Up to Date, Please Contact Your Agency or Service to Update Your TSP Address of Record Before You Apply for the Loan Form

Understanding the Thrift Savings Plan Loan

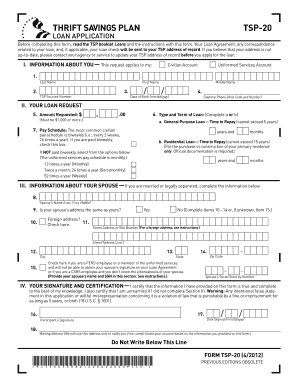

The Thrift Savings Plan (TSP) loan allows participants to borrow from their own retirement savings. This option is available to federal employees and members of the uniformed services. The loan amount can be up to 50% of your vested balance, with a maximum of $50,000. It is essential to understand the terms and conditions associated with this loan, including repayment schedules and interest rates. The interest you pay goes back into your TSP account, making it a unique borrowing opportunity.

Eligibility Criteria for TSP Loans

To qualify for a TSP loan, you must meet certain eligibility requirements. Participants must be in active service and have a minimum balance in their TSP account. Additionally, you must have no outstanding loans and meet the necessary repayment terms. Understanding these criteria is crucial before initiating the loan application process to ensure you meet all requirements.

Application Process for TSP Loans

The application process for a TSP loan involves several steps. First, you must log into your TSP account and navigate to the loan section. From there, you can select the type of loan you wish to apply for, either a general purpose loan or a residential loan. After providing the necessary information, including the loan amount and purpose, you will need to review and submit your application. It is important to ensure that all information is accurate to avoid delays in processing.

Required Documents for TSP Loan Application

When applying for a TSP loan, you will need to gather specific documents to support your application. This may include proof of income, identification, and any additional documentation related to the purpose of the loan. Having these documents ready can streamline the application process and help facilitate a quicker approval.

Repayment Terms and Conditions

Once your TSP loan is approved, you will be required to adhere to specific repayment terms. Loans must be repaid within a set timeframe, typically within one to five years, depending on the type of loan. Repayments are made through payroll deductions, which simplifies the process. Understanding these terms is vital to avoid any penalties or negative impacts on your TSP account.

Potential Consequences of Non-Compliance

Failing to comply with the repayment terms of your TSP loan can have significant consequences. If you default on the loan, it may be treated as a taxable distribution, which could result in tax liabilities and penalties. Additionally, defaulting can negatively affect your retirement savings, as the funds will no longer be growing in your TSP account. It is essential to stay informed about your repayment obligations to maintain your financial health.

Quick guide on how to complete up to date please contact your agency or service to update your tsp address of record before you apply for the loan

Effortlessly prepare Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan on any device through airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The simplest way to alter and electronically sign Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan without hassle

- Obtain Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the up to date please contact your agency or service to update your tsp address of record before you apply for the loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a thrift savings plan loan?

A thrift savings plan loan allows federal employees and members of the uniformed services to borrow funds from their TSP account. This type of loan is designed to provide individuals access to their savings for various personal financial needs while maintaining the integrity of their retirement savings.

-

How do I apply for a thrift savings plan loan?

To apply for a thrift savings plan loan, you must log in to your TSP account and complete the loan application. The process is streamlined and can typically be completed online, ensuring quick access to the funds you need without extensive paperwork.

-

What are the interest rates for a thrift savings plan loan?

Interest rates for a thrift savings plan loan are generally based on the G Fund interest rate, which is updated every quarter. This makes it an affordable option for borrowers since the interest rate is competitive compared to other personal loan options.

-

What is the repayment process for a thrift savings plan loan?

Repayment for a thrift savings plan loan is done through payroll deductions, making it an easy and manageable way to repay what you owe. Borrowers typically have up to 15 years to repay their loan, which helps ease the financial burden over time.

-

Is there a limit to how much I can borrow through a thrift savings plan loan?

Yes, the amount you can borrow through a thrift savings plan loan is limited to the lesser of $50,000 or the total account balance minus any outstanding loans. This ensures you are not borrowing more than you can afford to repay while still gaining access to necessary funds.

-

What are the benefits of using a thrift savings plan loan?

The primary benefits of using a thrift savings plan loan include easy access to funds, competitive interest rates, and the ability to repay through manageable payroll deductions. Additionally, you retain control over your TSP savings while meeting your immediate financial needs.

-

Can I use a thrift savings plan loan for any purpose?

Yes, you can use a thrift savings plan loan for various personal financial needs, such as consolidating debt, purchasing a home, or covering unexpected expenses. This flexibility makes it a viable option for individuals looking to leverage their retirement savings wisely.

Get more for Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan

- Ffl acknowledgement of responsibilities form

- Missouri disability application pdf form

- Section 8 residential lease agreement form

- Pathfinder honors answers pdf form

- Childrens apperception test cards download form

- Notice to buyer that seller is exercising their unilateral right to terminate the offer to purchase and contract form

- Phone reference check template form

- Mc 21 confidential case inventory domestic relations and form

Find out other Up to date, Please Contact Your Agency Or Service To Update Your TSP Address Of Record Before You Apply For The Loan

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement