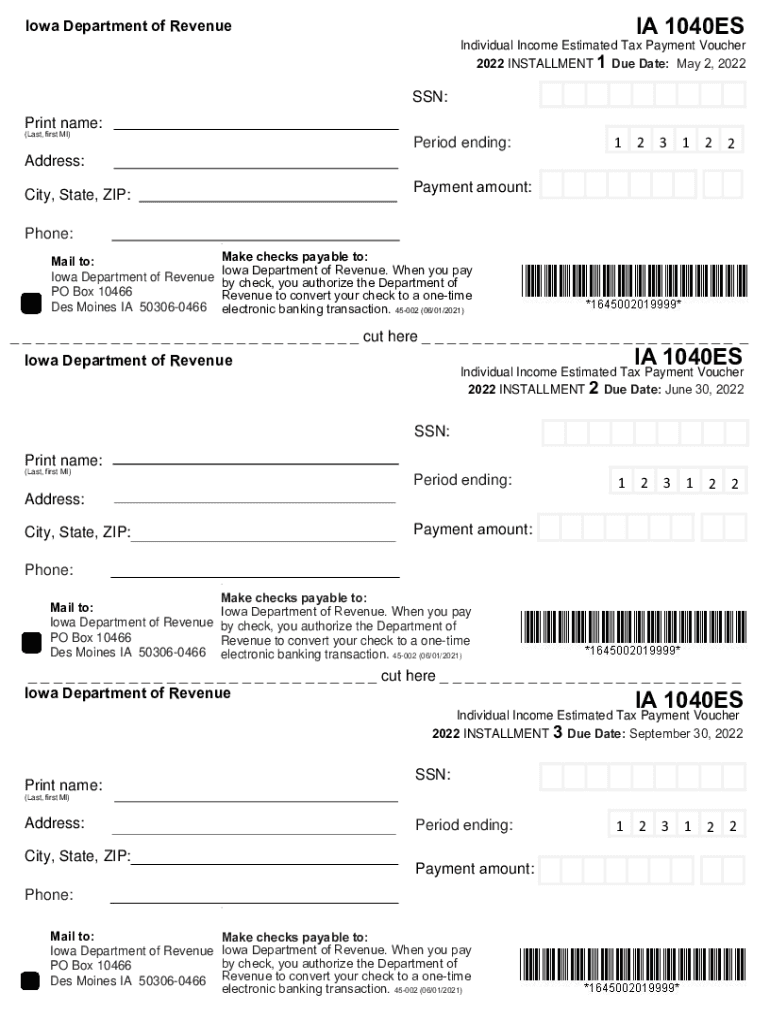

PDF IA 1040ES Iowa Department of Revenue Form

What is the Iowa estimated tax payments voucher?

The Iowa estimated tax payments voucher is a document used by taxpayers to report and pay estimated income taxes to the Iowa Department of Revenue. It is particularly relevant for individuals who expect to owe tax of one thousand dollars or more when they file their annual return. This voucher helps ensure that taxpayers meet their tax obligations throughout the year rather than facing a large bill at tax time.

Steps to complete the Iowa estimated tax payments voucher

Completing the Iowa estimated tax payments voucher involves several key steps:

- Obtain the Iowa 1040ES form, which serves as the estimated tax payments voucher.

- Fill in your personal information, including your name, address, and Social Security number.

- Calculate your estimated tax liability based on your expected income for the year.

- Divide your total estimated tax by the number of payment periods, typically four.

- Submit the completed voucher along with your payment to the Iowa Department of Revenue by the due dates.

Filing deadlines and important dates

It is crucial to be aware of the filing deadlines for the Iowa estimated tax payments voucher. Generally, payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines can lead to penalties and interest on unpaid taxes, so staying informed about these dates is essential for compliance.

Legal use of the Iowa estimated tax payments voucher

The Iowa estimated tax payments voucher is legally binding when filled out and submitted correctly. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, the voucher must comply with the regulations set forth by the Iowa Department of Revenue, which governs the submission of estimated tax payments.

Who issues the Iowa estimated tax payments voucher?

The Iowa estimated tax payments voucher is issued by the Iowa Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can obtain the voucher directly from the department's website or through authorized tax preparation services.

Required documents for filing

When filing the Iowa estimated tax payments voucher, taxpayers may need to gather several documents, including:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any deductions or credits that may affect estimated tax calculations.

Penalties for non-compliance

Failure to file or pay the Iowa estimated tax payments voucher on time can result in penalties. Taxpayers may face a penalty of up to ten percent of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes, increasing the total amount owed. It is advisable to stay compliant to avoid these financial repercussions.

Quick guide on how to complete pdf ia 1040es iowa department of revenue

Complete PDF IA 1040ES Iowa Department Of Revenue effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage PDF IA 1040ES Iowa Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign PDF IA 1040ES Iowa Department Of Revenue with ease

- Obtain PDF IA 1040ES Iowa Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign PDF IA 1040ES Iowa Department Of Revenue to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf ia 1040es iowa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa 1040 ES form 2024 printable?

The Iowa 1040 ES form 2024 printable is a document used by taxpayers in Iowa to estimate and pay their income tax throughout the year. This form allows individuals to report their expected annual income and calculate their tax payments in advance, ensuring they remain compliant with Iowa tax requirements.

-

How can I obtain the Iowa 1040 ES form 2024 printable?

You can easily download the Iowa 1040 ES form 2024 printable from the Iowa Department of Revenue's website or through platforms like airSlate SignNow. Simply visit the resources section for easy access to the form you need.

-

Can I eSign the Iowa 1040 ES form 2024 printable?

Yes, airSlate SignNow allows you to eSign the Iowa 1040 ES form 2024 printable, making it simpler and more efficient to submit your documents electronically. This feature ensures that your signature is secure and legally binding.

-

What are the benefits of using airSlate SignNow for the Iowa 1040 ES form 2024 printable?

Using airSlate SignNow for the Iowa 1040 ES form 2024 printable simplifies the process of filling out and signing documents. It offers a user-friendly interface, integrates with other platforms, and provides a secure method for managing sensitive tax information, increasing compliance and reducing errors.

-

Is there a cost associated with using the Iowa 1040 ES form 2024 printable through airSlate SignNow?

While the Iowa 1040 ES form 2024 printable itself is free to download, using airSlate SignNow may involve a subscription fee depending on the features you choose. However, many users find it to be a cost-effective solution for managing their tax documentation needs.

-

What features does airSlate SignNow offer for managing the Iowa 1040 ES form 2024 printable?

airSlate SignNow offers various features including template creation, secure cloud storage, and seamless eSignature capabilities to enhance your experience with the Iowa 1040 ES form 2024 printable. You can easily track document status and collaborate with others directly within the platform.

-

How does airSlate SignNow ensure the security of the Iowa 1040 ES form 2024 printable?

airSlate SignNow prioritizes security with advanced encryption and secure access controls to protect your Iowa 1040 ES form 2024 printable. This ensures that your sensitive tax information remains confidential and is only accessible to authorized individuals.

Get more for PDF IA 1040ES Iowa Department Of Revenue

Find out other PDF IA 1040ES Iowa Department Of Revenue

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile