Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

What is the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

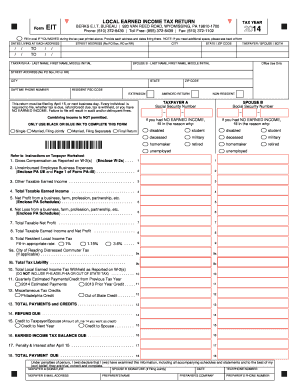

The Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E is a specific tax document used by residents of Berks County, Pennsylvania, to report their earned income for local taxation purposes. This form is essential for individuals who earn income within the county and are subject to local earned income tax regulations. It captures information regarding wages, salaries, and other forms of compensation, ensuring compliance with local tax laws.

Steps to complete the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

Completing the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E involves several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2 forms and other income statements. Next, enter your personal information, such as your name, address, and Social Security number. Then, report your total earned income and any applicable deductions. Finally, review the form for accuracy before submitting it to the appropriate local tax authority.

How to obtain the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

The Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E can be obtained through various channels. Residents can visit the official Berks County tax office website to download a digital copy of the form. Alternatively, physical copies may be available at local government offices or tax preparation services. It is advisable to ensure you have the correct version for the specific tax year you are filing.

Legal use of the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

The legal use of the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E is critical for compliance with local tax laws. This form must be completed accurately to avoid penalties and ensure that all earned income is reported. The form serves as a legal document that can be reviewed by tax authorities, making it essential to adhere to all guidelines and regulations when filling it out.

Filing Deadlines / Important Dates

Filing deadlines for the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E are typically aligned with the federal tax deadlines. It is important to check specific dates for the current tax year, as local regulations may vary. Generally, taxpayers should aim to file their forms by April 15 to avoid late fees or penalties. Staying informed about these dates helps ensure timely compliance.

Required Documents

When completing the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E, certain documents are required to support your income claims. These may include W-2 forms, 1099 forms for freelance or contract work, and any other relevant income documentation. Additionally, having records of deductions, such as business expenses or retirement contributions, can facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from local tax authorities. It is crucial for residents to understand the implications of non-compliance and to file their forms accurately and on time to avoid these consequences.

Quick guide on how to complete form local earned income tax return eit tax year berks e

Prepare Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E on any system using airSlate SignNow's Android or iOS apps and simplify any document-oriented process today.

The easiest way to alter and eSign Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E with minimal effort

- Locate Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form local earned income tax return eit tax year berks e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

The Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E is a necessary document for individuals working in Berks County to report their earned income. This form helps ensure compliance with local taxation laws and is essential for calculating the correct local income tax owed. You can complete this form easily using airSlate SignNow's user-friendly platform.

-

How does airSlate SignNow simplify the completion of the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

airSlate SignNow streamlines the process of completing the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E by offering templates and e-signature functionality. Users can fill out the form online, and then easily send it for signatures, ensuring the process is quick and efficient. This reduces the hassle associated with paper forms.

-

What are the pricing options for using airSlate SignNow for the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

airSlate SignNow offers flexible pricing plans designed to meet various business needs for handling the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E. From basic plans for individuals to comprehensive solutions for businesses, you can choose a plan that fits your budget. Try our free trial to see how it can work for your needs.

-

Can airSlate SignNow integrate with other tools to help manage the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

Yes, airSlate SignNow integrates seamlessly with multiple applications, enhancing your ability to manage the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E. You can connect it with cloud storage services, productivity tools, and accounting software, making it easier to streamline your workflow and keep all documents organized.

-

What are the key benefits of using airSlate SignNow for the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

Using airSlate SignNow for the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E offers numerous benefits, including time savings and increased accuracy. The platform helps eliminate errors through guided completion, ensuring your forms adhere to local regulations. Additionally, the e-signature feature speeds up the approval process, making it more convenient.

-

Is it secure to use airSlate SignNow for handling my Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E?

Absolutely! airSlate SignNow employs industry-standard encryption and security protocols to protect your data when handling the Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E. We prioritize the confidentiality and integrity of your information throughout the entire signing process, giving you peace of mind.

-

Can I access and complete my Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E on mobile devices?

Yes, airSlate SignNow is fully mobile-responsive, allowing you to access and complete your Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E from any device. Whether you're using a smartphone, tablet, or laptop, you can manage your documents on the go. This flexibility makes it convenient to handle your tax returns anywhere.

Get more for Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

- Chula vista form 5519b

- Fsa reimbursement form pdf infinisource

- Ohio beer and malt beverage tax return for qualified a 1c bpermitb bb tax ohio form

- Employment verification report form

- Prescription order form

- Farm balance sheet template excel form

- Instructions for form 1120 s

- Joint agreement template form

Find out other Form LOCAL EARNED INCOME TAX RETURN EIT TAX YEAR BERKS E

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship