Form VM 2 Virginia Vending Machine Dealer's Sales Tax 2020-2026

What is the Form VM 2 Virginia Vending Machine Dealer's Sales Tax

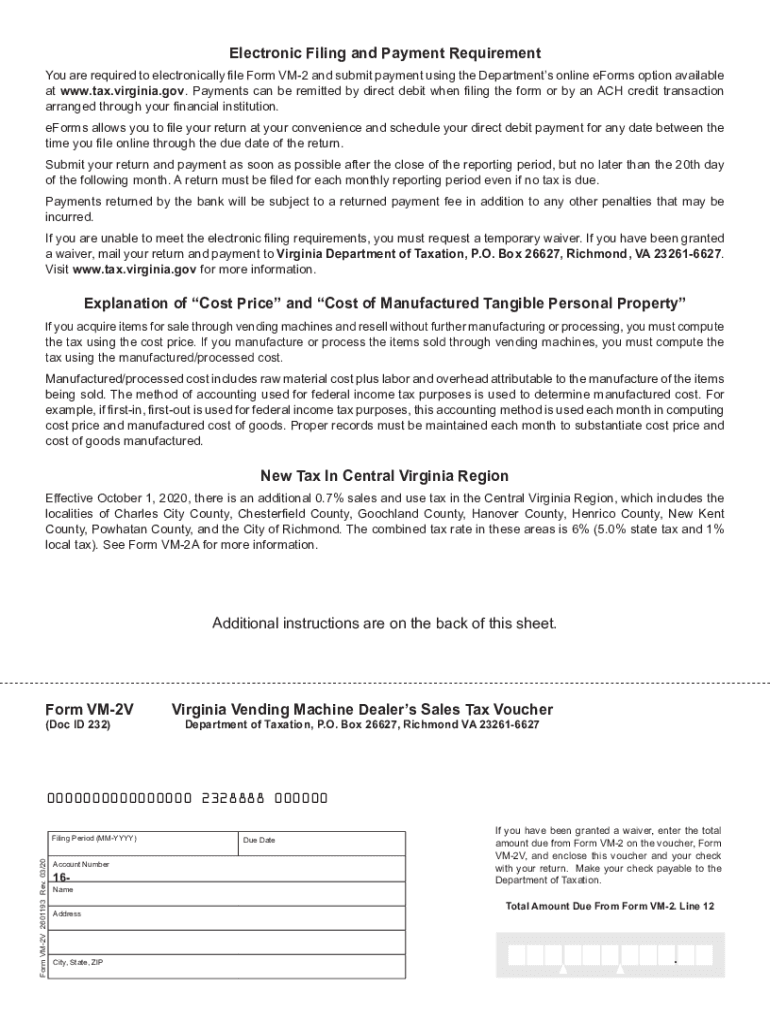

The Form VM 2 is a crucial document for vending machine dealers in Virginia, specifically designed for reporting and remitting sales tax on vending machine sales. This form ensures compliance with state tax regulations and helps businesses accurately account for their sales tax obligations. By using the VM 2 form, dealers can provide the necessary information regarding their sales, including the total sales amount, the tax collected, and any exemptions that may apply.

Steps to complete the Form VM 2 Virginia Vending Machine Dealer's Sales Tax

Completing the Form VM 2 involves several key steps to ensure accuracy and compliance. First, gather all sales records related to your vending machine operations for the reporting period. Next, fill in the required fields on the form, including your business information and sales totals. It is essential to calculate the correct sales tax based on the applicable rate in Virginia. After completing the form, review it for any errors before submission. Finally, retain a copy for your records, as it may be needed for future reference or audits.

Legal use of the Form VM 2 Virginia Vending Machine Dealer's Sales Tax

The legal use of the Form VM 2 is governed by Virginia tax laws, which require vending machine dealers to report sales tax accurately. The form serves as an official record of sales and tax collected, ensuring that businesses comply with state regulations. Failure to use the form correctly can result in penalties, including fines or additional tax liabilities. It is essential for dealers to understand the legal implications of their reporting and to maintain accurate records to support their submissions.

