Ks St 28j Form

What is the Ks St 28j

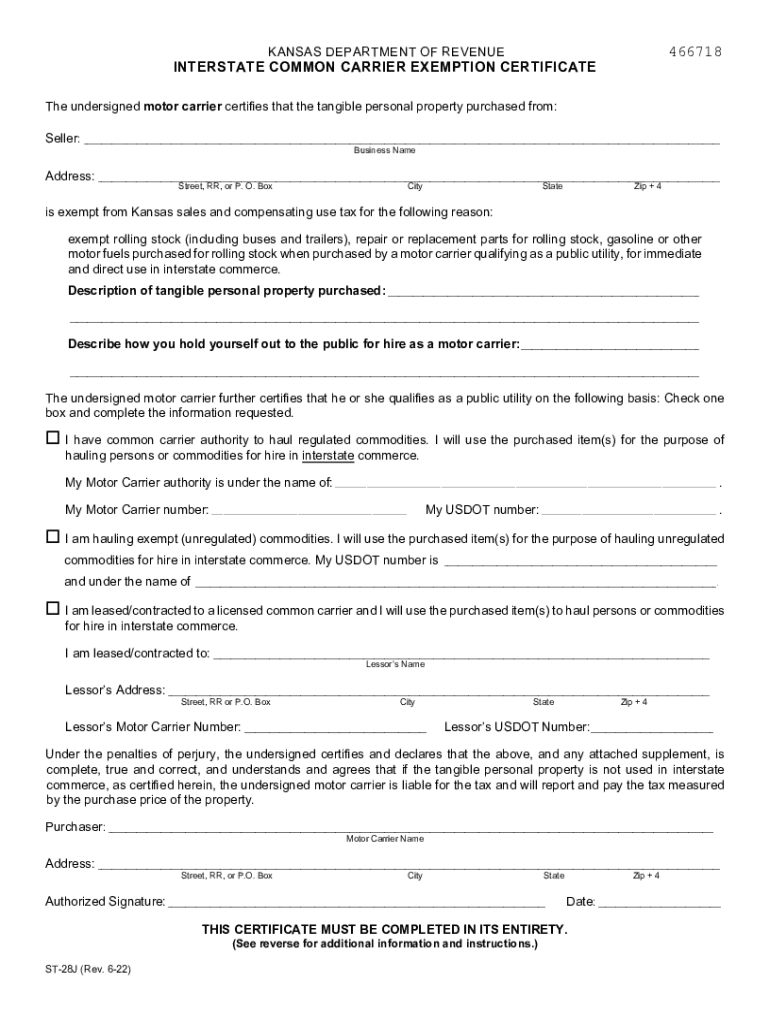

The Ks St 28j is a specific form used in the state of Kansas, primarily for tax-related purposes. This form is designed to collect essential information from taxpayers to ensure compliance with state tax regulations. The Ks St 28j serves as a declaration of certain financial details and is crucial for accurate tax assessment and processing. Understanding the purpose of this form is vital for individuals and businesses alike, as it helps to facilitate proper tax reporting and accountability.

How to use the Ks St 28j

Using the Ks St 28j involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation that supports the information you will provide on the form. This may include income statements, previous tax returns, and identification details. Next, carefully fill out the form, ensuring that all fields are completed as required. It is essential to double-check for accuracy to avoid any potential issues with the tax authorities. Finally, submit the form according to the specified method, whether online, by mail, or in person.

Steps to complete the Ks St 28j

Completing the Ks St 28j involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather Necessary Documents: Collect all relevant financial documents, including income statements and identification.

- Fill Out the Form: Carefully enter the required information in each section of the form.

- Review for Accuracy: Check all entries for correctness to prevent errors that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent before the deadline.

Legal use of the Ks St 28j

The legal use of the Ks St 28j is governed by state tax laws and regulations. It is important to understand that this form must be filled out truthfully and accurately, as any discrepancies can lead to legal consequences, including fines or audits. The information provided on the form is used to assess tax liabilities and ensure compliance with Kansas tax statutes. Adhering to the legal requirements surrounding the Ks St 28j is essential for maintaining good standing with tax authorities.

Key elements of the Ks St 28j

Several key elements define the Ks St 28j and its role in the tax process. These include:

- Taxpayer Identification: Essential for verifying the identity of the individual or business submitting the form.

- Financial Information: Details regarding income, deductions, and other relevant financial data.

- Signature: A declaration that the information provided is accurate and complete, often requiring a signature for validation.

- Submission Date: The date by which the form must be submitted to avoid penalties.

Form Submission Methods

Submitting the Ks St 28j can be done through various methods, catering to different preferences and situations. The available submission methods include:

- Online Submission: Many taxpayers prefer the convenience of submitting forms electronically through the Kansas Department of Revenue's website.

- Mail: The form can be printed and mailed to the appropriate tax authority address, ensuring it is sent with sufficient time to meet deadlines.

- In-Person: Individuals may choose to submit the form in person at designated tax offices for immediate processing.

Quick guide on how to complete ks st 28j

Complete Ks St 28j effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Ks St 28j on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ks St 28j seamlessly

- Obtain Ks St 28j and select Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Edit and eSign Ks St 28j and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ks st 28j

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ks st 28j and how does it work with airSlate SignNow?

The ks st 28j refers to a specific document standard that airSlate SignNow supports, enabling businesses to streamline their eSigning processes. With airSlate SignNow, users can efficiently send, sign, and manage ks st 28j documents electronically, ensuring compliance and efficiency.

-

What pricing plans are available for using airSlate SignNow with ks st 28j documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs when handling ks st 28j documents. From individual users to larger teams, our pricing options are designed to provide cost-effective solutions without sacrificing functionality.

-

What features does airSlate SignNow provide for managing ks st 28j documents?

With airSlate SignNow, users can take advantage of advanced features like customizable templates, automated workflows, and real-time tracking for ks st 28j documents. These features streamline the signing process, making it easier and more efficient for businesses.

-

How does airSlate SignNow benefit businesses handling ks st 28j documentation?

By using airSlate SignNow, businesses can signNowly reduce the time and costs associated with managing ks st 28j documentation. The platform enhances productivity through its user-friendly interface and automation capabilities, allowing teams to focus on more strategic tasks.

-

Can airSlate SignNow integrate with other tools for ks st 28j document management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage ks st 28j documents within existing workflows. This integration support allows businesses to streamline their processes and data flow, improving overall efficiency.

-

Is airSlate SignNow compliant with legal standards for ks st 28j documents?

Absolutely! airSlate SignNow complies with all major eSignature laws and regulations, ensuring that your ks st 28j documents are legally binding and secure. Our commitment to compliance gives businesses peace of mind while managing sensitive documentation.

-

How can I get started with airSlate SignNow for ks st 28j?

Getting started with airSlate SignNow for managing ks st 28j documents is simple. You can sign up for a free trial on our website, which allows you to explore our features tailored for ks st 28j document handling without any initial commitment.

Get more for Ks St 28j

- Tennessee advance directive form

- I 796 form

- Sdlt46 form

- Pa department of revenue bureau of compliance lien section form

- 204 s w walnut avenue dallas or 97338phone 50 form

- Hapueblo orgwp contentuploadshousing authority of the city of pueblo pre application form

- Construction complete and send to owner form

- Summons civil case to dft res form

Find out other Ks St 28j

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed