De 4 Form 2011

What is the De 4 Form

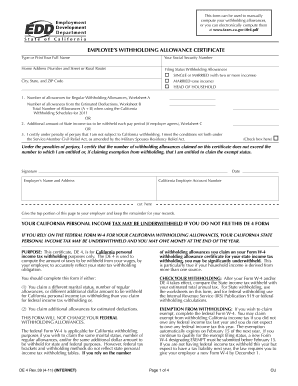

The De 4 form, also known as the Employee's Withholding Allowance Certificate, is a crucial document used in the state of California. It allows employees to indicate their withholding allowances for state income tax purposes. By filling out this form, employees can adjust the amount of state tax withheld from their paychecks, which can help manage their tax liability throughout the year. Understanding the De 4 form is essential for both employees and employers to ensure compliance with state tax regulations.

How to use the De 4 Form

Using the De 4 form is straightforward. Employees should complete the form when they start a new job or when their financial situation changes, such as marriage, divorce, or the birth of a child. To use the form, employees need to provide their personal information, including their name, address, and Social Security number. They also need to indicate the number of allowances they wish to claim based on their personal circumstances. Once completed, the form should be submitted to the employer, who will use it to determine the appropriate amount of state tax withholding.

Steps to complete the De 4 Form

Completing the De 4 form involves several key steps:

- Obtain the form: The De 4 form can be downloaded from the California Franchise Tax Board's website or obtained from your employer.

- Fill in personal information: Enter your name, address, and Social Security number at the top of the form.

- Claim allowances: Use the worksheet provided on the form to calculate and claim the number of allowances you are eligible for based on your personal and financial situation.

- Sign and date: After completing the form, sign and date it to certify that the information provided is accurate.

- Submit the form: Provide the completed form to your employer for processing.

Legal use of the De 4 Form

The De 4 form is legally binding and must be filled out accurately to ensure compliance with California tax laws. Employers are required to withhold state income tax based on the information provided in the form. Falsifying information on the De 4 form can lead to penalties, including fines and back taxes owed. It is important for employees to understand their rights and responsibilities when completing this form to avoid potential legal issues.

Key elements of the De 4 Form

Several key elements must be included in the De 4 form to ensure it is completed correctly:

- Personal Information: Name, address, and Social Security number are essential for identification.

- Allowances: The number of withholding allowances claimed must be calculated accurately based on personal circumstances.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

- Employer Information: The form should be submitted to the employer, who will use it for tax withholding purposes.

Who Issues the Form

The De 4 form is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's income tax laws and provides the necessary forms and guidance for taxpayers. Employers in California are also responsible for distributing the De 4 form to their employees and ensuring that it is completed and submitted correctly.

Quick guide on how to complete de 4 form

Prepare De 4 Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without interruptions. Manage De 4 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign De 4 Form without any hassle

- Obtain De 4 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from the device of your choosing. Modify and eSign De 4 Form to ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de 4 form

Create this form in 5 minutes!

How to create an eSignature for the de 4 form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the de 4 form and how can I use it with airSlate SignNow?

The de 4 form is a crucial document for tax purposes, specifically designed for employees. With airSlate SignNow, you can easily send, sign, and store your de 4 form securely online, streamlining your filing process.

-

Are there any costs associated with using airSlate SignNow to manage the de 4 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our affordable plans allow you to manage your de 4 form and other documents without breaking the bank, ensuring you have a cost-effective solution.

-

What features does airSlate SignNow offer for handling the de 4 form?

airSlate SignNow provides a range of advanced features including electronic signatures, document templates, and real-time tracking. These features ensure that managing your de 4 form is not only efficient but also compliant with legal standards.

-

How can airSlate SignNow help simplify the process of completing the de 4 form?

By using airSlate SignNow, you can fill out and sign your de 4 form electronically, eliminating the need for printing and mailing. This simplification accelerates the process, allowing you to focus on what truly matters.

-

Can I integrate airSlate SignNow with other software for managing the de 4 form?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, helping you streamline workflows related to the de 4 form. Whether it's CRM systems or cloud storage, our integrations enhance your productivity.

-

What benefits does using airSlate SignNow provide for businesses handling the de 4 form?

By utilizing airSlate SignNow, businesses benefit from increased efficiency, reduced errors, and enhanced security when managing the de 4 form. Our platform allows for easier collaboration and faster processing times.

-

Is airSlate SignNow secure for managing sensitive documents like the de 4 form?

Yes, airSlate SignNow is designed with robust security features to protect sensitive documents such as the de 4 form. We implement encryption and secure storage to ensure your information remains confidential and safe.

Get more for De 4 Form

- Mutual wills package with last wills and testaments for married couple with adult children new hampshire form

- Mutual wills package with last wills and testaments for married couple with no children new hampshire form

- Mutual wills package with last wills and testaments for married couple with minor children new hampshire form

- Nh last will testament form

- Nh civil union form

- Legal last will and testament form for a married person with no children new hampshire

- Nh civil form

- New hampshire legal 497318992 form

Find out other De 4 Form

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free