Stock Transfer Form Work V 10

What is the Stock Transfer Form?

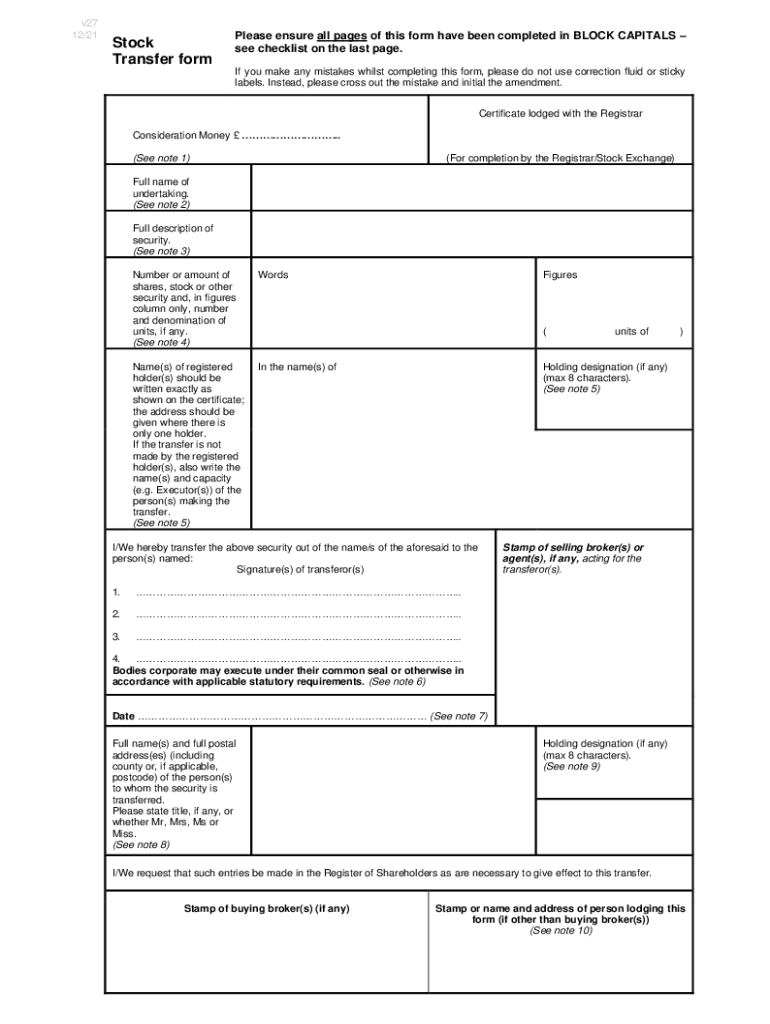

The stock transfer form is a legal document used to transfer ownership of shares from one party to another. It is essential for recording the change in ownership on the company’s register of members. This form typically includes details such as the names of the transferor and transferee, the number of shares being transferred, and the signature of the transferor. The form serves as a formal record of the transaction and is crucial for maintaining accurate ownership records within the company.

How to Obtain the Stock Transfer Form

To obtain the stock transfer form, individuals can typically download it from the official website of the company whose shares are being transferred. Many companies provide a stock transfer form template in PDF format for easy access. Alternatively, individuals may request a physical copy from the company's registrar or transfer agent. Ensuring that the correct version of the form is used is important to avoid delays in processing the transfer.

Steps to Complete the Stock Transfer Form

Completing the stock transfer form involves several key steps:

- Fill in the details of the transferor, including their full name and address.

- Provide the transferee's information, ensuring accuracy in their name and address.

- Specify the number of shares being transferred and the class of shares, if applicable.

- Sign and date the form in the designated area, ensuring that the signature matches the one on record.

- Submit the completed form to the company's registrar or transfer agent for processing.

Legal Use of the Stock Transfer Form

The stock transfer form is legally binding once it has been properly filled out and signed by the transferor. It must comply with relevant laws and regulations governing share transfers. In the United States, the form must meet specific requirements under state corporate laws to be considered valid. It is recommended to consult with a legal professional to ensure compliance with all applicable laws and to address any specific concerns regarding the transfer.

Key Elements of the Stock Transfer Form

Several key elements must be included in a stock transfer form to ensure its validity:

- Transferor's Information: Full name and address of the person transferring the shares.

- Transferee's Information: Full name and address of the person receiving the shares.

- Number of Shares: The quantity of shares being transferred.

- Class of Shares: The type of shares, if there are multiple classes.

- Signature: The signature of the transferor, affirming the transfer.

Examples of Using the Stock Transfer Form

The stock transfer form can be used in various scenarios, such as:

- Transferring shares as part of a gift between family members.

- Facilitating the sale of shares between private parties.

- Transferring shares as part of an estate settlement after the death of a shareholder.

Quick guide on how to complete stock transfer form work v 10

Prepare Stock Transfer Form Work V 10 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Stock Transfer Form Work V 10 on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

The easiest way to modify and eSign Stock Transfer Form Work V 10 seamlessly

- Locate Stock Transfer Form Work V 10 and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Stock Transfer Form Work V 10 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stock transfer form work v 10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UK stock transfer form PDF and how is it used?

A UK stock transfer form PDF is a legal document used to transfer ownership of shares from one party to another in the UK. This form must be completed and submitted to properly transfer shares, ensuring all parties' details are accurately recorded. Utilizing a stock transfer form is essential for maintaining accurate company records and complying with UK regulations.

-

How can I obtain a UK stock transfer form PDF?

You can easily obtain a UK stock transfer form PDF through various online legal document services or directly from your company's registered office. Many websites, including airSlate SignNow, offer customizable stock transfer forms that can be filled out and signed digitally. This makes the process efficient and convenient.

-

What features does airSlate SignNow provide for UK stock transfer forms?

airSlate SignNow offers features such as electronic signing, document tracking, and secure cloud storage for your UK stock transfer form PDF. Users can create, customize, and send forms for eSignature with ease. Additionally, our platform provides templates to streamline the document preparation process.

-

Is there a cost associated with using airSlate SignNow for UK stock transfer forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individual users and teams. The costs are transparent, and you can review our plans to find one that fits your budget while ensuring access to essential features for managing your UK stock transfer form PDF.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow provides integrations with popular applications such as Google Workspace, Microsoft Office, and various CRM platforms. This means you can seamlessly manage your UK stock transfer form PDF within your existing workflows, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for my stock transfer forms?

Using airSlate SignNow for your UK stock transfer forms streamlines the signing process, saves time, and reduces paperwork. The platform ensures that your documents are secure and easily accessible, which is particularly beneficial for businesses handling multiple transfers. Plus, you can track the status of your forms easily, providing peace of mind.

-

Is it safe to eSign my UK stock transfer form PDF with airSlate SignNow?

Yes, it is completely safe to eSign your UK stock transfer form PDF with airSlate SignNow. Our platform employs advanced encryption and security measures to protect your documents and signatures. You can trust that your personal and financial information will remain confidential and secure throughout the signing process.

Get more for Stock Transfer Form Work V 10

Find out other Stock Transfer Form Work V 10

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement