Employee's Statement of Nonresidence in Pennsylvania and Authorization to Withhold Other State's Income Tax REV 420 Fo Form

Understanding the rev 420 Form

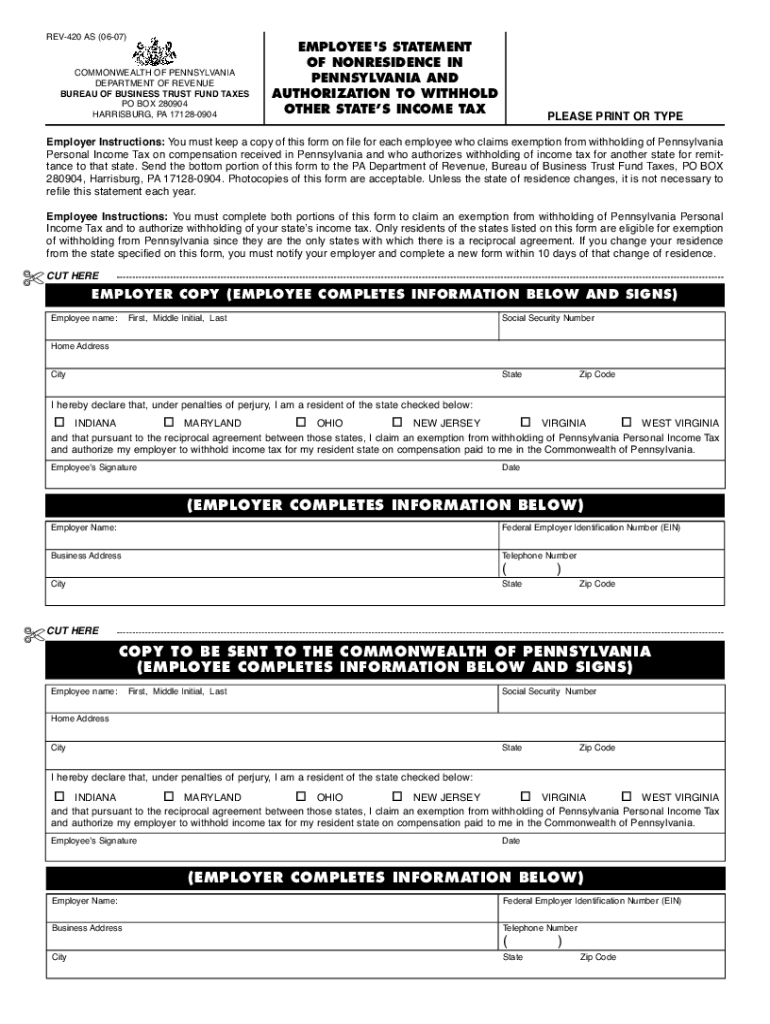

The rev 420 form, officially known as the Employee's Statement of Nonresidence in Pennsylvania and Authorization to Withhold Other State's Income Tax, is essential for employees who work in Pennsylvania but reside in another state. This form allows employers to withhold the correct amount of state income tax from employees' paychecks, ensuring compliance with tax regulations. By completing the rev 420, employees can avoid unnecessary state tax withholdings, which can lead to overpayment and complicated tax returns.

Steps to Complete the rev 420 Form

Completing the rev 420 form involves several straightforward steps:

- Gather Necessary Information: Collect personal details such as your name, address, Social Security number, and the state of residence.

- Provide Employment Details: Include your employer's name and address, along with your job title.

- Indicate Residency: Clearly state your non-resident status and the state where you reside.

- Sign and Date: Ensure that you sign and date the form to validate your information.

After completing these steps, submit the form to your employer for processing.

Legal Use of the rev 420 Form

The rev 420 form is legally binding when filled out correctly and submitted to the employer. It complies with Pennsylvania tax laws, ensuring that non-resident employees are not subjected to unnecessary state income tax withholdings. This form is crucial for maintaining accurate tax records and avoiding potential penalties for non-compliance.

Eligibility Criteria for the rev 420 Form

To be eligible to use the rev 420 form, employees must meet specific criteria:

- Be a non-resident of Pennsylvania.

- Work in Pennsylvania and receive income from an employer based in the state.

- Provide accurate and truthful information on the form.

Meeting these criteria ensures that the employee can benefit from proper tax withholdings according to their residency status.

Obtaining the rev 420 Form

The rev 420 form can be easily obtained through various channels. It is available on the Pennsylvania Department of Revenue's website, where you can download and print it. Additionally, employers may provide copies of the form for their employees to complete. Ensuring you have the most current version of the form is essential for compliance.

Form Submission Methods

Submitting the rev 420 form can be done through multiple methods, depending on your employer's policies:

- In-Person: Hand the completed form directly to your employer's HR or payroll department.

- Mail: Some employers may accept forms sent via postal service; check with your employer for their preferred method.

- Online: If your employer uses an electronic payroll system, you may be able to submit the form digitally.

Confirm with your employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete employees statement of nonresidence in pennsylvania and authorization to withhold other states income tax rev 420

Complete Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo effortlessly on any device

Digital document management has become widely accepted by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo with ease

- Locate Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employees statement of nonresidence in pennsylvania and authorization to withhold other states income tax rev 420

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 420 and how does it relate to airSlate SignNow?

Rev 420 refers to a comprehensive framework designed to enhance the functionality of eSignature solutions like airSlate SignNow. By implementing rev 420 principles, businesses can streamline their document workflows and ensure compliance with regulatory standards, making document management more efficient.

-

How much does airSlate SignNow cost for users interested in rev 420?

Pricing for airSlate SignNow varies based on the features selected, with options tailored for individuals to large enterprises. For those focusing on rev 420 compliance, it's essential to choose a plan that includes necessary integrations and security features, which may be included in our premium offerings.

-

What are the key features of airSlate SignNow that support rev 420 compliance?

AirSlate SignNow includes features like secure eSigning, document templates, and real-time tracking that align with rev 420 standards. These capabilities help ensure that all signed documents are legally binding and meet industry regulations, fostering trust and efficiency in transactions.

-

Can I integrate airSlate SignNow with other applications to enhance rev 420 functionality?

Yes, airSlate SignNow offers numerous integrations with popular applications such as Salesforce, Google Drive, and Microsoft Office. These integrations enhance the rev 420 compliance capability by allowing seamless data flow and document management across platforms, improving overall productivity.

-

What industries benefit the most from using airSlate SignNow and rev 420?

Industries such as real estate, healthcare, and finance greatly benefit from using airSlate SignNow under the rev 420 framework. These sectors require strict compliance with regulations, and our solution offers the necessary tools for secure and efficient document handling that meets these demands.

-

How does airSlate SignNow ensure data security and privacy in line with rev 420?

AirSlate SignNow prioritizes data security through advanced encryption technologies and compliance with international standards such as GDPR. By adhering to the rev 420 principles, we help businesses safeguard their documents, ensuring that sensitive information remains protected during and after the signing process.

-

Is there a mobile version of airSlate SignNow to support rev 420 functionalities?

Yes, airSlate SignNow offers a mobile app that provides full access to all eSigning features while maintaining rev 420 compliance. This allows users to manage their documents on the go, ensuring flexibility and convenience in their signing processes, no matter where they are.

Get more for Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo

Find out other Employee's Statement Of Nonresidence In Pennsylvania And Authorization To Withhold Other State's Income Tax REV 420 Fo

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors