Property Tax or Rent Rebate Claim PA 1000 FormsPublications 2022

Understanding the PA Property Tax or Rent Rebate Claim PA 1000 Form

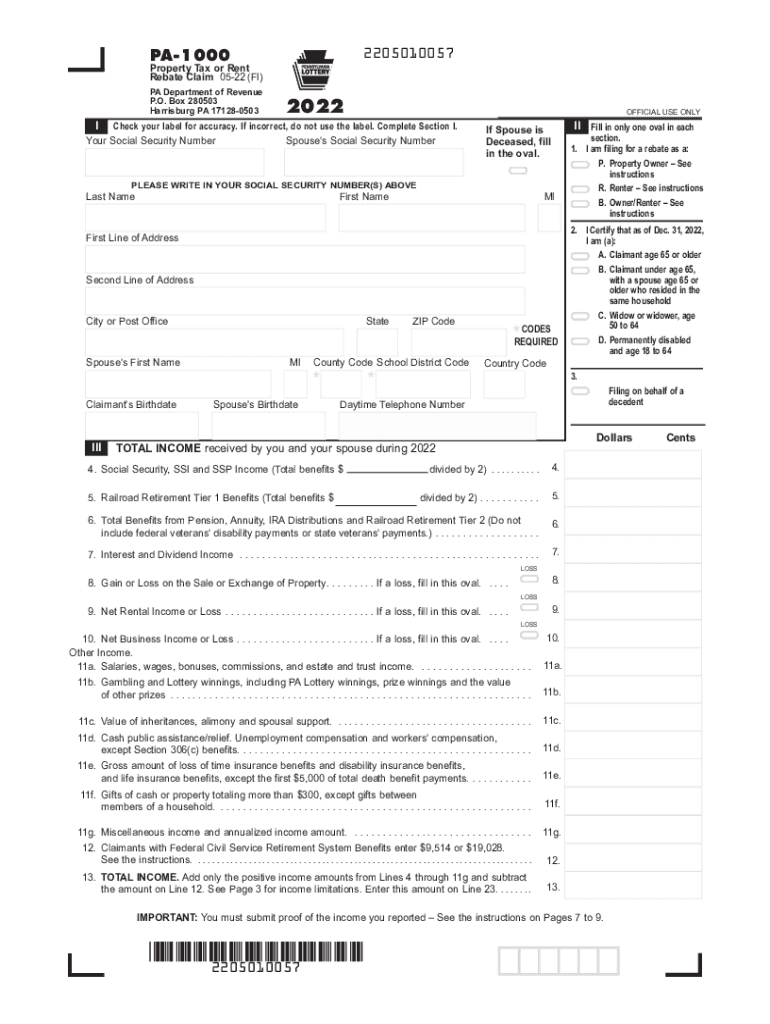

The PA Property Tax or Rent Rebate Claim PA 1000 form is designed for eligible Pennsylvania residents to claim a rebate on property taxes or rent paid during the previous year. This rebate is available to seniors, widows, widowers, and individuals with disabilities who meet certain income criteria. The form allows applicants to receive financial relief, making it an essential document for those who qualify.

Steps to Complete the PA Property Tax or Rent Rebate Claim PA 1000 Form

Completing the PA Property Tax or Rent Rebate Claim PA 1000 form involves several key steps:

- Gather necessary documentation, including proof of income, property tax receipts, or rental agreements.

- Fill out the form accurately, ensuring all personal information and financial details are correct.

- Double-check that you meet the eligibility criteria, including income limits and age requirements.

- Sign and date the form to validate your claim.

- Submit the completed form through the designated method, whether online or by mail.

Eligibility Criteria for the PA Property Tax or Rent Rebate Claim PA 1000 Form

To be eligible for the PA Property Tax or Rent Rebate Claim PA 1000 form, applicants must meet specific criteria:

- Must be a resident of Pennsylvania.

- Must be at least sixty-five years old, or a widow/widower aged fifty-one or older, or permanently disabled.

- Must have an income below the specified limits, which are adjusted annually.

- Must have paid property taxes or rent on a qualifying residence.

Required Documents for Submission of the PA Property Tax or Rent Rebate Claim PA 1000 Form

When submitting the PA Property Tax or Rent Rebate Claim PA 1000 form, certain documents are required to support your claim:

- Proof of income, such as tax returns or Social Security statements.

- Receipts for property taxes paid or rental agreements showing the amount of rent paid.

- Identification documents, if necessary, to verify age or disability status.

Form Submission Methods for the PA Property Tax or Rent Rebate Claim PA 1000 Form

The PA Property Tax or Rent Rebate Claim PA 1000 form can be submitted through various methods, ensuring convenience for all applicants:

- Online submission through the official state portal, which allows for a quicker processing time.

- Mailing a printed copy of the form to the appropriate state department.

- In-person submission at designated state offices for those who prefer direct assistance.

Legal Use of the PA Property Tax or Rent Rebate Claim PA 1000 Form

The PA Property Tax or Rent Rebate Claim PA 1000 form is legally binding when completed and submitted according to state regulations. It is essential to provide accurate information, as any discrepancies may lead to delays or denials of the rebate. The form must be signed by the applicant to confirm the validity of the claim, ensuring compliance with state laws regarding tax rebates.

Quick guide on how to complete property tax or rent rebate claim pa 1000 formspublications

Effortlessly Prepare Property Tax Or Rent Rebate Claim PA 1000 FormsPublications on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can obtain the necessary form and safely keep it online. airSlate SignNow provides you with all the resources you need to generate, modify, and eSign your documents quickly without delays. Handle Property Tax Or Rent Rebate Claim PA 1000 FormsPublications on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications with Ease

- Locate Property Tax Or Rent Rebate Claim PA 1000 FormsPublications and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Accentuate important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that require printing out new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax or rent rebate claim pa 1000 formspublications

Create this form in 5 minutes!

How to create an eSignature for the property tax or rent rebate claim pa 1000 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa property tax rebate form online, and who is eligible to file it?

The pa property tax rebate form online is a form designed for Pennsylvania residents who are eligible for property tax rebates. Homeowners aged 65 and older, as well as certain individuals with disabilities, can apply to receive rebates on their property taxes. To qualify, applicants must meet specific income limits set by the state.

-

How can I access the pa property tax rebate form online?

To access the pa property tax rebate form online, you can visit the official Pennsylvania Department of Revenue website. The form is available for download and can be filled out digitally or printed for submission. airSlate SignNow simplifies this process, allowing you to eSign the document easily before submitting.

-

What are the advantages of using airSlate SignNow for the pa property tax rebate form online?

Using airSlate SignNow for the pa property tax rebate form online offers signNow advantages such as streamlined eSigning and document management. Our platform ensures that your applications are sent securely and efficiently, reducing the time spent on paperwork. Additionally, you can track the document's status until it gets processed.

-

Is there a cost associated with submitting the pa property tax rebate form online?

Submitting the pa property tax rebate form online through the official state website is usually free of charge. However, if you choose to utilize airSlate SignNow for enhanced document services, there may be associated costs depending on the chosen plan. Our service provides an affordable solution for those needing to manage and sign multiple forms.

-

What features does airSlate SignNow offer for managing the pa property tax rebate form online?

airSlate SignNow offers a variety of features to streamline the management of the pa property tax rebate form online. These include user-friendly templates, customizable workflows, and eSignature capabilities. Our platform is designed to help users manage their documents efficiently, ensuring a hassle-free filing experience.

-

Does airSlate SignNow provide support for filling out the pa property tax rebate form online?

Yes, airSlate SignNow provides support for users needing assistance in filling out the pa property tax rebate form online. Our customer support team is accessible to answer any questions or guide you through the process. Additionally, our platform's intuitive interface makes it easy to complete the form accurately.

-

How secure is my information when using airSlate SignNow for the pa property tax rebate form online?

Security is a top priority at airSlate SignNow. When using our platform for the pa property tax rebate form online, your personal information is protected through industry-standard encryption and secure data storage. We ensure compliance with legal regulations to keep your information safe and confidential.

Get more for Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- American heart association emergency cardiovascular care programs heartsaver course roster course information heartsaver cpr

- Allen edmonds shoe fit guide form

- Trish and scotts big adventure answers form

- Da form 2702

- Lycoming college transcript request form

- Office of buildingsatlanta gabuilding permits jackson msbuilding permits jackson mshouston permitting center form

- Mentorship agreement template form

- Merchandise agreement template form

Find out other Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors