Tax Certification Statement Form

What is the Tax Certification Statement

The tax certification statement is a crucial document used by individuals and businesses to certify their tax status or compliance with tax regulations. This form is often required by financial institutions, employers, and government agencies to verify that the taxpayer is in good standing with the Internal Revenue Service (IRS). It serves as a declaration that the information provided regarding tax obligations is accurate and complete, helping to prevent tax fraud and ensuring compliance with tax laws.

How to use the Tax Certification Statement

Using the tax certification statement involves several steps to ensure that it is completed accurately. First, gather all necessary financial documents and records that pertain to your tax situation. This may include previous tax returns, income statements, and any relevant correspondence from the IRS. Next, fill out the form with precise information, ensuring that all entries are current and truthful. After completing the form, it may need to be signed and dated before submission to the requesting party, such as an employer or financial institution.

Steps to complete the Tax Certification Statement

Completing the tax certification statement requires careful attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all relevant documents that support your tax status.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form to the appropriate entity, whether electronically or via mail.

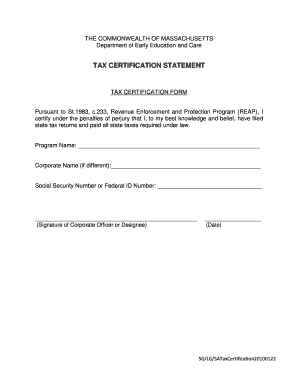

Key elements of the Tax Certification Statement

The tax certification statement includes several key elements that must be accurately represented. These elements typically consist of:

- Taxpayer Identification: This includes the name, address, and taxpayer identification number (TIN) of the individual or business.

- Certification of Tax Status: A declaration that the taxpayer is compliant with tax obligations.

- Signature: The signature of the taxpayer or an authorized representative, affirming the accuracy of the information provided.

- Date: The date on which the form is signed, which is important for record-keeping and compliance purposes.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the tax certification statement. It is essential to refer to the IRS website or official publications for the most current requirements and instructions. The guidelines outline the necessary information to include, any applicable deadlines for submission, and the consequences of providing false information. Adhering to these guidelines ensures that the form is valid and accepted by the IRS and other entities requiring it.

Filing Deadlines / Important Dates

Filing deadlines for the tax certification statement can vary depending on the specific circumstances of the taxpayer. Generally, it is advisable to submit the form as soon as it is completed to avoid any potential delays in processing. Key dates to keep in mind include:

- The annual tax filing deadline, typically April 15 for individual taxpayers.

- Any deadlines specified by financial institutions or employers requesting the form.

- Extensions that may be available for filing taxes, which can also affect the submission timeline for the certification statement.

Quick guide on how to complete tax certification statement 256349472

Effortlessly Prepare Tax Certification Statement on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Tax Certification Statement on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Edit and eSign Tax Certification Statement with Ease

- Locate Tax Certification Statement and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of the document or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Tax Certification Statement to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax certification statement 256349472

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax certification statement?

A tax certification statement is a document that verifies a taxpayer's withholding status or tax obligations. It is essential for businesses to ensure compliance with tax regulations. Using airSlate SignNow, you can easily create and send tax certification statements electronically, saving time and reducing errors.

-

How can airSlate SignNow help with tax certification statements?

airSlate SignNow simplifies the process of generating and signing tax certification statements. With our intuitive platform, you can customize these statements, track their status, and obtain legally binding e-signatures quickly. This streamlines your workflow and ensures that you meet your tax documentation needs efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business sizes and needs. Each plan includes features for creating, sending, and managing documents, including tax certification statements. We provide competitive pricing to help you manage your tax documentation efficiently and affordably.

-

Is airSlate SignNow secure for handling sensitive documents like tax certification statements?

Yes, airSlate SignNow prioritizes the security of your documents, including tax certification statements. We employ industry-standard encryption and advanced security protocols to protect your data. This ensures that your sensitive tax information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for managing tax-related documents?

Absolutely! airSlate SignNow offers integrations with various third-party applications to help streamline your document management process. You can connect it with accounting software, CRMs, and other platforms to ensure that your tax certification statements and related documents are centralized and easily accessible.

-

What features does airSlate SignNow offer for managing tax certification statements?

Our platform provides several useful features for managing tax certification statements, including customizable templates, secure e-signature options, and real-time tracking. These features allow you to automate your document workflows and ensure compliance with tax regulations, improving overall efficiency.

-

How long does it take to create and send a tax certification statement using airSlate SignNow?

Creating and sending a tax certification statement with airSlate SignNow can take only a few minutes. Our user-friendly interface allows you to easily fill out the required information, customize your statement, and send it for e-signature. This rapid process helps businesses respond quickly to tax compliance needs.

Get more for Tax Certification Statement

Find out other Tax Certification Statement

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy