Edd Ca Govpdfpubctrde4Employeess Withholding Allowance Certificate 2021

What is the DE-4 Employee Withholding Allowance Certificate?

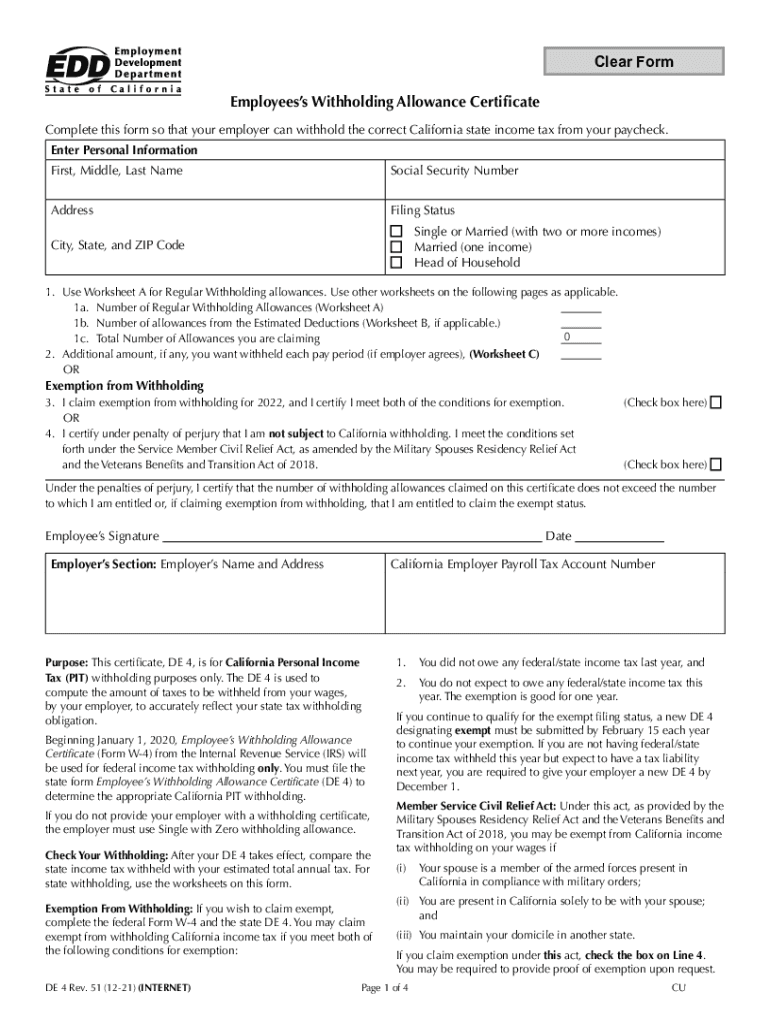

The DE-4 form, officially known as the Employee's Withholding Allowance Certificate, is a crucial document used in California for tax purposes. It allows employees to indicate their withholding allowances to their employers, which in turn helps determine the amount of state income tax withheld from their paychecks. This form is particularly important for ensuring that employees do not overpay or underpay their taxes throughout the year.

Steps to Complete the DE-4 Employee Withholding Allowance Certificate

Completing the DE-4 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Determine the number of allowances you wish to claim based on your personal situation, such as dependents or additional deductions.

- If applicable, specify any additional amount you want withheld from each paycheck.

- Sign and date the form to validate your information.

Once completed, submit the DE-4 form to your employer, who will use it to adjust your state income tax withholding accordingly.

Legal Use of the DE-4 Employee Withholding Allowance Certificate

The DE-4 form is legally recognized in California and must be completed accurately to ensure compliance with state tax laws. Employers are required to keep this form on file for each employee, as it serves as a record of the employee's withholding allowances. It is important to update the form whenever there are significant changes in your financial situation, such as marriage, divorce, or the birth of a child, to maintain accurate withholding.

Key Elements of the DE-4 Employee Withholding Allowance Certificate

Several key elements make up the DE-4 form:

- Personal Information: Includes your name, address, and Social Security number.

- Filing Status: Indicates whether you are single, married, or head of household.

- Allowances: The number of allowances you claim, affecting your tax withholding.

- Additional Withholding: An option to specify any extra amount you want withheld.

- Signature: Your signature and date affirm the accuracy of the information provided.

Filing Deadlines / Important Dates for the DE-4 Form

While the DE-4 form does not have a specific filing deadline, it is important to submit it to your employer as soon as you start a new job or experience a change in your financial situation. Keeping your withholding information up to date helps ensure that the correct amount of state income tax is withheld throughout the year, which can prevent unexpected tax liabilities during tax season.

Form Submission Methods for the DE-4

The DE-4 form can be submitted to your employer through various methods:

- In-Person: Hand the completed form directly to your HR or payroll department.

- Mail: If your employer allows it, you can mail the form to the appropriate HR address.

- Online: Some employers may provide a digital platform for submitting tax forms electronically.

It is advisable to confirm with your employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete eddcagovpdfpubctrde4employeess withholding allowance certificate

Complete Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed materials, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest way to alter and eSign Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate with ease

- Find Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and possesses the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct eddcagovpdfpubctrde4employeess withholding allowance certificate

Create this form in 5 minutes!

How to create an eSignature for the eddcagovpdfpubctrde4employeess withholding allowance certificate

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to de4?

airSlate SignNow is an innovative eSignature solution that allows businesses to send and sign documents easily. When utilizing de4, organizations can streamline their document workflow, enhancing efficiency and productivity without breaking the bank.

-

How much does airSlate SignNow cost for de4 users?

The pricing for airSlate SignNow varies based on the plan selected. For de4 users, there are affordable options available that cater to both small businesses and larger enterprises, ensuring that everyone can find a plan that fits their budget.

-

What key features does airSlate SignNow offer for de4 documentation?

airSlate SignNow provides essential features such as customizable templates, advanced security measures, and real-time tracking for de4 documents. These features empower teams to manage their eSigning processes efficiently and securely.

-

Can airSlate SignNow integrate with other tools while using de4?

Yes, airSlate SignNow supports integration with various applications and tools while leveraging de4 technology. This makes it easy to connect your eSigning processes with other business systems, improving overall workflow and collaboration.

-

What are the benefits of choosing airSlate SignNow for de4?

Choosing airSlate SignNow for your de4 needs offers a range of benefits, including increased productivity, cost savings, and ease of use. The platform is designed to simplify the signing process, allowing teams to focus on what matters most.

-

Is airSlate SignNow user-friendly for de4 signers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for de4 signers. Both senders and recipients can navigate the platform with ease, ensuring a hassle-free eSigning experience.

-

How secure is my data when using airSlate SignNow with de4?

Security is a top priority for airSlate SignNow. When utilizing de4, your data is protected with advanced encryption and compliance with industry standards, ensuring that your sensitive documents remain confidential and secure throughout the signing process.

Get more for Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate

Find out other Edd ca govpdfpubctrde4Employeess Withholding Allowance Certificate

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF