Use Your Mouse or Tab Key to Move through the Fiel Form

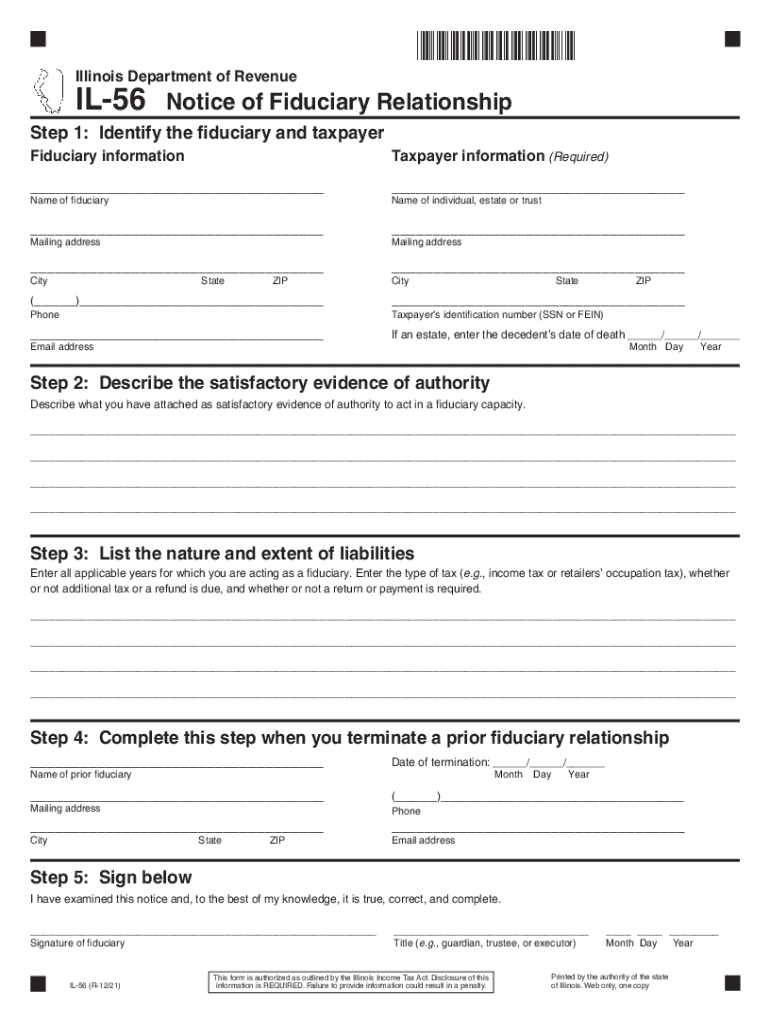

Understanding the Illinois IL56 Revenue Form

The Illinois IL56 revenue form is primarily used for reporting income and calculating tax obligations for individuals and businesses in Illinois. This form is essential for ensuring compliance with state tax laws. Completing the IL56 accurately is crucial for avoiding penalties and ensuring that all income is reported correctly.

Steps to Complete the Illinois IL56 Revenue Form

Filling out the Illinois IL56 revenue form involves several key steps:

- Gather all necessary income documentation, including W-2s, 1099s, and any other relevant financial records.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources in the appropriate sections of the form.

- Calculate any deductions or credits you may qualify for, as these can significantly affect your tax liability.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, following the guidelines provided by the Illinois Department of Revenue.

Filing Deadlines for the Illinois IL56 Revenue Form

It is important to be aware of the filing deadlines for the Illinois IL56 revenue form to avoid late fees and penalties. Generally, the deadline for filing is April 15 for individual taxpayers. However, if you are unable to meet this deadline, you may be eligible for an extension, but you must still pay any taxes owed by the original due date.

Required Documents for Filing the Illinois IL56 Revenue Form

When preparing to file the Illinois IL56 revenue form, you will need several documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous tax returns for reference

Penalties for Non-Compliance with the Illinois IL56 Revenue Form

Failure to file the Illinois IL56 revenue form or inaccuracies in reporting can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time

- Interest on any unpaid taxes

- Potential audits by the Illinois Department of Revenue

Digital vs. Paper Version of the Illinois IL56 Revenue Form

The Illinois IL56 revenue form can be completed either digitally or on paper. The digital version often allows for easier calculations and quicker submission. However, some individuals may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, ensure that the form is completed accurately to avoid issues with the Illinois Department of Revenue.

Quick guide on how to complete use your mouse or tab key to move through the fiel

Complete Use Your Mouse Or Tab Key To Move Through The Fiel seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Handle Use Your Mouse Or Tab Key To Move Through The Fiel on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to edit and electronically sign Use Your Mouse Or Tab Key To Move Through The Fiel effortlessly

- Obtain Use Your Mouse Or Tab Key To Move Through The Fiel and then click Get Form to begin.

- Employ the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Use Your Mouse Or Tab Key To Move Through The Fiel to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the use your mouse or tab key to move through the fiel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the illinois il56 revenue document?

The illinois il56 revenue document plays a crucial role in ensuring compliance with state regulations and reporting requirements. By utilizing airSlate SignNow, businesses can easily eSign and manage these documents efficiently. This process not only simplifies document handling but also ensures timely submissions.

-

How does airSlate SignNow simplify the eSigning process for illinois il56 revenue forms?

airSlate SignNow streamlines the eSigning process for illinois il56 revenue forms by providing an intuitive platform that allows easy document uploads and signature requests. Users can quickly set up workflows to manage multiple signers, ensuring a fast turnaround. Additionally, the platform's tracking features help monitor the status of documents throughout the signing process.

-

What are the pricing plans for using airSlate SignNow for illinois il56 revenue documentation?

AirSlate SignNow offers various pricing plans designed to accommodate different business needs, making it cost-effective for handling illinois il56 revenue documentation. Businesses can choose from monthly or annual plans, which include features for managing eSignatures and document workflows. This flexibility allows teams to select a plan that aligns with their budget and operational requirements.

-

Can businesses integrate airSlate SignNow with other tools for managing illinois il56 revenue documents?

Yes, airSlate SignNow offers integrations with a variety of third-party applications to support the management of illinois il56 revenue documents. This includes popular tools like Google Drive, Salesforce, and Microsoft Office. By integrating these applications, businesses can enhance their document workflows and streamline processes further.

-

What features does airSlate SignNow offer for illinois il56 revenue eSigning?

AirSlate SignNow includes a range of features tailored for illinois il56 revenue eSigning, such as customizable templates, automated reminders, and real-time tracking. These features help ensure that documents are signed promptly and that all parties are informed throughout the process. This efficiency not only saves time but also reduces the risk of errors in document management.

-

Is airSlate SignNow compliant with regulations for illinois il56 revenue documentation?

Absolutely, airSlate SignNow is designed to comply with legal standards and regulations surrounding illinois il56 revenue documentation. The platform adheres to the ESIGN Act and UETA, ensuring that all eSignatures are legally binding and secure. This compliance guarantees that your business can confidently manage its financial documentation without legal concerns.

-

What are the benefits of using airSlate SignNow for illinois il56 revenue paperwork?

Utilizing airSlate SignNow for illinois il56 revenue paperwork brings numerous benefits, including increased efficiency and reduced costs associated with traditional document signing. The platform's user-friendly interface allows teams to collaborate effectively and manage documents from anywhere. Furthermore, the speed of eSigning accelerates the overall process, helping businesses stay compliant without delays.

Get more for Use Your Mouse Or Tab Key To Move Through The Fiel

Find out other Use Your Mouse Or Tab Key To Move Through The Fiel

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors