502b 2018

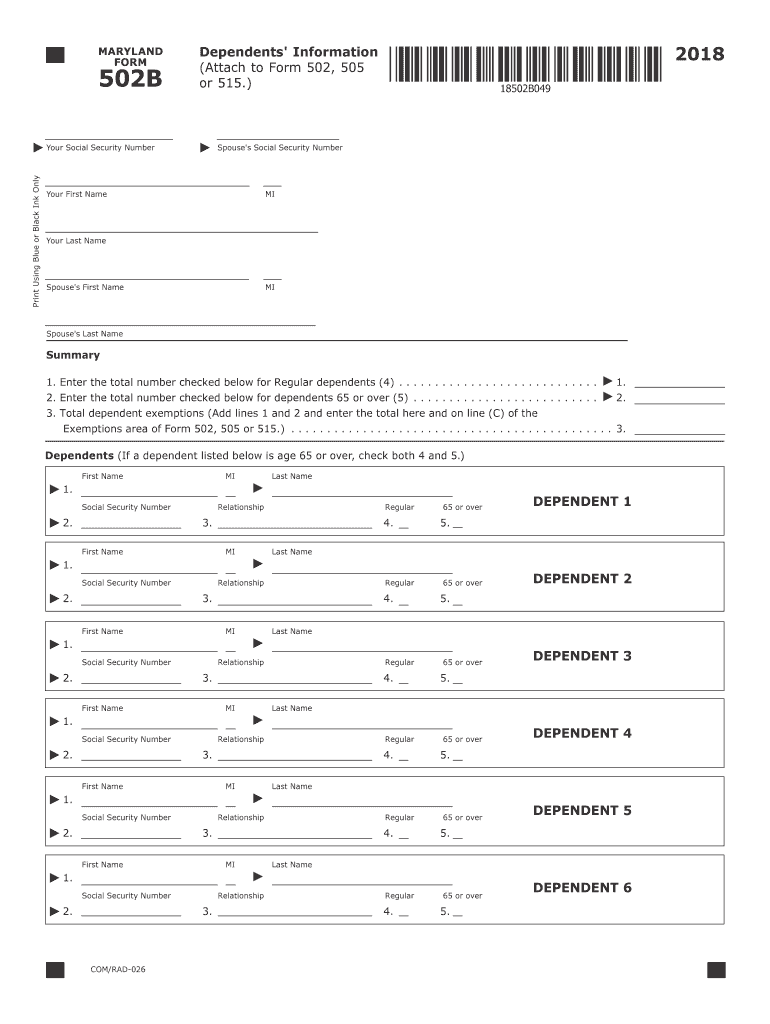

What is the MD 502B?

The MD 502B, also known as the Maryland Form 502B, is a tax document used by individuals in the state of Maryland to report their income and calculate their state tax liability. This form is specifically designed for residents and non-residents who earn income within Maryland. It is essential for ensuring compliance with state tax laws and for accurate tax reporting.

How to Obtain the MD 502B

The Maryland Form 502B can be easily obtained from the official Maryland state government website or through the Maryland Comptroller's office. The form is available in both printable and fillable formats, allowing taxpayers to complete it online or by hand. It is important to ensure that you are using the correct version for the tax year you are filing.

Steps to Complete the MD 502B

Completing the MD 502B involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Calculate your total income and apply any deductions or credits you qualify for.

- Review your calculations to ensure accuracy before signing and dating the form.

Legal Use of the MD 502B

The MD 502B is legally recognized by the state of Maryland as an official document for tax reporting purposes. To ensure its validity, it must be completed accurately and submitted by the appropriate deadlines. The form also requires a signature, which can be provided electronically if using an eSignature solution that complies with state regulations.

Filing Deadlines / Important Dates

Taxpayers should be aware of the key filing deadlines associated with the MD 502B. Typically, the form must be filed by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Maryland Comptroller's website for any updates or changes to these dates.

Form Submission Methods

The MD 502B can be submitted in several ways:

- Online through the Maryland Comptroller's e-file system, which allows for quick and secure submission.

- By mail, using the address provided on the form for the specific tax year.

- In-person at designated state offices, although this method may require an appointment.

Quick guide on how to complete form 502 b 2018 2019

Your assistance manual on how to prepare your 502b

If you’re interested in learning how to create and submit your 502b, presented below are some concise instructions on how to simplify tax processing.

Initially, you just need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that allows you to modify, create, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to edit information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your 502b in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your 502b in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to increased errors and delays in refunds. Naturally, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 502 b 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the form 502 b 2018 2019

How to create an eSignature for your Form 502 B 2018 2019 online

How to generate an eSignature for the Form 502 B 2018 2019 in Chrome

How to make an electronic signature for putting it on the Form 502 B 2018 2019 in Gmail

How to generate an eSignature for the Form 502 B 2018 2019 right from your smartphone

How to make an electronic signature for the Form 502 B 2018 2019 on iOS

How to make an eSignature for the Form 502 B 2018 2019 on Android

People also ask

-

What is md 502b and how does it relate to airSlate SignNow?

md 502b is a document management solution that streamlines eSignature processes in a user-friendly manner. With airSlate SignNow, you can effectively utilize md 502b to send, sign, and manage documents electronically, ensuring a quick turnaround for business operations.

-

How can I benefit from using md 502b with airSlate SignNow?

By integrating md 502b with airSlate SignNow, businesses can enhance their workflow efficiency. This solution allows for seamless document signing, reducing processing time and increasing productivity through its intuitive interface.

-

What pricing options are available for airSlate SignNow with md 502b?

airSlate SignNow offers various pricing plans tailored to meet different business needs while using md 502b. You can choose from monthly or annual subscriptions, allowing you to select the best option that fits your budget and requirements.

-

Does airSlate SignNow with md 502b offer mobile access?

Yes, airSlate SignNow provides mobile access for users utilizing md 502b. This ensures that you can send and eSign documents on-the-go, making it an ideal solution for busy professionals who need flexibility in their document management.

-

What integrations does airSlate SignNow support with md 502b?

airSlate SignNow supports a variety of integrations with popular business tools when using md 502b. You can connect it with CRM platforms, cloud storage services, and collaboration tools to create a comprehensive solution for document management.

-

Is customer support available for users of airSlate SignNow with md 502b?

Absolutely! airSlate SignNow offers dedicated customer support for users leveraging md 502b. Our team is available to assist you with any questions or technical issues, ensuring a smooth and efficient experience.

-

Can I customize templates in airSlate SignNow while using md 502b?

Yes, airSlate SignNow allows you to create and customize templates using md 502b. This feature facilitates consistency across your documents while saving you time on repetitive tasks, making your workflows more efficient.

Get more for 502b

- Evidence of property insurance nh gov form

- Renasa property loss claim form

- Model 1440 microprocessor based temperature dynisco form

- Butte county housing authority form

- Dcfs detention court report samole form

- Opcf 27b form

- Instructions for request for the return of origina form

- Non standard grievance form

Find out other 502b

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure