IL 1040 ES, Estimated Income Tax Payments for Individuals 2020

What is the IL 1040 ES, Estimated Income Tax Payments For Individuals

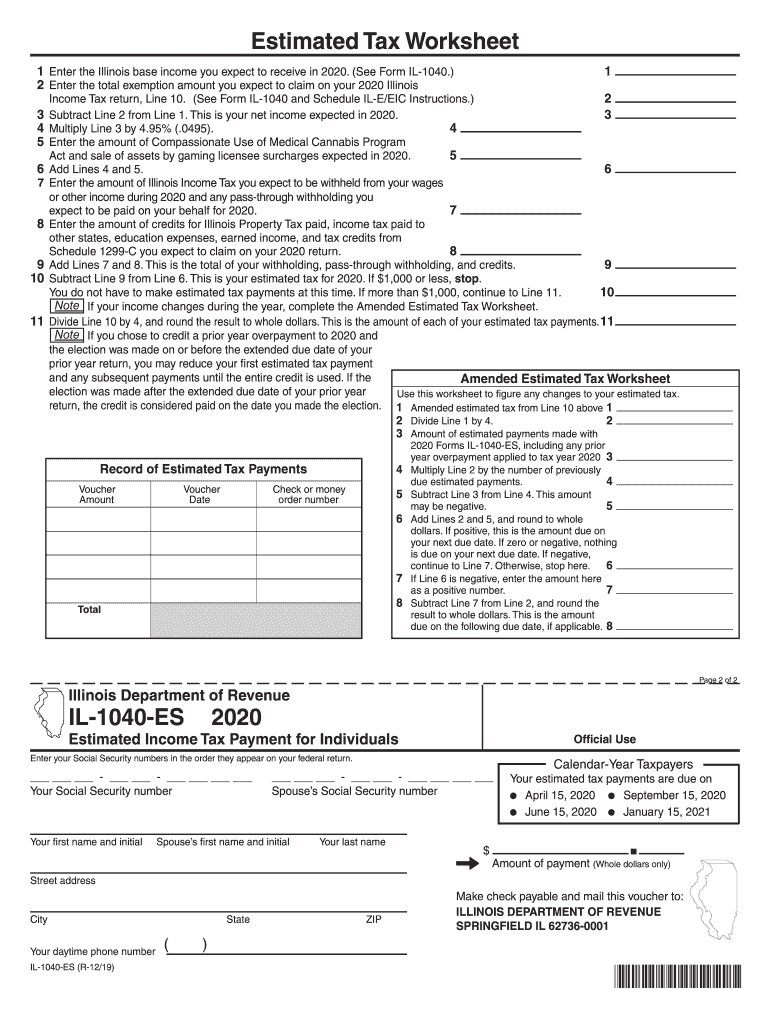

The IL 1040 ES, Estimated Income Tax Payments For Individuals, is a tax form used by residents of Illinois to report and pay estimated income taxes. This form is essential for individuals who expect to owe tax of $1,000 or more when they file their annual tax return. The IL 1040 ES allows taxpayers to make quarterly payments throughout the year, helping them manage their tax liabilities and avoid penalties for underpayment. It is particularly relevant for self-employed individuals, freelancers, or anyone with income not subject to withholding.

Steps to complete the IL 1040 ES, Estimated Income Tax Payments For Individuals

Completing the IL 1040 ES requires careful attention to detail to ensure accuracy. Here are the steps involved:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year based on your expected income.

- Determine the amount to be paid quarterly, which is typically one-fourth of your total estimated tax liability.

- Fill out the IL 1040 ES form with your personal information and payment details.

- Submit the form either electronically or by mail, ensuring you meet the deadlines for each payment period.

Filing Deadlines / Important Dates

Timely filing of the IL 1040 ES is crucial to avoid penalties. The estimated tax payments are generally due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

If any of these dates fall on a weekend or holiday, the due date is typically extended to the next business day.

Legal use of the IL 1040 ES, Estimated Income Tax Payments For Individuals

The IL 1040 ES is legally binding when completed accurately and submitted on time. It is important to provide truthful information, as any discrepancies can lead to penalties or audits by the Illinois Department of Revenue. The form must be signed and dated to validate the submission. Utilizing a secure platform for electronic filing can enhance the legitimacy of your submission, ensuring compliance with eSignature laws.

Key elements of the IL 1040 ES, Estimated Income Tax Payments For Individuals

The IL 1040 ES includes several key elements that taxpayers must understand:

- Personal Information: This includes your name, address, and Social Security number.

- Estimated Tax Calculation: You must provide an estimate of your taxable income and the corresponding tax owed.

- Payment Amount: Specify the amount you are paying for each quarter.

- Signature: Your signature is required to validate the form.

How to use the IL 1040 ES, Estimated Income Tax Payments For Individuals

Using the IL 1040 ES effectively involves understanding its purpose and how to fill it out correctly. Begin by estimating your annual income and tax obligations. Use this information to calculate your quarterly payments. The form can be filled out manually or electronically, with the latter offering a streamlined process for submission and record-keeping. Ensure that you keep copies of your submissions for your records, as they may be needed for future reference or audits.

Quick guide on how to complete il 1040 es estimated income tax payments for individuals

Complete IL 1040 ES, Estimated Income Tax Payments For Individuals with ease on any device

Digital document handling has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage IL 1040 ES, Estimated Income Tax Payments For Individuals on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest way to modify and eSign IL 1040 ES, Estimated Income Tax Payments For Individuals effortlessly

- Obtain IL 1040 ES, Estimated Income Tax Payments For Individuals and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of your documents or redact sensitive information with the specific tools offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign IL 1040 ES, Estimated Income Tax Payments For Individuals and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1040 es estimated income tax payments for individuals

Create this form in 5 minutes!

How to create an eSignature for the il 1040 es estimated income tax payments for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1040 ES, Estimated Income Tax Payments For Individuals?

The IL 1040 ES, Estimated Income Tax Payments For Individuals, is a form used by individuals in Illinois to report and pay estimated income tax throughout the year. This form helps taxpayers manage their tax liabilities and avoid penalties for underpayment by making timely payments based on expected annual income.

-

Why do I need to file the IL 1040 ES, Estimated Income Tax Payments For Individuals?

Filing the IL 1040 ES, Estimated Income Tax Payments For Individuals, is necessary for those who expect to owe $1,000 or more in Illinois state income tax after deductions. By making estimated payments, you ensure compliance with state tax laws and can reduce the financial burden when tax season arrives.

-

How can airSlate SignNow help with IL 1040 ES, Estimated Income Tax Payments For Individuals?

AirSlate SignNow simplifies the process of signing and sending your IL 1040 ES, Estimated Income Tax Payments For Individuals. Our platform allows you to electronically sign documents, ensuring quick submission and reducing the risk of errors that can lead to tax-related issues.

-

What features does airSlate SignNow provide for managing IL 1040 ES payments?

AirSlate SignNow offers features like document templates, custom workflows, and secure electronic signatures specifically for managing IL 1040 ES, Estimated Income Tax Payments For Individuals. This streamlines your tax payment process, making it easier and more efficient.

-

Is airSlate SignNow a cost-effective solution for filing IL 1040 ES payments?

Yes, airSlate SignNow provides a cost-effective solution for businesses and individuals managing IL 1040 ES, Estimated Income Tax Payments For Individuals. With various pricing plans available, users can choose the option that best suits their needs without compromising on features or quality.

-

Can I integrate airSlate SignNow with other accounting software for IL 1040 ES payments?

Absolutely! AirSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your IL 1040 ES, Estimated Income Tax Payments For Individuals alongside your financial records. This integration helps streamline your workflow and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for IL 1040 ES payments?

Using airSlate SignNow for IL 1040 ES, Estimated Income Tax Payments For Individuals offers numerous benefits, including time savings, reduced paperwork, and enhanced document security. Our user-friendly platform ensures that your payments are processed quickly and efficiently.

Get more for IL 1040 ES, Estimated Income Tax Payments For Individuals

- File of life template 100073276 form

- Osha written respiratory protection program template form

- Board member application form

- Pearson decodable readers form

- Application is made to lease property located at for monthly form

- Plec de clusules administratives particulars que ha de regir la contractaci dels serveis de vigilncia salvament i socorrisme a form

- Car rental terms and conditions agreement template form

- Chair rental agreement template form

Find out other IL 1040 ES, Estimated Income Tax Payments For Individuals

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile