The Tax Organizer Should Be Completed and Sent to Your Tax Preparer with Your Tax Information

What is the tax organizer?

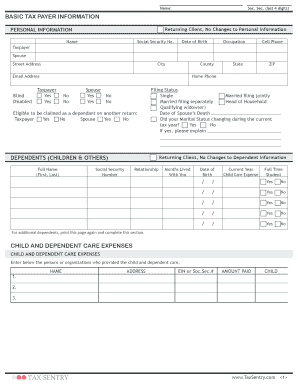

The tax organizer is a crucial document designed to assist individuals and businesses in gathering and organizing necessary tax information for their tax preparer. This form typically includes sections for personal details, income sources, deductions, and credits. By completing the tax organizer, you ensure that your tax preparer has all relevant information to accurately prepare your tax return. This document is particularly important in the context of electronic submissions, as it streamlines the process and reduces the likelihood of errors or omissions.

How to use the tax organizer

Using the tax organizer involves several straightforward steps. First, download or access the form through your tax preparer's platform. Next, fill in your personal information, including your name, address, and Social Security number. Proceed to detail your income sources, such as wages, dividends, and any other earnings. After that, list potential deductions and credits you may qualify for, such as mortgage interest or education expenses. Finally, review your entries for accuracy before submitting the completed organizer to your tax preparer, either electronically or via traditional mail.

Key elements of the tax organizer

Several key elements should be included in the tax organizer to ensure comprehensive coverage of your tax situation. These elements typically consist of:

- Personal Information: Name, address, Social Security number, and filing status.

- Income Details: Sources of income, including wages, self-employment income, and investment earnings.

- Deductions: Itemized deductions such as mortgage interest, medical expenses, and charitable contributions.

- Credits: Information on tax credits for which you may be eligible, such as education credits or child tax credits.

- Additional Notes: Any other relevant information that may impact your tax situation.

Steps to complete the tax organizer

Completing the tax organizer can be broken down into a series of manageable steps:

- Access the tax organizer form from your tax preparer.

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Fill in your personal information accurately.

- Detail your income from all sources.

- List all applicable deductions and credits.

- Review the completed form for any errors or missing information.

- Submit the organizer to your tax preparer electronically or by mail.

Legal use of the tax organizer

When used correctly, the tax organizer is considered a legally binding document. It serves as a formal declaration of your financial information and intentions regarding your tax return. To ensure its legal validity, it is essential to provide accurate and truthful information. Additionally, using a reliable eSignature solution can enhance the legitimacy of the document, ensuring compliance with relevant regulations such as the ESIGN Act and UETA.

Filing deadlines / Important dates

Being aware of filing deadlines is crucial to avoid penalties and ensure timely processing of your tax return. Generally, individual tax returns are due on April 15 of each year. If that date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific state deadlines or extensions that may apply to your situation. Keeping track of these dates will help you stay organized and compliant with tax regulations.

Quick guide on how to complete the tax organizer should be completed and sent to your tax preparer with your tax information

Complete The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the right forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly and without delays. Manage The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to edit and eSign The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information seamlessly

- Find The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information and click on Get Form to begin.

- Make use of the tools provided to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether it be via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the tax organizer should be completed and sent to your tax preparer with your tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax sentry and how does it work?

Tax Sentry is an advanced feature offered by airSlate SignNow that helps users manage and monitor their tax-related documents efficiently. It automates reminders for tax deadlines, ensuring that you never miss an important date. By integrating with your existing workflows, Tax Sentry simplifies the document signing process while maintaining compliance with tax regulations.

-

How does Tax Sentry enhance document security?

Tax Sentry enhances document security by providing advanced encryption methods and robust authentication features. With airSlate SignNow, your sensitive tax documents are safeguarded throughout the signing process, ensuring that only authorized personnel can access them. This level of security provides peace of mind, especially when handling critical tax information.

-

What are the pricing options for using Tax Sentry with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that include access to Tax Sentry at competitive rates. You can choose from different tiers that cater to the size and needs of your business, ensuring you get the features you need without overspending. For detailed pricing information, visit our pricing page or contact our sales team.

-

Can Tax Sentry be integrated with other software?

Yes, Tax Sentry easily integrates with various accounting and management software applications. airSlate SignNow supports numerous integrations that streamline your workflow and enhance productivity. By connecting Tax Sentry with tools you already use, you can manage your tax documents more effectively.

-

What are the key features of Tax Sentry?

Key features of Tax Sentry include automated document reminders, secure eSignature capabilities, document tracking, and seamless integration with other tools. AirSlate SignNow's Tax Sentry allows you to stay organized and compliant while reducing the risk of missing important tax deadlines. These features make managing tax documents easier for both individuals and businesses.

-

Is there a free trial available for Tax Sentry?

Yes, airSlate SignNow offers a free trial for users to experience the benefits of Tax Sentry firsthand. This trial allows you to explore the features and usability of the platform without any commitment. Sign up today to see how Tax Sentry can streamline your tax document management.

-

How can Tax Sentry benefit small businesses?

Tax Sentry provides signNow benefits to small businesses by streamlining tax document management and ensuring compliance. With easy-to-use features and automated reminders, small business owners can focus more on growth and less on paperwork. This cost-effective solution is designed to adapt to the needs of small businesses.

Get more for The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information

Find out other The Tax Organizer Should Be Completed And Sent To Your Tax Preparer With Your Tax Information

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed