Cp261 Form

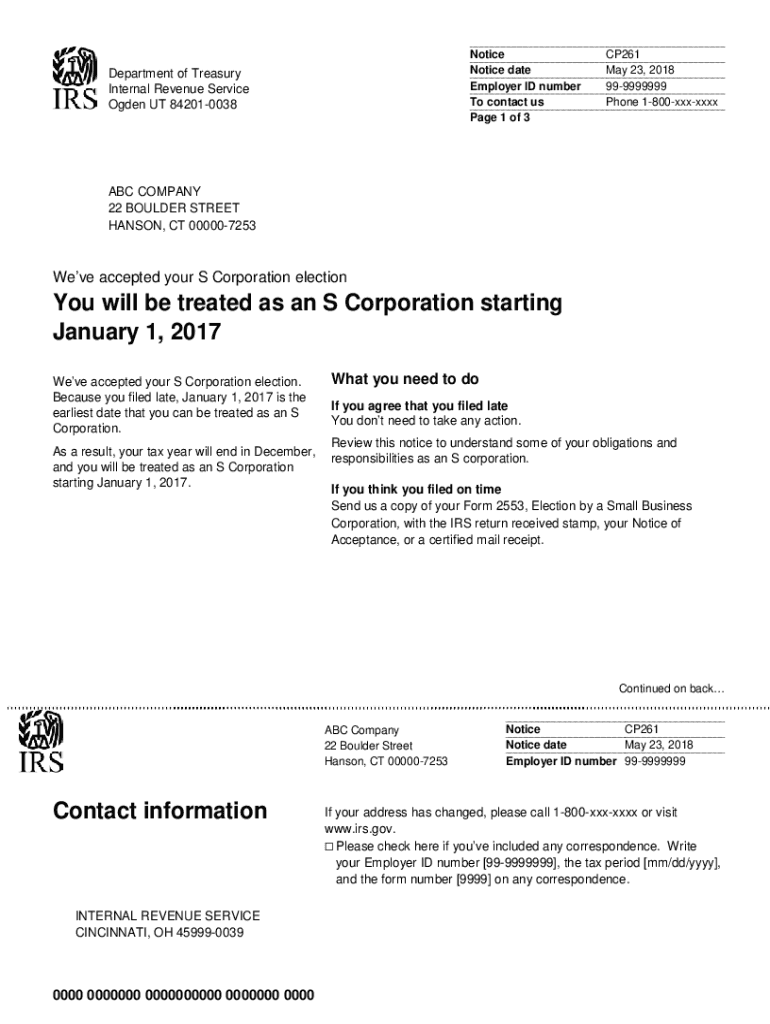

What is the CP261?

The CP261 notice is an official communication from the IRS that informs taxpayers about the status of their tax return or account. It typically addresses discrepancies or issues that may require the taxpayer's attention. Understanding the CP261 notice is crucial for ensuring compliance with tax regulations and for resolving any potential problems that may arise during the tax filing process.

How to use the CP261

Using the CP261 notice effectively involves reviewing the information provided carefully. Taxpayers should identify the specific issues mentioned in the notice, which may include missing information or required actions. Responding promptly to the notice is essential to avoid penalties or delays in processing. It is also advisable to keep a copy of the CP261 for personal records and future reference.

Steps to complete the CP261

Completing the CP261 notice involves several steps to ensure that all necessary information is accurately provided. First, read the notice thoroughly to understand the requirements. Next, gather any supporting documents or information requested by the IRS. Fill out the required sections of the notice, ensuring that all entries are clear and legible. Finally, submit the completed notice to the IRS by the specified deadline, either online or via mail.

Legal use of the CP261

The CP261 notice is legally binding, meaning that taxpayers must address the issues outlined within it to remain compliant with IRS regulations. Failure to respond appropriately can lead to penalties or further action from the IRS. It is important to understand the legal implications of the notice and to seek professional advice if needed to ensure proper handling.

Filing Deadlines / Important Dates

When dealing with the CP261 notice, it is critical to be aware of any associated deadlines. The notice will typically specify a due date for responding or providing additional information. Missing these deadlines can result in penalties or complications with your tax account. Taxpayers should mark these dates on their calendars and prioritize timely responses to avoid issues.

Who Issues the Form

The CP261 notice is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Understanding that this notice comes directly from the IRS underscores its importance and the need for prompt attention to any issues raised within it.

Quick guide on how to complete cp261

Prepare Cp261 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and without obstacles. Handle Cp261 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Cp261 with ease

- Locate Cp261 and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Cp261 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp261

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CP261 notice and why is it important?

A CP261 notice is a notification from the IRS that provides information about your tax account and any changes made. Understanding the contents of your CP261 notice is crucial as it can impact your tax obligations and inform you of any necessary actions you might need to take.

-

How can airSlate SignNow help me manage CP261 notices?

With airSlate SignNow, you can easily send and eSign documents related to your CP261 notice electronically. This enables quick and secure handling of any documents that may require a signature, ensuring compliance and a streamlined process.

-

What features does airSlate SignNow offer for handling tax notices like CP261?

airSlate SignNow provides robust features such as document templates, automated workflows, and real-time tracking, which are particularly useful when dealing with CP261 notices. These tools help streamline documentation processes, saving you time and minimizing errors.

-

Is there a trial period available for airSlate SignNow to handle CP261 notices?

Yes, airSlate SignNow offers a free trial period that allows you to explore its features for managing CP261 notices and other documents. This lets you experience the platform's ease of use and efficiency before committing to a subscription.

-

What kind of integrations does airSlate SignNow offer for managing CP261 notices?

airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and Salesforce. These integrations streamline the management of CP261 notices by allowing you to access and store documents from various platforms efficiently.

-

How much does it cost to use airSlate SignNow for handling CP261 notices?

airSlate SignNow offers various pricing plans to fit different business needs, starting from affordable options for small businesses. Each plan provides essential features to manage CP261 notices effectively, allowing businesses of all sizes to benefit.

-

Can airSlate SignNow ensure the security of documents related to CP261 notices?

Yes, airSlate SignNow prioritizes document security through advanced encryption and compliance with industry standards. This ensures that your CP261 notices and other sensitive documents are handled securely, giving you peace of mind.

Get more for Cp261

- Fam fcs 021 rev 0113 replaces 76c646p fam 048 form

- Group membership change form kirkwood

- Wh 1606a the south carolina department of revenue form

- Notice of special appearance pdf 33938869 form

- Nj chapter 51 form

- Hospital discharge papers for asthma form

- Kyle keller po box 13037 sfa station nacogdoches tx form

- City of alice fire department smoke alarm request form ci alice tx

Find out other Cp261

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online