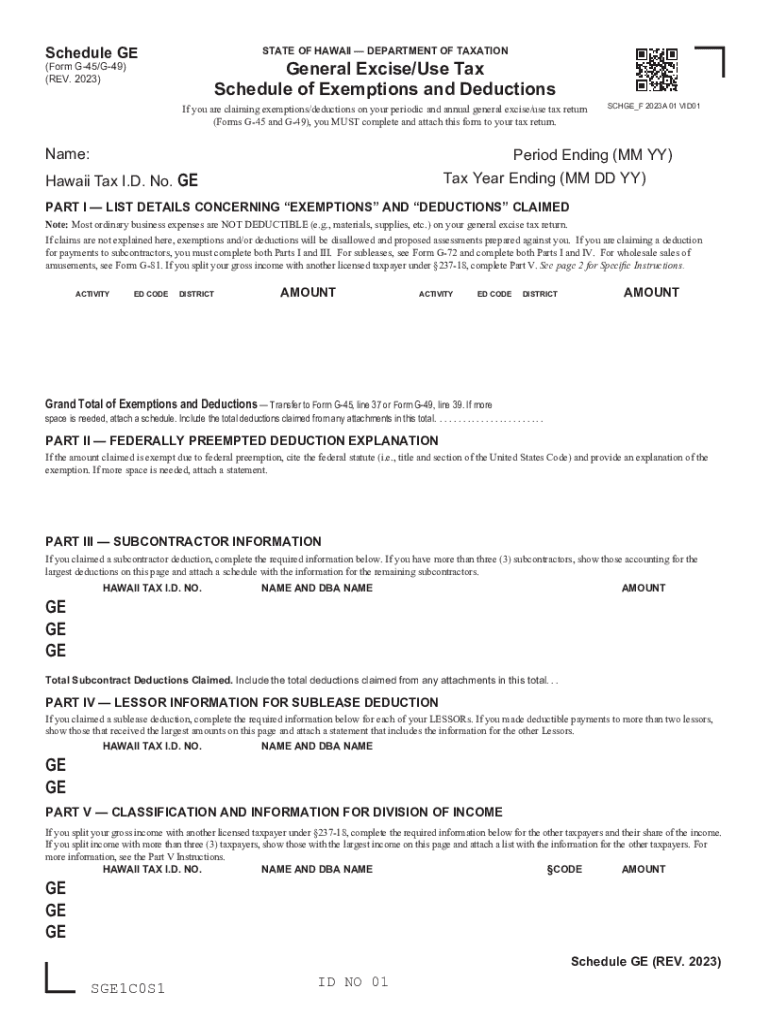

Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule of Exemptions and Deductions Forms 2023-2026

Understanding Form G-49

Form G-49, also known as the General Excise Tax Form, is a crucial document for businesses operating in Hawaii. This form is used to report and pay general excise taxes on income generated within the state. The general excise tax is applicable to various business activities, including retail sales, services, and rentals. Understanding this form is essential for compliance with state tax laws and to ensure that businesses accurately report their earnings.

How to Complete Form G-49

Completing Form G-49 requires careful attention to detail. First, gather all necessary financial records, including sales receipts and expense reports. The form consists of several sections, including total gross income, deductions, and the amount of tax owed. Each section must be filled out accurately to reflect the business's financial activities. After entering the required information, review the form for any errors before submission. It is advisable to consult with a tax professional if there are uncertainties regarding specific entries.

Filing Deadlines for Form G-49

Timely filing of Form G-49 is critical to avoid penalties. The form is typically due on the last day of the month following the end of the reporting period. For businesses that file quarterly, this means the form is due at the end of January, April, July, and October. Annual filers must submit their forms by the end of January for the previous calendar year. Staying aware of these deadlines helps ensure compliance and avoids unnecessary fines.

Required Documentation for Form G-49

When filing Form G-49, businesses must provide supporting documentation to substantiate their reported income and deductions. This may include:

- Sales receipts and invoices

- Expense reports

- Bank statements

- Records of any exempt sales

Having these documents organized and readily available will facilitate a smoother filing process and help in case of any audits by the state.

Submission Methods for Form G-49

Form G-49 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Hawaii Department of Taxation website

- Mailing a physical copy to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method depends on the business's preferences and the urgency of the filing.

Common Mistakes to Avoid with Form G-49

Filing Form G-49 can be straightforward, but common mistakes can lead to complications. It is important to avoid:

- Incorrect calculations of gross income or deductions

- Missing the filing deadline

- Failing to include all required documentation

- Not keeping copies of submitted forms for records

By being aware of these pitfalls, businesses can enhance their filing accuracy and compliance.

Quick guide on how to complete schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions forms

Effortlessly prepare Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to swiftly create, edit, and electronically sign your documents without delays. Handle Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms on any platform using airSlate SignNow's Android or iOS applications and enhance every document-oriented process today.

How to edit and electronically sign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms with ease

- Locate Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details, then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions forms

Create this form in 5 minutes!

How to create an eSignature for the schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form g 49?

Form G 49 is a document used for various official processes, often requiring signatures for verification. With airSlate SignNow, you can easily prepare and eSign form g 49 electronically, ensuring compliance and streamlining your workflow.

-

How can airSlate SignNow help me with form g 49?

airSlate SignNow allows you to create, send, and manage form g 49 effortlessly. Our platform provides templates and user-friendly tools to facilitate quick e-signatures, making it ideal for businesses looking to accelerate document processing.

-

Is there a cost to use airSlate SignNow for form g 49?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including eSigning capabilities for form g 49. We provide a cost-effective solution that scales with your requirements, allowing you to choose a plan that suits your budget.

-

Are there any features specifically for handling form g 49?

Absolutely! AirSlate SignNow offers signature workflows, template storage, and document tracking features specifically designed for form g 49. These features enhance efficiency, ensuring that you can complete your documentation quickly and securely.

-

Can I integrate airSlate SignNow with other applications when managing form g 49?

Yes, airSlate SignNow integrates seamlessly with various third-party applications such as Google Drive and Salesforce. This enables you to streamline your workflow and manage form g 49 alongside other business tools, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for eSigning form g 49?

Using airSlate SignNow for eSigning form g 49 offers numerous benefits, including reduced turnaround times, improved security, and increased convenience. Our platform simplifies the signing process, allowing for greater collaboration and faster completion of important documents.

-

Is airSlate SignNow secure for handling sensitive form g 49 documents?

Yes, airSlate SignNow employs advanced encryption protocols and follows industry standards to ensure the security of your form g 49 documents. You can trust that your sensitive information is protected throughout the signing process.

Get more for Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms

Find out other Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions Forms

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template