Hawaii Form G 45 2021

What is the Hawaii Form G 45

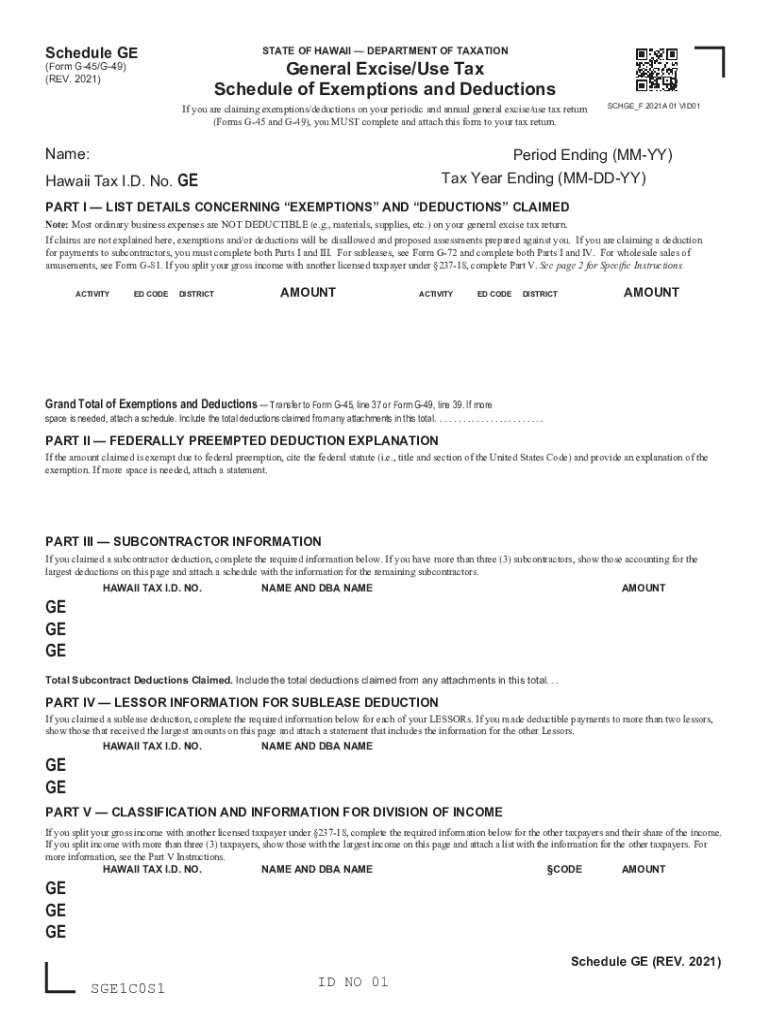

The Hawaii Form G 45 is a general excise tax return form used by businesses operating in Hawaii. This form is essential for reporting the gross income earned from business activities within the state. It is a crucial document for compliance with Hawaii tax regulations and helps ensure that businesses fulfill their tax obligations. The form must be filed periodically, typically on a quarterly basis, depending on the business's gross income levels.

How to use the Hawaii Form G 45

To use the Hawaii Form G 45, businesses must first gather all relevant financial information, including gross income figures and any applicable deductions. The form requires detailed reporting of income from various sources, including sales, services, and rentals. After completing the form, businesses must submit it to the Hawaii Department of Taxation along with any taxes owed. It is important to ensure that the form is filled out accurately to avoid penalties and interest on unpaid taxes.

Steps to complete the Hawaii Form G 45

Completing the Hawaii Form G 45 involves several key steps:

- Gather financial records, including sales and income statements.

- Calculate the total gross income for the reporting period.

- Identify any applicable deductions or exemptions, such as general excise exemptions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form to the Hawaii Department of Taxation, along with any required payment.

Legal use of the Hawaii Form G 45

The Hawaii Form G 45 is legally binding when completed and submitted according to state regulations. Businesses must adhere to the guidelines set forth by the Hawaii Department of Taxation to ensure compliance. This includes maintaining accurate records and filing the form by the established deadlines. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form G 45 are typically set on a quarterly basis. Businesses must submit the form and any taxes owed by the last day of the month following the end of each quarter. Specific dates include:

- First Quarter: Due April 20

- Second Quarter: Due July 20

- Third Quarter: Due October 20

- Fourth Quarter: Due January 20

It is crucial for businesses to mark these dates on their calendars to avoid late fees and penalties.

Required Documents

To complete the Hawaii Form G 45, businesses should have the following documents on hand:

- Sales and income records for the reporting period.

- Receipts for any deductions or exemptions claimed.

- Previous tax returns for reference.

- Any correspondence from the Hawaii Department of Taxation.

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete hawaii form g 45 613809494

Complete Hawaii Form G 45 effortlessly on any gadget

Digital document administration has gained signNow traction among enterprises and individuals. It serves as an ideal sustainable substitute for traditional printed and signed materials, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Hawaii Form G 45 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to alter and eSign Hawaii Form G 45 with ease

- Locate Hawaii Form G 45 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Hawaii Form G 45 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form g 45 613809494

Create this form in 5 minutes!

How to create an eSignature for the hawaii form g 45 613809494

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hawaii Form G 45?

Hawaii Form G 45 is a tax form used for reporting and paying general excise taxes in Hawaii. It is essential for businesses operating in the state to comply with tax regulations and helps ensure accurate reporting. Completing the Hawaii Form G 45 correctly can help avoid penalties and maintain good standing with the state.

-

How can airSlate SignNow assist with Hawaii Form G 45?

airSlate SignNow streamlines the process of preparing and submitting Hawaii Form G 45 by allowing businesses to eSign documents quickly and securely. Our easy-to-use platform helps ensure that all necessary information is gathered and submitted correctly. With airSlate SignNow, you can complete your Hawaii Form G 45 with confidence and efficiency.

-

What features does airSlate SignNow offer for managing Hawaii Form G 45 submissions?

airSlate SignNow offers features that simplify the management of Hawaii Form G 45 submissions, such as customizable templates and advanced tracking capabilities. These tools help businesses minimize errors and ensure timely filing of forms. Additionally, our platform provides a secure environment for managing sensitive financial documents.

-

Is airSlate SignNow cost-effective for businesses filing Hawaii Form G 45?

Yes, airSlate SignNow is cost-effective for businesses, offering flexible pricing plans tailored to different needs. By minimizing administrative time and costs associated with filing Hawaii Form G 45, our solution delivers excellent value. Investing in airSlate SignNow can lead to signNow savings in the long run.

-

Can I integrate airSlate SignNow with my accounting software for Hawaii Form G 45?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage Hawaii Form G 45 alongside your financial records. This integration allows for automatic updates and streamlined processes, enhancing your overall efficiency. Managing your taxes and documents becomes much simpler with these integrations.

-

How does airSlate SignNow enhance security for Hawaii Form G 45 submissions?

airSlate SignNow enhances security for Hawaii Form G 45 submissions with advanced encryption and compliance with industry standards. Our platform ensures that all your documents are securely stored and accessed only by authorized users. This commitment to security helps protect sensitive financial information related to your tax submissions.

-

What are the benefits of using airSlate SignNow for Hawaii Form G 45 processing?

Using airSlate SignNow for Hawaii Form G 45 processing provides various benefits, including increased efficiency and accuracy in document handling. Our user-friendly interface allows quick eSigning and collaboration among team members. Additionally, the ability to track document status in real-time ensures that you never miss a filing deadline.

Get more for Hawaii Form G 45

- Need tax return information or transcripts publication 4201

- Ifta ct form

- Beer pong rules form

- Step to preliminary anglia pdf form

- Substantial completion checklist form

- Child protection and welfare report form tusla

- Housing transfer form chp org uk

- Re 2090a request for course evaluation myfloridalicense com form

Find out other Hawaii Form G 45

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast