Nonprofit Application *To Be Able to Save This for Form

What is the Nonprofit Application *To Be Able To Save This For

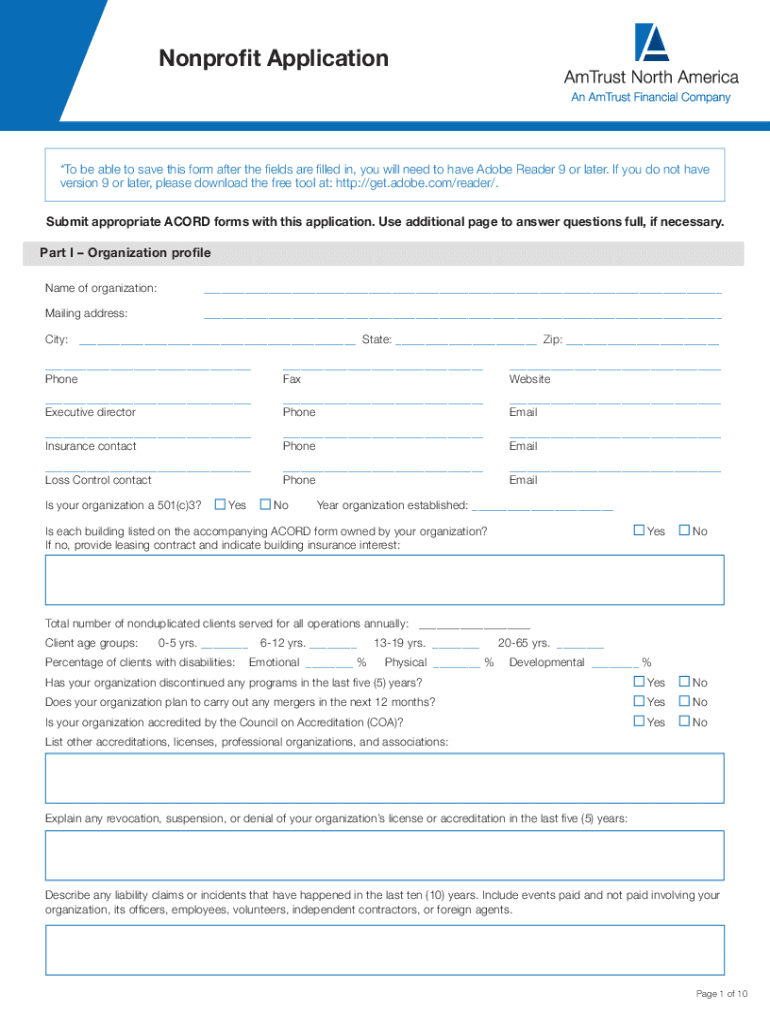

The Nonprofit Application *To Be Able To Save This For is a crucial document for organizations seeking nonprofit status in the United States. This form serves as an official request for recognition as a tax-exempt entity under the Internal Revenue Code. By completing this application, organizations can gain access to various benefits, including tax deductions for donors and exemption from federal income tax. Understanding the purpose and significance of this application is essential for any organization aiming to operate as a nonprofit.

Steps to complete the Nonprofit Application *To Be Able To Save This For

Completing the Nonprofit Application *To Be Able To Save This For involves several key steps. First, gather all necessary information about your organization, including its mission, structure, and financial data. Next, fill out the application form accurately, ensuring that all sections are completed to avoid delays. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the application either electronically or via mail, depending on the submission options available. Following these steps carefully can help streamline the approval process.

Legal use of the Nonprofit Application *To Be Able To Save This For

The legal use of the Nonprofit Application *To Be Able To Save This For is governed by specific regulations set forth by the Internal Revenue Service (IRS). For the application to be valid, it must comply with the requirements outlined in the IRS guidelines for nonprofit organizations. This includes providing accurate information about the organization's activities, governance, and financial practices. Ensuring compliance with these legal standards is vital for obtaining and maintaining tax-exempt status.

Eligibility Criteria

To qualify for the Nonprofit Application *To Be Able To Save This For, organizations must meet certain eligibility criteria. These criteria typically include being organized for charitable, educational, religious, or scientific purposes. Additionally, the organization must operate primarily for these purposes and not for profit. It is important to review the specific requirements outlined by the IRS to ensure that your organization meets all necessary qualifications before submitting the application.

Required Documents

When preparing to submit the Nonprofit Application *To Be Able To Save This For, several documents are typically required. These may include the organization's articles of incorporation, bylaws, and a detailed description of its activities. Financial statements and a list of the board of directors may also be necessary. Collecting and organizing these documents in advance can facilitate a smoother application process and help ensure that all required information is submitted.

Application Process & Approval Time

The application process for the Nonprofit Application *To Be Able To Save This For can vary in length depending on several factors, including the complexity of the application and the volume of submissions received by the IRS. Generally, organizations can expect to wait several months for approval. It is advisable to monitor the application status and be prepared to respond to any requests for additional information from the IRS during this period. Understanding the timeline can help organizations plan their activities accordingly.

Quick guide on how to complete nonprofit application to be able to save this for

Prepare Nonprofit Application *To Be Able To Save This For with ease on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Nonprofit Application *To Be Able To Save This For on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Nonprofit Application *To Be Able To Save This For effortlessly

- Obtain Nonprofit Application *To Be Able To Save This For and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Nonprofit Application *To Be Able To Save This For and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonprofit application to be able to save this for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nonprofit Application *To Be Able To Save This For?

The Nonprofit Application *To Be Able To Save This For is a dedicated program designed to assist nonprofit organizations in efficiently managing their documents. By using this application, nonprofits can streamline their signing processes and enhance collaboration, all while ensuring compliance and security.

-

How does pricing work for the Nonprofit Application *To Be Able To Save This For?

The Nonprofit Application *To Be Able To Save This For offers special pricing tailored for nonprofit organizations. Users can take advantage of discounts compared to standard rates, making it an affordable solution for those on a budget. This approach helps nonprofits maximize their resources while utilizing effective document management tools.

-

What features are included in the Nonprofit Application *To Be Able To Save This For?

The Nonprofit Application *To Be Able To Save This For includes features such as unlimited eSigning, customizable templates, and real-time collaboration tools. Additional functionalities like document tracking and secure storage further enhance the user experience, making it a comprehensive solution for nonprofit needs.

-

Can I integrate the Nonprofit Application *To Be Able To Save This For with other tools?

Yes, the Nonprofit Application *To Be Able To Save This For offers seamless integrations with various popular software platforms. This includes integrations with CRM systems, project management tools, and cloud storage solutions, allowing nonprofits to maintain their existing workflows while enhancing efficiency.

-

What are the benefits of using the Nonprofit Application *To Be Able To Save This For?

Using the Nonprofit Application *To Be Able To Save This For allows nonprofits to save time and resources by automating the document signing process. It enhances transparency and accountability, fostering improved communication among team members. Overall, it contributes to a more organized and efficient operational environment.

-

Is training available for using the Nonprofit Application *To Be Able To Save This For?

Yes, airSlate SignNow provides comprehensive training resources for users of the Nonprofit Application *To Be Able To Save This For. This includes tutorials, webinars, and customer support to ensure users can fully leverage the platform’s capabilities and features.

-

What security measures are in place for the Nonprofit Application *To Be Able To Save This For?

The Nonprofit Application *To Be Able To Save This For employs advanced security measures to protect sensitive documents. This includes data encryption, secure access controls, and compliance with industry regulations, ensuring that nonprofit organizations can trust the safety of their information.

Get more for Nonprofit Application *To Be Able To Save This For

- Bartender application form

- Direct bill form 52331146

- Relapse prevention plan template 427845336 form

- Plan de vuelo form

- Name address form 709 see rule 75 authority for legal practitioner chartered accountant cost accountant or sales tax

- Report to ssa ssa 7162 ocr sm 739212015 form

- Room rental lodger agreement template form

- Room rental boarding agreement template form

Find out other Nonprofit Application *To Be Able To Save This For

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking