R43Manual Claim to Personal Allowances and Tax Repayment by an Individual Not Resident in the UK 2023-2026

Understanding the R43 Manual Claim for Personal Allowances and Tax Repayment

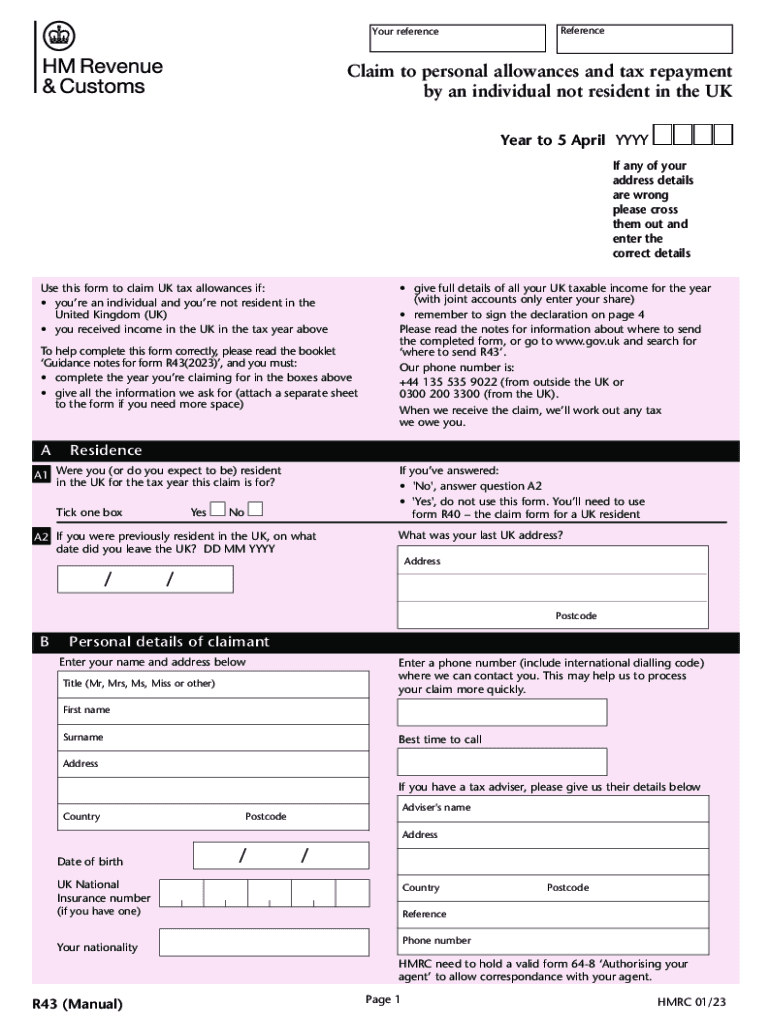

The R43 manual claim is a specific form used for individuals not residing in the UK to claim personal allowances and tax repayments. This form is particularly relevant for expatriates or non-residents who have paid taxes in the UK and are eligible for refunds based on their personal circumstances. Understanding the eligibility criteria and the purpose of the R43 form is crucial for ensuring that individuals can successfully navigate the claims process.

Steps to Complete the R43 Manual Claim

Completing the R43 manual claim involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of income and any relevant tax documents. Next, fill out the R43 form carefully, ensuring that all sections are completed accurately. It is important to provide clear and truthful information, as discrepancies can lead to delays or denials in processing. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Required Documents for the R43 Manual Claim

To successfully submit the R43 form, certain documents are required. These typically include:

- Proof of income from UK sources

- Tax identification number or National Insurance number

- Any previous tax returns filed in the UK

- Documentation supporting the claim for personal allowances

Having these documents ready will facilitate a smoother submission process and help in addressing any inquiries from tax authorities.

Form Submission Methods for the R43 Manual Claim

The R43 form can be submitted through various methods, depending on the preferences of the individual. Common submission methods include:

- Online submission via the official tax authority website

- Mailing a physical copy of the completed form

- In-person submission at designated tax offices

Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the individual's circumstances.

Eligibility Criteria for the R43 Manual Claim

Eligibility for the R43 manual claim is determined by several factors. Individuals must not be residents of the UK and must have incurred tax liabilities in the UK. Additionally, they should be able to demonstrate that they qualify for personal allowances based on their income level and personal circumstances. Understanding these criteria is essential to avoid unnecessary claims that may lead to complications.

IRS Guidelines Related to the R43 Manual Claim

While the R43 form is specific to UK tax regulations, it is important for individuals to be aware of IRS guidelines that may affect their tax situation. The IRS requires that all foreign income be reported, and individuals claiming allowances or refunds must ensure compliance with both UK and US tax laws. This dual compliance is crucial for avoiding penalties and ensuring that all tax obligations are met.

Quick guide on how to complete r43manual claim to personal allowances and tax repayment by an individual not resident in the uk

Effortlessly Prepare R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK on any platform using airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The easiest method to modify and electronically sign R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK effortlessly

- Find R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark essential parts of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing the form—via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK to guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r43manual claim to personal allowances and tax repayment by an individual not resident in the uk

Create this form in 5 minutes!

How to create an eSignature for the r43manual claim to personal allowances and tax repayment by an individual not resident in the uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are allowances repayment individual options available with airSlate SignNow?

airSlate SignNow offers flexible allowances repayment individual options that cater to various business needs. You can choose from different pricing plans that allow for adaptable usage, whether you're a small business or a large enterprise. This ensures that you can manage your allowances repayment individual efficiently.

-

How does airSlate SignNow streamline the allowances repayment individual process?

The platform simplifies the allowances repayment individual process by allowing users to send and eSign documents in a seamless manner. With its user-friendly interface, businesses can quickly create and manage repayment documents, reducing processing time and increasing productivity. Integration with other tools further enhances this efficiency.

-

What features support allowances repayment individual in airSlate SignNow?

Key features that support allowances repayment individual include customizable templates, automated reminders, and secure document storage. These tools help ensure that all documents related to allowances repayment individual are handled systematically and efficiently. Enhanced tracking capabilities also allow users to monitor signature statuses instantly.

-

Is airSlate SignNow compliant with legal requirements for allowances repayment individual?

Yes, airSlate SignNow ensures compliance with legal regulations pertaining to allowances repayment individual. The platform adheres to industry standards for electronic signatures, making sure that all agreements are legally binding. This offers peace of mind for businesses managing allowances repayment individual documentation.

-

Can I integrate airSlate SignNow with other software for allowances repayment individual?

Absolutely! airSlate SignNow provides integrations with popular business applications that enhance the management of allowances repayment individual. This allows users to connect with their existing systems, streamlining workflows and ensuring a seamless experience across platforms.

-

What are the benefits of using airSlate SignNow for allowances repayment individual?

Using airSlate SignNow for allowances repayment individual offers numerous benefits, including cost-effectiveness and time savings. The platform allows for quick processing of documents, thereby reducing administrative burdens. Additionally, users appreciate its ease of use, which empowers any team member to manage allowances repayment individual efficiently.

-

Is there a trial version of airSlate SignNow for allowances repayment individual?

Yes, airSlate SignNow offers a free trial that gives users the chance to explore features related to allowances repayment individual. This trial enables businesses to assess how the platform can enhance their document management processes before committing to a paid plan. Exploring the trial can help you understand its applicability to your specific allowances repayment individual needs.

Get more for R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK

Find out other R43Manual Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later