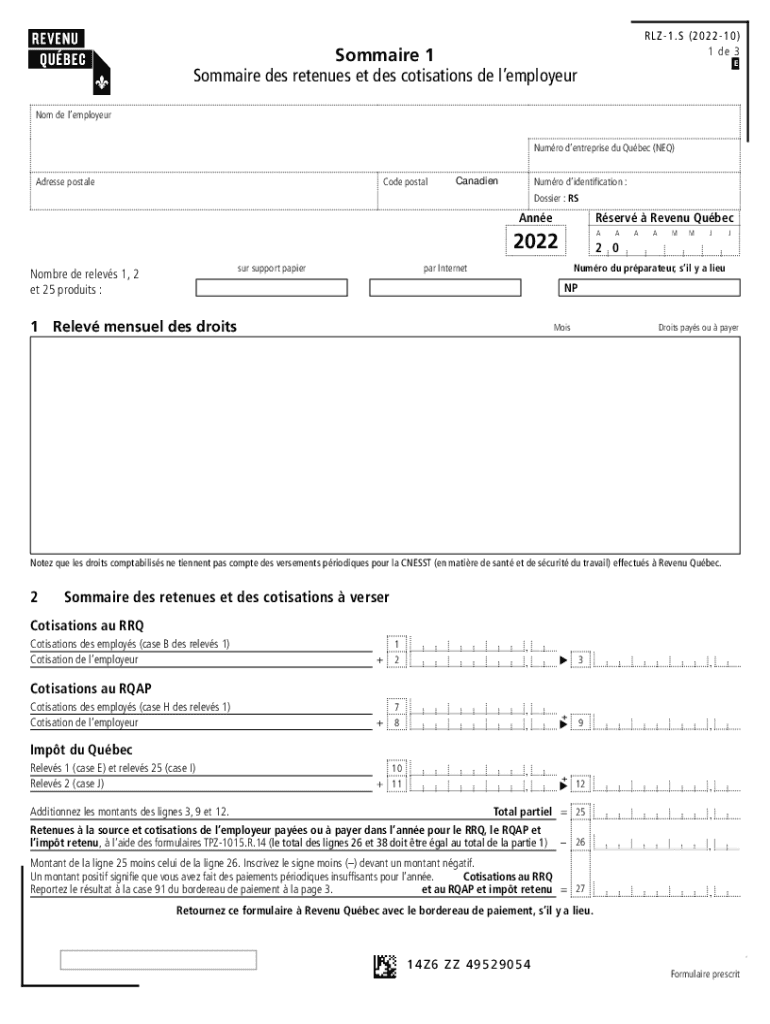

The Sommaire Des Retenues Et Des Cotisations De L'employeur, commonly referred to as the RLZ1S form, is a crucial document for employers in Canada. It summarizes the deductions and contributions made by employers for their employees during a specific tax year. This form includes information about income tax withheld, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Understanding this form is essential for compliance with Canadian tax regulations and for ensuring accurate reporting to the Canada Revenue Agency (CRA).

How to use the Sommaire Des Retenues Et Des Cotisations De L'employeur

Using the RLZ1S form involves several steps to ensure accurate reporting of employee deductions. Employers should first gather all necessary payroll records for the tax year. This includes details of each employee's earnings, deductions, and contributions. Once the data is compiled, employers can fill out the RLZ1S form, ensuring that all figures are accurate and reflect the total amounts withheld. After completing the form, it must be submitted to the CRA by the specified deadline, along with any required supporting documents.

Steps to complete the Sommaire Des Retenues Et Des Cotisations De L'employeur

Completing the RLZ1S form requires a systematic approach:

- Gather payroll records for all employees for the tax year.

- Calculate the total income tax withheld for each employee.

- Determine the total CPP contributions and EI premiums for each employee.

- Fill out the RLZ1S form with accurate totals for each category.

- Review the form for accuracy before submission.

- Submit the completed form to the CRA by the deadline.

Legal use of the Sommaire Des Retenues Et Des Cotisations De L'employeur

The RLZ1S form is legally required for employers in Canada to report deductions and contributions accurately. Failure to complete and submit this form can result in penalties and interest on unpaid amounts. It is essential for employers to understand their obligations under Canadian tax law to ensure compliance and avoid legal repercussions. Proper use of the RLZ1S form helps maintain transparency and accountability in payroll practices.

Key elements of the Sommaire Des Retenues Et Des Cotisations De L'employeur

Key elements of the RLZ1S form include:

- Employer Information: Name, address, and business number.

- Employee Information: Names and social insurance numbers of employees.

- Deductions: Total income tax withheld, CPP contributions, and EI premiums.

- Signature: The form must be signed by an authorized representative of the employer.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the RLZ1S form. Typically, the form is due by the end of February following the tax year. For instance, for the 2022 tax year, the deadline would be February 28, 2023. It is crucial for employers to mark this date on their calendars to ensure timely submission and avoid penalties.

Quick guide on how to complete sommaire des retenues et des cotisations de lemployeur

Complete Sommaire Des Retenues Et Des Cotisations De L'employeur effortlessly on any device

Managing documents online has gained traction with enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Sommaire Des Retenues Et Des Cotisations De L'employeur on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Sommaire Des Retenues Et Des Cotisations De L'employeur with ease

- Locate Sommaire Des Retenues Et Des Cotisations De L'employeur and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact private information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require new printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Sommaire Des Retenues Et Des Cotisations De L'employeur and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sommaire des retenues et des cotisations de lemployeur

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Canada RLZ1S?

The 2022 Canada RLZ1S is an essential resource for businesses looking to navigate eSignatures and digital documentation. It outlines the regulations and expectations surrounding electronic signatures in Canada, ensuring that your business remains compliant while utilizing solutions like airSlate SignNow.

-

How does airSlate SignNow integrate with the 2022 Canada RLZ1S requirements?

AirSlate SignNow is designed to meet the standards set by the 2022 Canada RLZ1S. This means that your eSignature processes will align with legal requirements, providing security and validity for digitally signed documents in Canada.

-

What features does airSlate SignNow offer that align with the 2022 Canada RLZ1S?

AirSlate SignNow provides features such as secure document storage, customizable templates, and audit trails, which are all compliant with the 2022 Canada RLZ1S. These features ensure that your digital documentation remains organized, secure, and legally binding.

-

Is airSlate SignNow cost-effective for businesses in 2022 Canada RLZ1S?

Yes, airSlate SignNow is a cost-effective solution for businesses navigating the 2022 Canada RLZ1S. Our pricing plans are designed to fit the budget of companies of all sizes, providing exceptional value for seamless eSigning and document management.

-

What benefits does airSlate SignNow provide related to the 2022 Canada RLZ1S?

Using airSlate SignNow allows businesses to streamline their eSigning processes while ensuring compliance with the 2022 Canada RLZ1S. This not only enhances efficiency but also improves the overall customer experience by enabling quick and legal document signing online.

-

Can airSlate SignNow integrate with other software for the 2022 Canada RLZ1S?

Absolutely! AirSlate SignNow offers integrations with various software solutions that support the 2022 Canada RLZ1S. Whether it's CRM tools or document management systems, our platform works actively to enhance your workflow and compliance.

-

How does airSlate SignNow ensure compliance with the 2022 Canada RLZ1S?

AirSlate SignNow incorporates industry best practices and security measures to ensure compliance with the 2022 Canada RLZ1S. This includes encrypted communications and features that support authentication, making your eSignature processes legally sound in Canada.

Get more for Sommaire Des Retenues Et Des Cotisations De L'employeur

Find out other Sommaire Des Retenues Et Des Cotisations De L'employeur

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template