by an Individual Not Resident in the UK 2020

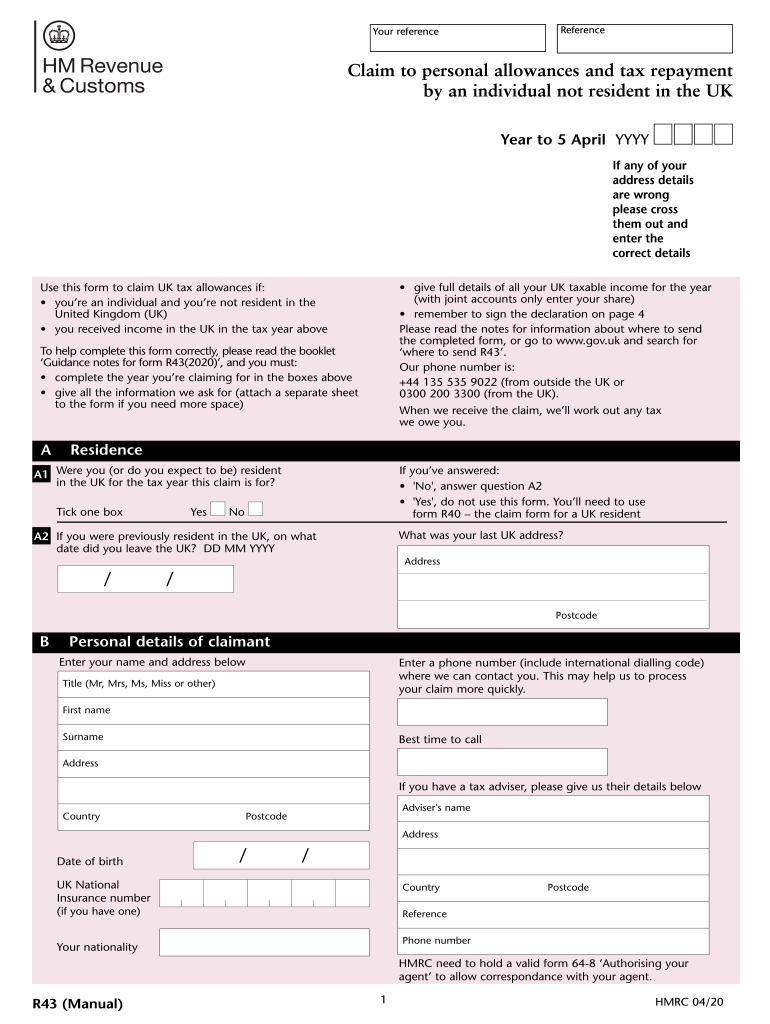

What is the R43 Form?

The R43 form is a tax document used by individuals who are not residents of the United Kingdom but have income or allowances that may be subject to UK tax. This form allows non-residents to claim personal allowances on their self-assessment tax returns, ensuring they are taxed correctly based on their residency status. The R43 form is essential for those who wish to ensure compliance with UK tax regulations while potentially reducing their tax liabilities.

Steps to Complete the R43 Form

Completing the R43 form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding your income and any allowances you wish to claim. This may include details about your employment, investments, and personal circumstances. Next, accurately fill out each section of the form, providing clear and honest answers. Pay special attention to the sections related to personal allowances, as these can significantly impact your tax calculations. Finally, review your completed form for any errors before submitting it to the appropriate tax authority.

Required Documents for the R43 Form

When filling out the R43 form, certain documents may be required to support your claims. These documents typically include:

- Proof of identity, such as a passport or national ID.

- Income statements from UK sources, including payslips or P60 forms.

- Details of any other income or allowances you wish to claim.

- Previous tax returns, if applicable, to provide context for your current claims.

Having these documents ready can streamline the process and help ensure that your application is processed without delays.

Form Submission Methods for the R43 Form

The R43 form can be submitted through various methods, depending on your preference and the requirements of the tax authority. Common submission methods include:

- Online submission via the official tax authority website, which often allows for quicker processing.

- Mailing a printed version of the form to the designated tax office.

- In-person submission at local tax offices, which may provide immediate assistance and confirmation of receipt.

Choosing the right submission method can depend on your specific circumstances and the urgency of your filing.

Legal Use of the R43 Form

The R43 form is legally recognized for claiming personal allowances by non-residents in the UK. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. The form must be completed in accordance with the guidelines set forth by the tax authority to maintain its validity. Understanding the legal implications of the R43 form can help non-residents navigate their tax obligations effectively.

Eligibility Criteria for the R43 Form

To be eligible to use the R43 form, individuals must meet specific criteria. Generally, you must be a non-resident of the UK who has income or allowances that may be taxable in the UK. Additionally, you should not be claiming personal allowances through another tax return. It is essential to review the eligibility requirements carefully to ensure that you qualify for the benefits offered by the R43 form.

Quick guide on how to complete by an individual not resident in the uk

Accomplish By An Individual Not Resident In The UK seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, amend, and electronically sign your documents swiftly without setbacks. Handle By An Individual Not Resident In The UK on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to modify and eSign By An Individual Not Resident In The UK without hassle

- Find By An Individual Not Resident In The UK and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and has the same legal standing as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form—via email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Revise and eSign By An Individual Not Resident In The UK while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct by an individual not resident in the uk

Create this form in 5 minutes!

How to create an eSignature for the by an individual not resident in the uk

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an r43 form and how is it used?

The r43 form is a specific type of document that businesses can use to request and process specific types of data and transactions. By implementing the airSlate SignNow platform, users can easily fill out, send, and eSign r43 forms securely, streamlining their workflow and ensuring compliance.

-

How can airSlate SignNow help with managing r43 forms?

airSlate SignNow offers an intuitive interface for creating, sending, and managing r43 forms. Users can track the status of their forms in real-time, ensuring that nothing falls through the cracks while enhancing overall productivity and document security.

-

What are the pricing options for using airSlate SignNow with r43 forms?

airSlate SignNow provides various pricing plans that cater to businesses of all sizes. Users can choose a plan that suits their needs, ensuring they get the most value while efficiently managing their r43 forms without overspending.

-

Can I customize my r43 form within airSlate SignNow?

Yes, airSlate SignNow allows users to customize their r43 forms by adding fields, logos, and tailored messages. This ensures that your forms align with your brand identity and meet specific compliance requirements.

-

What other features does airSlate SignNow offer for r43 form users?

In addition to eSigning, airSlate SignNow includes features like automated reminders, template creation, and real-time document tracking for r43 forms. These features help you keep your processes efficient and organized at every step.

-

Is it easy to integrate airSlate SignNow with other software while using r43 forms?

Absolutely, airSlate SignNow provides seamless integrations with various applications, making it easy to manage your r43 forms alongside other tools your business may use. This integration helps create a streamlined workflow across platforms.

-

What are the benefits of using airSlate SignNow for processing r43 forms?

Using airSlate SignNow for your r43 forms enhances efficiency, reduces paper usage, and minimizes processing time. The platform's user-friendly design ensures that your team can eSign documents quickly, allowing for quicker decision-making.

Get more for By An Individual Not Resident In The UK

- Canada card pr form

- Applying for a medicare card online form

- Renovation of judson nature trails building form

- Tc 451 form

- Servicesflhsmvgovcdlmedcertflorida department of highway safety and motor vehicles form

- Dot physical form pa

- Vendor informationsubstitute w 9 form azusa pacific university apu

- Compel responses form

Find out other By An Individual Not Resident In The UK

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure