Form 3 Accounts Receivable Write off Request Depa 2015-2026

Understanding the Accounts Receivable Write Off Request Form

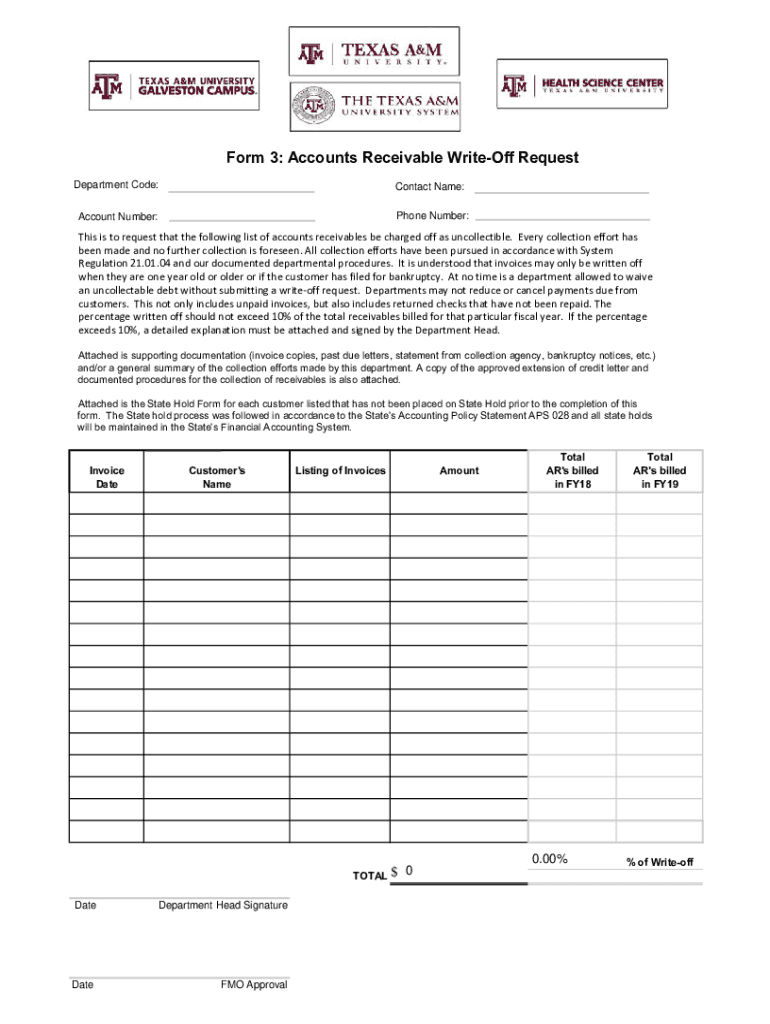

The Accounts Receivable Write Off Request Form is essential for businesses looking to formally document the decision to write off uncollectible accounts. This form serves as a record for internal accounting purposes and can be critical for tax reporting. It allows companies to maintain accurate financial statements by removing bad debts from their accounts receivable. Properly filling out this form ensures compliance with accounting standards and helps in maintaining clear financial records.

Steps to Complete the Accounts Receivable Write Off Request Form

Completing the Accounts Receivable Write Off Request Form involves several key steps:

- Identify the Account: Begin by clearly identifying the account that is to be written off. Include the account number and customer details.

- Document the Reason: Provide a detailed explanation of why the account is deemed uncollectible. Common reasons include bankruptcy, disputes, or prolonged non-payment.

- Attach Supporting Documents: Include any relevant documentation, such as previous correspondence, payment history, or legal notices, to support the write-off request.

- Obtain Necessary Approvals: Ensure that the form is reviewed and signed by the appropriate personnel within the organization, such as a manager or finance officer.

- Submit the Form: Follow the designated submission process, whether it be electronic or paper, to ensure the request is officially recorded.

Legal Considerations for the Write Off Request Form

When using the Accounts Receivable Write Off Request Form, it is important to adhere to relevant legal guidelines. The form must comply with the Fair Debt Collection Practices Act, which governs how debts are collected and reported. Additionally, businesses should ensure that their write-off practices align with Generally Accepted Accounting Principles (GAAP) to avoid potential legal issues. Keeping thorough records of all write-off requests can also provide legal protection in case of disputes.

Required Documents for Submission

To ensure a smooth submission process for the Accounts Receivable Write Off Request Form, certain documents are typically required:

- Proof of Debt: Documentation showing the original transaction and the amount owed.

- Communications Records: Any emails, letters, or notes regarding attempts to collect the debt.

- Approval Signatures: Signatures from management or finance personnel indicating approval of the write-off.

Examples of Write Off Scenarios

Various scenarios may warrant the use of the Accounts Receivable Write Off Request Form. For instance:

- A customer files for bankruptcy, making it impossible to collect the owed amount.

- A long-standing customer disputes a charge and refuses to pay, leading to a write-off after all collection efforts have failed.

- A business decides to write off a small balance that is no longer cost-effective to pursue.

Submission Methods for the Write Off Request Form

The Accounts Receivable Write Off Request Form can typically be submitted through various methods, depending on the organization's policies:

- Online Submission: Many companies utilize electronic systems for submitting forms, which can streamline the process.

- Mail: Physical copies can be mailed to the finance department for processing.

- In-Person: Some organizations may require forms to be submitted in person for immediate review and approval.

Quick guide on how to complete form 3 accounts receivable write off request depa

Accomplish Form 3 Accounts Receivable Write off Request Depa seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Form 3 Accounts Receivable Write off Request Depa on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 3 Accounts Receivable Write off Request Depa effortlessly

- Find Form 3 Accounts Receivable Write off Request Depa and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 3 Accounts Receivable Write off Request Depa and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3 accounts receivable write off request depa

Create this form in 5 minutes!

How to create an eSignature for the form 3 accounts receivable write off request depa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a write off form?

A write off form is a document used by businesses to officially record the decision to write off an asset or account receivable. It includes details such as the reason for the write-off and any relevant financial implications. Understanding how to properly fill out a write off form can help streamline your accounting processes.

-

How can airSlate SignNow help with write off forms?

airSlate SignNow allows you to create, send, and eSign write off forms quickly and efficiently. With our easy-to-use platform, you can eliminate paperwork and streamline the process of managing write off forms in your organization. This simplification can save you time and enhance your team’s productivity.

-

Is there a cost associated with using airSlate SignNow for write off forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features specifically for managing write off forms. You can choose a plan that fits your budget while still gaining access to essential tools for document management and eSigning. Our pricing is transparent, with no hidden fees.

-

Can I integrate airSlate SignNow with other tools to manage write off forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your ability to manage write off forms alongside your existing workflows. Integrations with tools like CRM systems and accounting software make it easy to maintain organized records and improve efficiency.

-

What features does airSlate SignNow offer for creating write off forms?

airSlate SignNow includes features such as customizable templates for write off forms, eSignature capabilities, and real-time tracking of document status. These tools simplify the write off process and ensure that all necessary information is accurately captured and stored securely.

-

What are the benefits of using airSlate SignNow for write off forms?

Using airSlate SignNow for your write off forms provides numerous benefits including faster processing times, reduced errors, and increased compliance with legal requirements. Additionally, the electronic nature of our platform helps in maximizing document organization and retrieval, facilitating better financial decision-making.

-

Is it easy to get started with airSlate SignNow for write off forms?

Yes, getting started with airSlate SignNow for write off forms is straightforward. Our user-friendly interface requires minimal setup, and we provide extensive resources and customer support to guide you through the initial process. You can be managing write off forms within minutes.

Get more for Form 3 Accounts Receivable Write off Request Depa

Find out other Form 3 Accounts Receivable Write off Request Depa

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter