Illinois Department of RevenueIL1040ES Estimated I 2021

Understanding the Illinois Department of Revenue IL-1040-ES Estimated Income Tax Payments

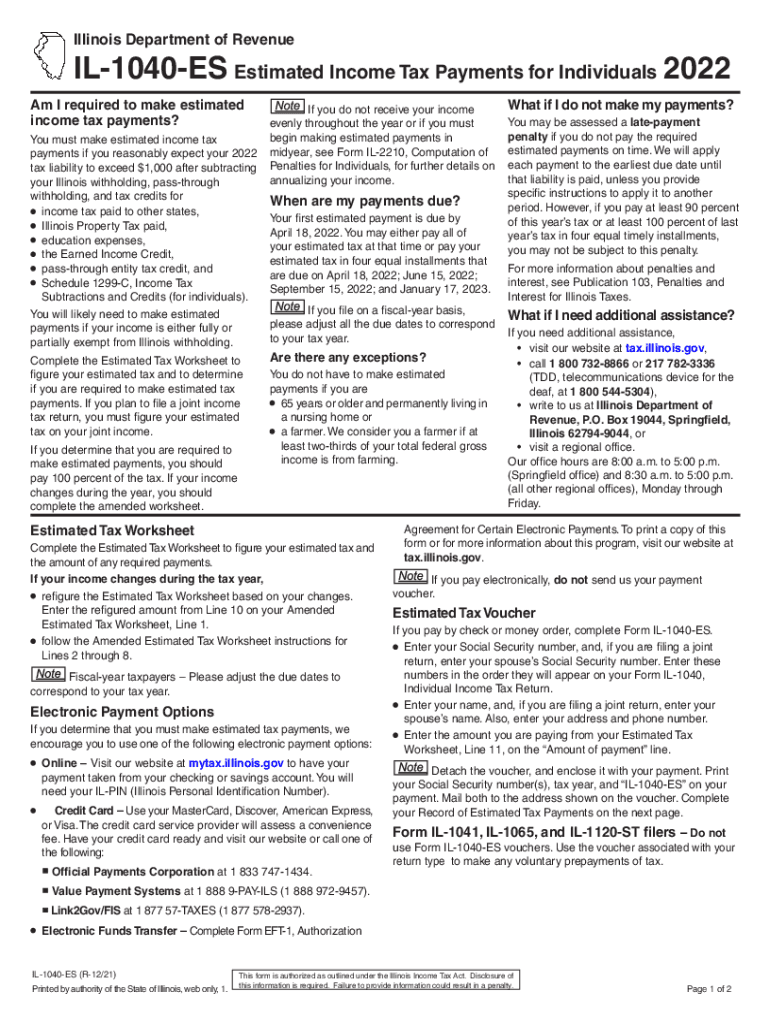

The Illinois Department of Revenue IL-1040-ES form is essential for taxpayers who expect to owe state income tax. This form allows individuals to make estimated income tax payments throughout the year, helping to avoid a large tax bill when filing their annual return. It is particularly relevant for self-employed individuals, retirees, and anyone with income not subject to withholding. By submitting this form, taxpayers can manage their tax obligations more effectively and ensure compliance with state tax laws.

Steps to Complete the Illinois Department of Revenue IL-1040-ES

Completing the IL-1040-ES form involves several key steps to ensure accuracy and compliance. First, gather necessary financial documents, including income statements and previous tax returns. Next, calculate your expected income and tax liability for the year. This information will guide the amount you should pay. Fill out the IL-1040-ES form with your personal details, estimated income, and payment amounts. Finally, review the form for accuracy before submitting it online or via mail to the Illinois Department of Revenue.

Filing Deadlines for Estimated Income Tax Payments

Timely filing of the IL-1040-ES is crucial to avoid penalties. Estimated income tax payments are typically due in four installments throughout the year. The deadlines for these payments are usually April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar and ensure payments are made on time to maintain compliance with Illinois tax regulations.

Required Documents for IL-1040-ES Submission

Before filling out the IL-1040-ES form, it is important to gather all necessary documents. Key documents include your previous year’s tax return, income statements such as W-2s or 1099s, and any relevant deductions or credits you plan to claim. Having these documents on hand will facilitate accurate calculations of your estimated income tax payments and help ensure that your submission is complete and correct.

Legal Use of the Illinois Department of Revenue IL-1040-ES

The IL-1040-ES form is legally recognized for making estimated income tax payments in Illinois. To ensure its validity, taxpayers must follow specific guidelines set forth by the Illinois Department of Revenue. This includes providing accurate information, adhering to filing deadlines, and making payments through approved methods. Using electronic tools, such as e-signature solutions, can enhance the security and efficiency of the submission process.

Penalties for Non-Compliance with Estimated Tax Payments

Failure to comply with the estimated income tax payment requirements can lead to significant penalties. If payments are not made on time or if the amounts are insufficient, taxpayers may face interest charges and penalties based on the unpaid tax. It is advisable to regularly review your estimated payments and adjust them as necessary to avoid these consequences and ensure compliance with Illinois tax laws.

Quick guide on how to complete illinois department of revenueil1040es estimated i

Prepare Illinois Department Of RevenueIL1040ES Estimated I effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Illinois Department Of RevenueIL1040ES Estimated I on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Illinois Department Of RevenueIL1040ES Estimated I with ease

- Locate Illinois Department Of RevenueIL1040ES Estimated I and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and bears the same legal validity as a traditional wet ink signature.

- Recheck the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Illinois Department Of RevenueIL1040ES Estimated I and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois department of revenueil1040es estimated i

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenueil1040es estimated i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are estimated income tax payments?

Estimated income tax payments are quarterly payments made to the IRS to cover income tax liabilities for the year. These payments are based on your expected income, tax deductions, and credits. It's essential to calculate them accurately to avoid penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow help with tracking estimated income tax payments?

airSlate SignNow allows you to easily send, sign, and manage documents related to your estimated income tax payments. By digitizing tax-related documents, you can keep track of due dates and payment confirmations conveniently in one place. This streamlines the process and minimizes the risk of missing important payments.

-

Is airSlate SignNow a cost-effective solution for managing estimated income tax payments?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to simplify their management of estimated income tax payments. With various pricing plans, you can choose a package that fits your needs while ensuring you have access to critical features for document management and eSigning. This can ultimately save you time and resources.

-

What features does airSlate SignNow offer for estimated income tax payments?

airSlate SignNow offers features such as customizable templates, automatic reminders, and secure eSigning, all of which streamline the process of managing estimated income tax payments. Additionally, the platform allows for easy collaboration among team members, ensuring everyone is on the same page regarding payment deadlines and required documents.

-

Can I integrate airSlate SignNow with my accounting software for estimated income tax payments?

Absolutely! airSlate SignNow can integrate seamlessly with a variety of accounting software solutions. This integration helps automate workflows related to estimated income tax payments, ensuring that you can synchronize important financial data and eliminate duplicate entries, thereby enhancing efficiency.

-

What are the benefits of using airSlate SignNow for estimated income tax payments?

Using airSlate SignNow for estimated income tax payments offers several advantages, including improved organization, time savings, and reduced paper usage. The platform's user-friendly interface allows for quick document setup and eSignature collection, ensuring that you stay compliant and avoid late fees associated with missed payments.

-

How secure is airSlate SignNow when handling estimated income tax payment documents?

airSlate SignNow prioritizes security and ensures that all documents related to estimated income tax payments are encrypted and stored safely. The platform adheres to industry standards and compliance regulations, providing users with peace of mind knowing that their sensitive financial data is well protected.

Get more for Illinois Department Of RevenueIL1040ES Estimated I

- Practica final obligatoria historia amp final doc form

- Wg006 filing fee in california form

- The french revolution and napoleon worksheet answer key pdf form

- Igetc gcc form

- Cost form odyssey of the mind

- Responsible person questionnaire form

- 42a900 771913862 form

- Disruptive patient behavior contract template form

Find out other Illinois Department Of RevenueIL1040ES Estimated I

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer