Form or TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 2024-2026

Understanding the Form OR TM

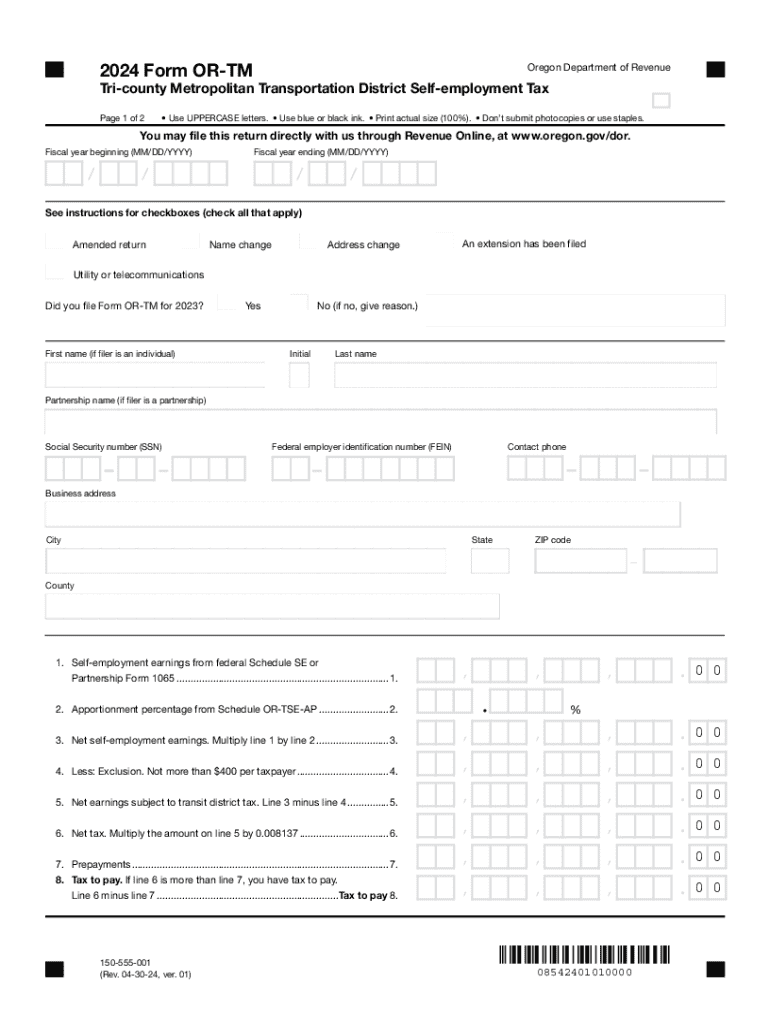

The Form OR TM, officially known as the Tri County Metropolitan Transportation District Self Employment Tax, is a specific tax form utilized by self-employed individuals within the Tri-County area of Oregon. This form is essential for reporting income and calculating the self-employment tax owed to the local transportation district. It is important for taxpayers to understand the purpose of this form, as it directly impacts local funding for transportation services.

Steps to Complete the Form OR TM

Completing the Form OR TM involves several key steps to ensure accurate reporting. Begin by gathering all relevant financial information, including total income from self-employment activities. Next, fill out the form by entering your personal details, including your name, address, and Social Security number. Carefully report your income and any deductions applicable to your business operations. Once all sections are completed, review the form for accuracy before submission.

How to Obtain the Form OR TM

The Form OR TM can be obtained through the Tri County Metropolitan Transportation District's official website or by visiting their local offices. Additionally, the form may be available at various tax preparation offices and community centers within the Tri-County area. It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Form OR TM

The Form OR TM is legally mandated for self-employed individuals operating within the Tri-County area. It is important to file this form accurately and on time to comply with local tax laws. Failure to submit the form can result in penalties and interest on unpaid taxes, emphasizing the need for proper adherence to filing requirements.

Filing Deadlines and Important Dates

Filing deadlines for the Form OR TM typically align with the federal tax deadlines. Self-employed individuals should be aware of these dates to ensure timely submission. Generally, the form must be filed by April fifteenth of each year for the previous tax year. It is crucial to mark these dates on your calendar to avoid late penalties.

Key Elements of the Form OR TM

The Form OR TM includes several key elements that taxpayers must complete. These elements typically include personal identification information, total income from self-employment, allowable deductions, and the calculated self-employment tax. Understanding these components is vital for accurate completion and compliance with local tax regulations.

Examples of Using the Form OR TM

Self-employed individuals in various industries, such as freelance graphic designers or independent contractors, utilize the Form OR TM to report their earnings. For instance, a freelance writer would report income earned from multiple clients on this form. Each example illustrates the diverse applications of the form across different self-employment scenarios, highlighting its importance in local tax compliance.

Create this form in 5 minutes or less

Find and fill out the correct form or tm tri county metropolitan transportation district self employment tax 150 555 001 771963007

Create this form in 5 minutes!

How to create an eSignature for the form or tm tri county metropolitan transportation district self employment tax 150 555 001 771963007

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 form or tm and how does it work?

The 2024 form or tm is a digital document that allows users to fill out and sign forms electronically. With airSlate SignNow, you can easily create, send, and eSign the 2024 form or tm, streamlining your workflow and reducing paperwork.

-

How much does it cost to use airSlate SignNow for the 2024 form or tm?

airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that suits your budget while efficiently managing the 2024 form or tm, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 2024 form or tm?

airSlate SignNow provides a range of features for the 2024 form or tm, including customizable templates, real-time tracking, and secure cloud storage. These features enhance your document management process, making it easier to handle forms efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2024 form or tm?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage the 2024 form or tm alongside your existing tools. This integration helps streamline your processes and enhances productivity across your organization.

-

What are the benefits of using airSlate SignNow for the 2024 form or tm?

Using airSlate SignNow for the 2024 form or tm offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. By digitizing your document processes, you can focus more on your core business activities.

-

Is airSlate SignNow secure for handling the 2024 form or tm?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the 2024 form or tm. With encryption and secure access controls, you can trust that your sensitive information is safe.

-

How can I get started with airSlate SignNow for the 2024 form or tm?

Getting started with airSlate SignNow for the 2024 form or tm is simple. Sign up for an account, choose a pricing plan, and begin creating and sending your forms. Our user-friendly interface makes it easy to navigate and utilize all features.

Get more for Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- Promissory note in connection with sale of vehicle or automobile minnesota form

- Mn bill sale boat form

- Bill of sale of automobile and odometer statement for as is sale minnesota form

- Construction contract cost plus or fixed fee minnesota form

- Painting contract for contractor minnesota form

- Trim carpenter contract for contractor minnesota form

- Fencing contract for contractor minnesota form

- Hvac contract for contractor minnesota form

Find out other Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free