Filing Deadlines / Important Dates

Vending machine dealers must be aware of specific filing deadlines associated with the Form VM 2. Generally, the form is due on a quarterly basis, with deadlines typically falling on the last day of the month following the end of the quarter. For example, the filing deadline for the first quarter (January to March) is April 30. Missing these deadlines can lead to penalties and interest on unpaid taxes, making it crucial for dealers to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

The Form VM 2 can be submitted through various methods, providing flexibility for vending machine dealers. Dealers may choose to file the form online through the Virginia Department of Taxation's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its advantages, and dealers should select the one that best suits their operational needs.

Examples of using the Form VM 2 Virginia Vending Machine Dealer's Sales Tax

Examples of using the Form VM 2 can help clarify its application in real-world scenarios. For instance, a vending machine operator who generates $10,000 in sales during a quarter must report this amount on the VM 2 form. If the applicable sales tax rate is six percent, the operator would calculate $600 in sales tax to remit. Another example includes a dealer who has multiple vending machines across different locations; they must aggregate sales from all machines to report accurately on the VM 2 form.

Quick guide on how to complete form vm 2 virginia vending machine dealers sales tax

Effortlessly Prepare Form VM 2 Virginia Vending Machine Dealer's Sales Tax on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form VM 2 Virginia Vending Machine Dealer's Sales Tax on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Edit and eSign Form VM 2 Virginia Vending Machine Dealer's Sales Tax with Ease

- Locate Form VM 2 Virginia Vending Machine Dealer's Sales Tax and click Get Form to begin.

- Utilize the available tools to submit your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form VM 2 Virginia Vending Machine Dealer's Sales Tax to ensure optimal communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form vm 2 virginia vending machine dealers sales tax

Create this form in 5 minutes!

How to create an eSignature for the form vm 2 virginia vending machine dealers sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vm 2 and how does it integrate with airSlate SignNow?

VM 2 is a powerful feature within airSlate SignNow that enhances document management capabilities. It allows users to easily automate workflows, making document signing and eSigning more efficient. With VM 2, you can seamlessly integrate various applications, boosting your overall productivity.

-

How much does airSlate SignNow's vm 2 feature cost?

The cost of airSlate SignNow varies depending on the chosen plan, which includes the vm 2 feature. We offer flexible pricing options designed to fit various business needs and sizes. For detailed pricing information, you can visit our pricing page or contact our support team.

-

What are the key features of vm 2 in airSlate SignNow?

VM 2 in airSlate SignNow provides advanced features such as automated workflows, customizable templates, and comprehensive tracking. These features ensure your document signing process is streamlined and more efficient. This empowers you to focus on what matters most—your business.

-

What benefits can my business gain from using vm 2?

By utilizing vm 2, your business can experience faster document turnaround times and improved team collaboration. The automation features reduce manual tasks, allowing your team to dedicate time to strategic initiatives. Overall, vm 2 enhances efficiency while saving costs for your organization.

-

Is vm 2 easy to use for non-technical users?

Absolutely! VM 2 is designed with user-friendliness in mind, making it accessible for non-technical users. The intuitive interface allows anyone to navigate the software with ease, enabling all team members to take advantage of its powerful features without a steep learning curve.

-

Can I integrate vm 2 with other software applications?

Yes, vm 2 supports integration with a variety of popular software applications, enhancing workflow capabilities. This interoperability allows you to connect airSlate SignNow with tools you already use, thus making your document management processes even more efficient. Integration options can be explored on our integrations page.

-

How does vm 2 ensure the security of my documents?

VM 2 employs top-notch security protocols to ensure that your documents are safe and secure. This includes data encryption, secure access controls, and regular audits, helping you to maintain compliance and protect sensitive information. You can trust vm 2 to prioritize your document security.

Get more for Form VM 2 Virginia Vending Machine Dealer's Sales Tax

- Mold inspection agreement form

- Discharge of judgment lien michigan form

- Eviction petition kaufman county form

- Uysa participant registration form docx utah youth

- Graduation application form durham technical community college

- Form ssa 8 f4 application for lump sum death payment

- Key holder agreement template form

- Key employee agreement template form

Find out other Form VM 2 Virginia Vending Machine Dealer's Sales Tax

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation