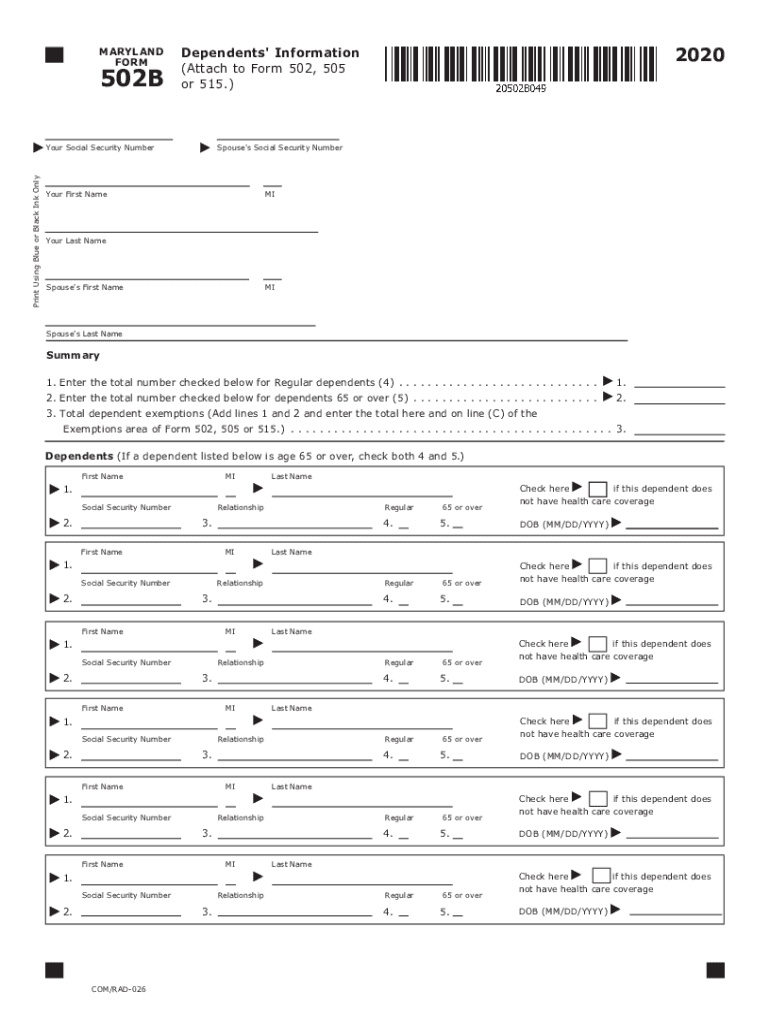

TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM 2020

What is the 2017 Maryland Form 502B?

The 2017 Maryland Form 502B is a tax form specifically designed for individual taxpayers in the state of Maryland. This form is used to report income, calculate tax liability, and claim any applicable credits or deductions for the tax year 2017. It is an essential document for residents who need to file their state income taxes, ensuring compliance with Maryland tax laws. The form helps taxpayers accurately report their financial information to the Maryland Comptroller's office.

Steps to Complete the 2017 Maryland Form 502B

Completing the 2017 Maryland Form 502B involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately report all sources of income on the designated lines.

- Calculate deductions and credits: Identify any deductions or credits you may qualify for and apply them accordingly.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it.

How to Obtain the 2017 Maryland Form 502B

The 2017 Maryland Form 502B can be obtained through several methods. Taxpayers can access the form online via the Maryland Comptroller's website, where it is available for download in PDF format. Additionally, printed copies may be available at local tax offices, libraries, or government buildings. It is important to ensure that you are using the correct version of the form for the 2017 tax year to avoid any filing issues.

Legal Use of the 2017 Maryland Form 502B

The 2017 Maryland Form 502B is legally binding when completed and submitted in accordance with state tax laws. To ensure its legal validity, taxpayers must provide accurate information and adhere to all filing requirements. Electronic signatures are accepted for forms submitted online, provided that the eSignature complies with Maryland's eSignature laws. Maintaining a copy of the submitted form and any supporting documents is advisable for record-keeping and potential audits.

Filing Deadlines / Important Dates

For the 2017 tax year, the deadline to file the Maryland Form 502B is typically April 15 of the following year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure timely submission to avoid penalties or interest on unpaid taxes.

Form Submission Methods

Taxpayers have multiple options for submitting the 2017 Maryland Form 502B:

- Online submission: The form can be filed electronically through the Maryland Comptroller's e-filing system.

- Mail: Completed forms can be printed and sent via postal mail to the appropriate address provided by the Maryland Comptroller.

- In-person: Taxpayers may also choose to submit their forms in person at designated tax offices.

Quick guide on how to complete ty 2020 502b tax year 2020 502b individual taxpayer form

Effortlessly Complete TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Handle TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM seamlessly

- Acquire TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 502b tax year 2020 502b individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 502b tax year 2020 502b individual taxpayer form

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2017 Maryland Form 502B?

The 2017 Maryland Form 502B is a tax form used by businesses to report income and calculate taxes owed to the state of Maryland. Ensuring accurate completion of the 2017 Maryland Form 502B is vital for compliance with state tax laws. Using tools like airSlate SignNow can streamline this process by allowing you to eSign and send documents securely.

-

How can airSlate SignNow help with the 2017 Maryland Form 502B?

airSlate SignNow offers an intuitive platform for eSigning and managing the 2017 Maryland Form 502B. This solution empowers businesses to easily send, sign, and track their tax documents, ensuring that they meet submission deadlines. The process is both efficient and compliant, reducing the margin for errors in tax filings.

-

What are the features of airSlate SignNow for managing forms like the 2017 Maryland Form 502B?

airSlate SignNow provides a variety of features for managing documents such as the 2017 Maryland Form 502B, including customizable templates, automated workflows, and secure cloud storage. These features simplify the completion and submission process for tax forms and improve document organization. You can complete and eSign your forms quickly, making tax season a less daunting task.

-

Is airSlate SignNow affordable for small businesses that need the 2017 Maryland Form 502B?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses needing to submit the 2017 Maryland Form 502B. With flexible pricing plans, you can choose an option that best fits your budget and document signing needs. The savings from improved efficiency and reduced paper costs can outweigh the subscription expense.

-

Can I integrate airSlate SignNow with other tools while preparing the 2017 Maryland Form 502B?

Absolutely! airSlate SignNow seamlessly integrates with various applications to facilitate your workflow while preparing the 2017 Maryland Form 502B. Whether you are using accounting software or document management systems, you can enhance your productivity and ensure that your forms are prepared and submitted on time.

-

What benefits does airSlate SignNow offer for eSigning the 2017 Maryland Form 502B?

Using airSlate SignNow to eSign the 2017 Maryland Form 502B provides numerous benefits, including faster processing times and enhanced security features. eSigning eliminates the need for printing and mailing, making it easier to file your taxes efficiently. Additionally, airSlate SignNow offers tracking capabilities so you can verify the status of your submissions.

-

How do I start using airSlate SignNow for the 2017 Maryland Form 502B?

Getting started with airSlate SignNow for the 2017 Maryland Form 502B is simple! You can sign up for a free trial on their website, explore the features, and begin uploading your tax documents. With easy-to-follow instructions, you'll be eSigning and managing your forms in no time.

Get more for TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM

Find out other TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template