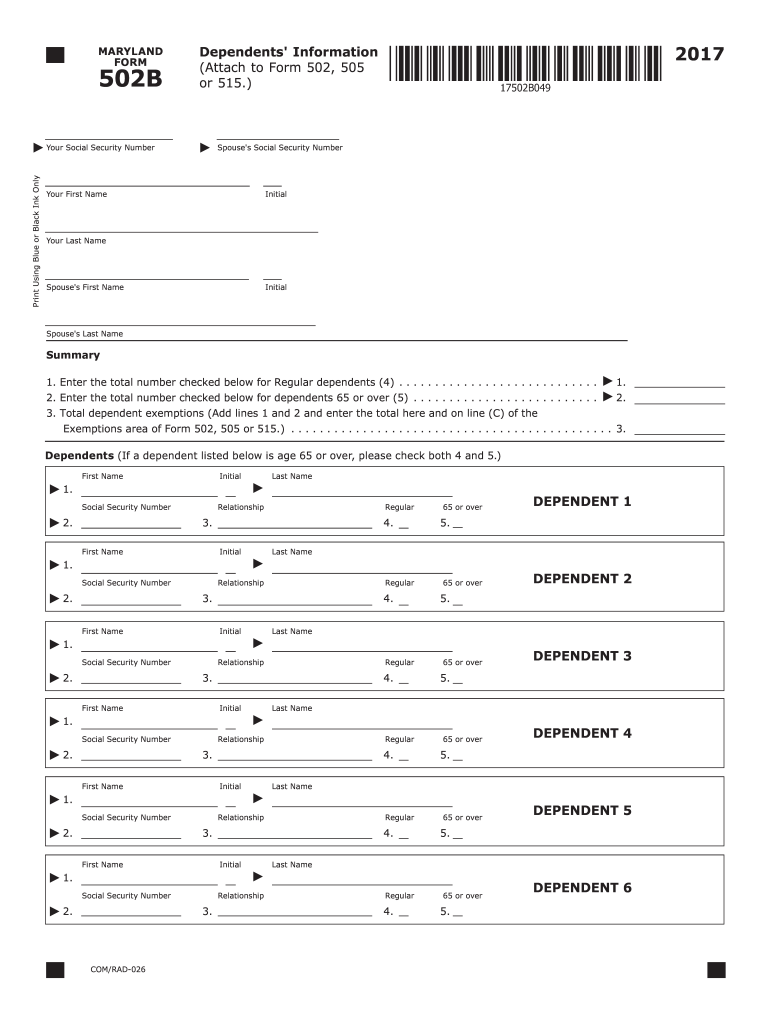

Form 502 B 2017

What is the Form 502 B

The Form 502 B is a tax document used by individuals and businesses in the United States to report specific income and deductions. This form is primarily associated with state tax filings, allowing taxpayers to accurately disclose their financial information to the relevant tax authorities. It is essential for ensuring compliance with state tax regulations and for calculating the correct amount of tax owed or refund due.

How to use the Form 502 B

Using the Form 502 B involves several straightforward steps. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, fill out the form with accurate information regarding your income, deductions, and any credits you may qualify for. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. It is important to keep a copy of the submitted form for your records.

Steps to complete the Form 502 B

Completing the Form 502 B requires careful attention to detail. Follow these steps for an efficient process:

- Obtain the latest version of Form 502 B from the official tax authority website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- List any deductions you are eligible for, ensuring to follow the guidelines provided.

- Calculate your tax liability based on the information provided.

- Sign and date the form before submission.

Legal use of the Form 502 B

The Form 502 B is legally recognized for tax reporting purposes. To ensure its validity, taxpayers must adhere to specific guidelines set forth by the state tax authority. This includes providing truthful and complete information, as any discrepancies can lead to penalties or audits. Additionally, eSigning the form is permissible under the ESIGN Act, making it easier to submit electronically while maintaining legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 502 B can vary based on state regulations. Generally, taxpayers should aim to submit their forms by April 15 for the previous tax year. It is crucial to be aware of any extensions or specific state deadlines that may apply. Missing these deadlines can result in penalties or interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 502 B can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the state tax authority's website, often the fastest method.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices, which may offer assistance if needed.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 502 B can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete form 502 b 2017

Your assistance manual on how to prepare your Form 502 B

If you are looking to learn how to fill out and submit your Form 502 B, here are some brief guidelines to simplify your tax filing process.

First, you need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and effective document platform that allows you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, as well as modify information whenever necessary. Enhance your tax organization with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to finalize your Form 502 B in just a few minutes:

- Create your account and start working on PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax document; explore different versions and schedules.

- Click Get form to access your Form 502 B in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if applicable).

- Examine your document and amend any mistakes.

- Save updates, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased return mistakes and delayed refunds. Naturally, before electronically filing your taxes, verify the IRS website for reporting regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 502 b 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

What is the last date to fill out the management form in BVM and GCET for B.tech admission 2017?

BVM, GCET and ADIT- all these three colleges have common form for management admissions. You can refer website of BVM or GCET or ADIT to get the form and details precisely!Even if you will make a call they will furnish information. (Get college’s contact number from website. )If nothing works out, drop me a message- I have personal contacts.:)

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form 502 b 2017

How to make an electronic signature for your Form 502 B 2017 online

How to make an eSignature for your Form 502 B 2017 in Chrome

How to make an eSignature for putting it on the Form 502 B 2017 in Gmail

How to create an electronic signature for the Form 502 B 2017 from your mobile device

How to generate an eSignature for the Form 502 B 2017 on iOS devices

How to generate an electronic signature for the Form 502 B 2017 on Android

People also ask

-

What is Form 502 B and how is it used?

Form 502 B is a specific document often required for various regulatory and compliance purposes. Businesses can utilize airSlate SignNow to easily create, send, and eSign Form 502 B, streamlining the entire process while ensuring compliance with necessary regulations.

-

How can airSlate SignNow help with completing Form 502 B?

airSlate SignNow provides an intuitive platform for businesses to fill out and eSign Form 502 B. With features like templates and real-time collaboration, users can ensure accuracy and efficiency in completing this important document.

-

Is there a cost associated with using airSlate SignNow for Form 502 B?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you need to send a few Form 502 B documents or manage multiple workflows, you'll find a cost-effective solution that meets your requirements.

-

What are the key features of airSlate SignNow for handling Form 502 B?

airSlate SignNow includes features like document templates, secure eSigning, and automated workflows, all of which are beneficial for managing Form 502 B. These features not only enhance productivity but also ensure that your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 502 B?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage Form 502 B alongside your existing tools. This interoperability ensures that you can streamline document workflows across different platforms.

-

What are the benefits of using airSlate SignNow for Form 502 B?

Using airSlate SignNow for Form 502 B provides numerous benefits, including reduced turnaround time and improved document accuracy. The platform's user-friendly interface and robust features allow businesses to enhance their efficiency and compliance when handling important documents.

-

Is airSlate SignNow secure for signing Form 502 B?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for signing Form 502 B. With advanced encryption and authentication measures, you can trust that your documents are protected throughout the signing process.

Get more for Form 502 B

- Pastebin credit card dump form

- Daily routines crossword puzzle worksheet form

- Graphing quadratic functions in standard form worksheet

- Hhs 690 form 2832

- Special resident retiree39s visa bapplicationb philippine retirement bb form

- Photography ge agreement template form

- Photography ge rights agreement template form

- Photography license agreement template form

Find out other Form 502 B

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple